What's Balance of Power Indicator? - Definition of Balance of Power Indicator

Balance of Power - Balance of Power indicators is a popular indicator which can be found in the - Indicators Listing on this website. Balance of Power is used by the traders to forecast price movement based on the chart price analysis done using this Balance of Power indicator. Traders can use the Balance of Power buy & Sell Trading Signals explained below to identify when to open a buy or sell trade when using this Balance of Power indicator. By using Balance of Power and other fx indicators combinations traders can learn how to make decisions about market entry & market exit.

What is Balance of Power Indicator? Balance of Power Indicator

How Do You Combine Indicators with Balance of Power? - Adding Balance of Power in MT4 Platform

Which Indicator is the Best to Combine with Balance of Power?

Which is the best Balance of Power combination for trading?

The most popular indicators combined with Balance of Power are:

- RSI

- MAs Moving Averages Trading Indicator

- MACD

- Bollinger Band Indicator

- Stochastic Oscillator Indicator

- Ichimoku Indicator

- Parabolic SAR

Which is the best Balance of Power combination for trading? - Balance of Power MT4 indicators

What Indicators to Combine with Balance of Power?

Find additional indicators in addition to Balance of Power that will determine the trend of the forex market & also others that confirm the market trend. By combining forex indicators that determine trend & others that confirm the trend and combining these indicators with Forex Balance of Power a trader will come up with a Balance of Power based system that they can test using a demo account on the MetaTrader 4 platform.

This BOP based system will also help traders to figure out when there is a market reversal based on the technical indicators signals generated and thence trades can know when to exit the market if they have open trades.

What is Balance of Power Based Trading? Indicator based system to analyze and interpret price & provide trade signals.

What's the Best Balance of Power Strategy?

How to Choose & Select the Best Balance of Power Strategy

For traders researching on What is the best Balance of Power strategy - the following learn forex guides will help traders on the steps required to course them with coming up with the best strategy for trading forex market based on the Balance of Power system.

How to Develop Balance of Power Systems Strategies

- What is Balance of Power Trading Strategy

- Creating Balance of Power Strategy Template

- Writing Balance of Power Strategy Trading Rules

- Generating Balance of Power Buy and Balance of Power Sell Trading Signals

- Creating Balance of Power Trading System Tips

About Balance of Power Described

Balance of Power Analysis and Balance of Power Signals

Developed by Igor Livshin

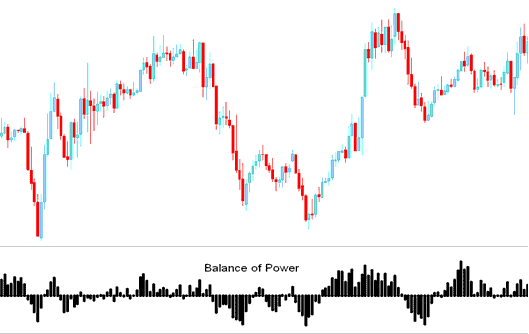

Balance of Power (BOP) indicator measures the momentum of the bulls vs the bears by evaluating the capability of each to push and advance price to extreme areas.

Technical Analysis and How to Generate Trading Signals

When using this indicator, zero mark crossovers are used to generate Forex signals.

Center is marked and labeled as zero line, areas oscillating above or below are used to generate trading signals.

Buy - The scale is labeled from Zero to +100 for bullish market movements

Sell - The scale is marked and tagged from Zero to -100 for bearish market movements

How to Generate Buy & Sell Trading Signals

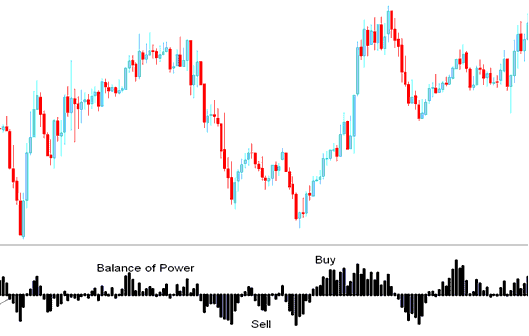

Buy Signal

When the BOP indicator crosses above 0 mark a buy signal is generated.

Also when the Balance of Power (BOP) is rising, the market is in an upwards trend, some traders use this as a buy signal but it is best to wait for the confirmation by the indicator moving above zero mark. As this will be a buy signal in bearish territory & this type of trading signal is more likely to be a whipsaw.

Sell Trade Signal

When Balance of Power(BOP) crosses below the zero mark a sell signal is generated.

Also when the Balance of Power (BOP) is falling, the market is in a downwards trend, some traders use this as a sell trading signal but it is best to wait and chill for a confirmation by moving below zero mark because this will be a sell trading signal in bullish territory & this type of trading signal is more likely to be a whipsaw.

Sell & Buy Signals

Divergence Trade

In forex trading, divergences between the BOP and price can be used to effectively spotting potential reversal and/or trend continuation points in currency movement. There are different types of divergence-setups:

Classic Divergence Trading Setup - Trend reversal setup

Hidden Divergence Trading Setup - Trend continuation

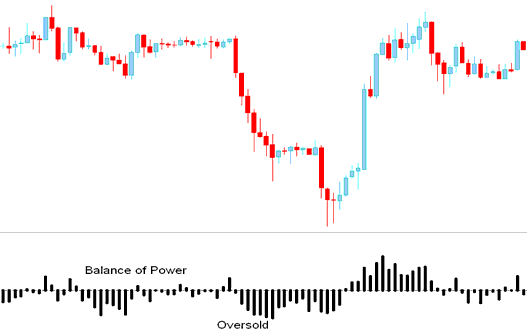

Forex Trading Overbought-Oversold Conditions

This BOP can be used to identify the potentially over-bought & over-sold conditions in price movement.

- Over-bought Over-sold levels can be used to give an early signal for potential price trend reversals.

- These levels are derived & generated when indicator clusters its tops & bottoms thus setting up the overbought and oversold levels around those values.

However, price may also stay at these over bought and over-sold levels and continue heading in that particular direction for a duration of some time and thence it is always a good idea to wait until the Balance of Power (BOP) indicator crosses over the Zero mark.

From the illustration set-out below, though the Balance of Power BOP showed the price was oversold, price continued heading downwards until the indicator crossed over to above Zero Line Mark.

Technical Analysis in FX Trading

Study More Tutorials & Topics:

- Forex Trend Trigger Factor Expert Advisor(EA) Setup

- When Not to Trade XAU USD

- How to Trade the Cac 40 Indices

- How to Use MetaTrader 5 DeMarks Range Extension Indices Technical Indicator

- Methods of Setting Stop Loss Orders in XAU USD

- How Can I Use Fractals Indicator in Forex Trading?

- How to Find and Get NIKKEI225 on MT4 PC

- Learn Trade Forex Strategies Examples for Beginner Traders

- Trading FX Pivot Point Support and Resistance Levels

- Average Directional Index Gold Indicator