Forex Pivot Points

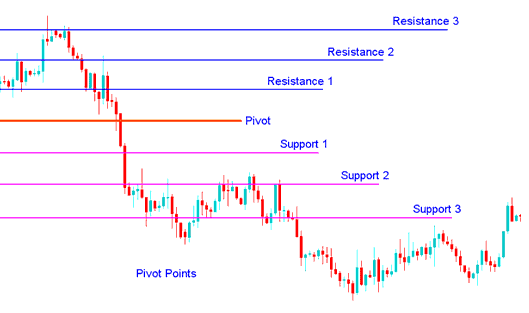

Pivot Points is a tool that puts a Pivot Point on a chart, plus 3 support levels below it and 3 resistance areas above the pivot point as well.

Pivot points are a group of indicators that traders in the commodities markets made to find possible turning points, also called 'pivots.' These points are figured out to show levels where the feeling about the currency trend could switch from 'going up' to 'going down.' Currency traders use these points as markers of support and resistance.

These points are calculated as the average/mean of the high, low and close from the previous session:

FX Pivot Point = (High + Low + Close) / 3

Day traders calculate pivot points to set entries, stops, and targets. They guess where others will act too.

A pivot point marks a key price in market analysis. Traders use it to guess price shifts. It averages the high, low, and close from the last period. Next period above the pivot? Bullish sign. Below? Bearish.

The central pivot point is employed to calculate subsequent support and resistance levels situated both beneath and above it, respectively, by either subtracting or adding calculated differences in price derived from prior trading ranges.

A pivot point, along with its corresponding support and resistance levels, often serves as a critical turning point for price direction in the market.

- In an up-trend, the pivot-point & the resistance levels may represent a ceiling level for the price. If price goes above this level the uptrend is no longer sustainable and a trend reversal may occur.

- In a downtrend, a pivot-point & the support levels may represent a low for price level or a resistance to further decline.

The central pivot point can be used to calculate support and resistance levels as follows:

Pivot points feature a central level with three support areas below and three resistance areas above. Floor traders on stock and futures markets started using them. They gave a quick view of daily market action through simple calculations. In time, these tools have aided traders in various markets as well.

One reason they're so popular now is because they're seen as a 'leading' indicator that predicts what will happen, not a lagging indicator that follows what has already happened. All you need to calculate the pivot point levels for the upcoming (current) day is the previous day's highest, lowest, and closing prices. The 24-hour pivot points in this indicator are calculated with these formulas:

The center pivot then may be used in calculating the aid and resistance levels as follows:

Resistance 3

Resistance 2

Resistance 1

Pivot Point

Support 1

Support 2

Support 3

Pivot Points Support and Resistance Areas

Pivot Points as a tool

The pivot point level itself signifies a critical juncture representing either the peak level of resistance or support, contingent upon the dominant market sentiment. In situations where the market lacks a clear direction (is ranging), prices frequently fluctuate significantly around this level until a definitive price breakout occurs. Prices situated above or below this central reference point indicate whether the overall sentiment is bullish or bearish, respectively. This specialized technical indicator leads the market, offering advance indications of potential new highs or lows within a preset time frame.

You can use the support and resistance points that are figured out from the middle point and the past market size as places to end open trades, but they are not often used as signals to start trades. For example, if the price is going up and goes past the pivot point, the first or second resistance point is often a good place to end a trade, because the chance of resistance and a change in direction gets much bigger with each resistance area.

In pivot point analysis, it is common practice to identify three distinct levels situated both above and below a central reference point. These are mathematically derived from the prior period's price range and are subsequently added to the central point to establish resistance boundaries and subtracted to establish support boundaries.

Analysis of Pivots Points

Pivot points levels can be used in many different ways. Here are a few of the most often methods for utilizing them:

Trend Direction: When used alongside supplementary analysis methods such as overbought/oversold oscillators and volatility measures, the central point can assist in defining the dominant directional trend within the currency market. Trade positions should exclusively be initiated in alignment with the prevailing market price trend. Buy orders are placed only when the price is situated above the central point, whereas sell positions are entered only when the price falls below this pivot point.

Trading Price Break Outs: In price break-outs, a bullish buy signal appears and happens when the price moves upward through the center point or one of the resistance levels (usually Resistance Area 1). A short sell signal appears and happens when the price moves downward through the center point or one of the support levels (often Support Level 1).

In a trend shift, a buy sign appears when price nears support. It might touch or slightly pass it, then turn back the other way.

To download Pivot Points Leves Indicator:

https://c.mql5.com/21/9/pro4x_pivot_lines.mq4

After downloading, launch the file within the MQL4 language MetaEditor, then formalize the indicator by hitting the Compile Button, and it will automatically integrate into your MT4 application.

Important Note: After integrating the indicator into your MT4 platform, it introduces supplementary lines referred to as MidPoints. To eliminate these extraneous lines, access the MQL4 Meta Editor (via the F4 shortcut key) and modify line 16 from its current setting:

Extern bool mid-pivots = true:

To

Extern bool mid-pivots = false:

Following this, activate the Compile Button once more: the resulting output will then be visible and displayed as demonstrated on the www.tradeforextrading.com domain.

More Topics & Courses:

- Getting the Best MT5 Indicator: A Lesson

- Setting Up Nas100 in the MetaTrader 4 App

- How to Incorporate RSI into Charts?

- Programming Custom Indicators in MT4 Meta-Editor Tutorial

- Types of Forex Risk You Need to Know

- Stochastic Crossovers for Buy and Sell Trading Signals

- Strategies for stochastic analysis

- Set Up XAGUSD Chart on MT5

- A Collection of the Best DJ 30 Trading Strategies for Analysis

- When Does the XAUUSD Market Start & When Does it Finish Each Day?