Methods of Setting Stop Loss XAUUSD Orders in Gold Trading

Traders utilizing an XAUUSD trading system must perform mathematical calculations to determine the appropriate placement of their stop loss.

A XAUUSD trader can also establish a stop loss depending on the signals employed to establish these stop losses. Some indicators employ mathematical formulas to determine the optimum location for stop loss orders when trading gold, which helps to identify the best moment to exit a trade. The basis for establishing these stop losses might be these chart indicators.

Other online Gold traders also place these stoploss order orders according to a predetermined risk : reward ratio. This method of setting these orders depends upon certain mathematical calculations based on Gold chart price moves. For example illustration a ratio of 50 pips stop loss order can be used by a gold trader if the Gold trade has the potential to make 100 pips in profit: this is a risk reward ratio of 2:1. Also, a ratio of 30 pips stop loss order can be used by a gold trader if the trade has potential to earn 90 pips in profit: this is a risk : reward ratio of 3:1

Other traders just use a predetermined % of their total equity trading balance.

To set a stop loss it's best to use one of the following techniques:

1. Percent of equity balance

This approach relies on the percentage of the trading account balance that a gold trader is prepared to risk on a single Gold trade. If an individual is willing to risk 2% of their account balance, the trader will then establish the stop loss level based on the size of the trade they have executed, whether buying or selling.

Example:

If a trader has a $100,000 account & is willing to risk 2 %

If the online trader buys 5 lots

1 pip = $5 dollars

Then setting at 2 %

2 % is $2,000 dollars

2000 /5 = 400 pips

Stop loss = 400 pips

If the Gold trader buys 10 contracts

1 pip = $10 dollars

Then setting the stop at 2 %

2 % is $2,000

2000 /10 = 200 pips

Stoploss = 200 pips

If the gold trader buys 20 contracts

1 pip = $20

Then setting at 2 %

2 % is $2,000

2000 /20 = 100 pips

Stoploss = 100 pips

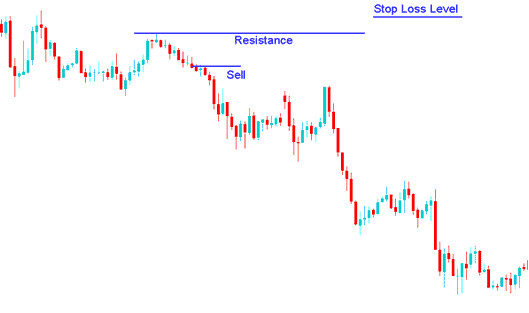

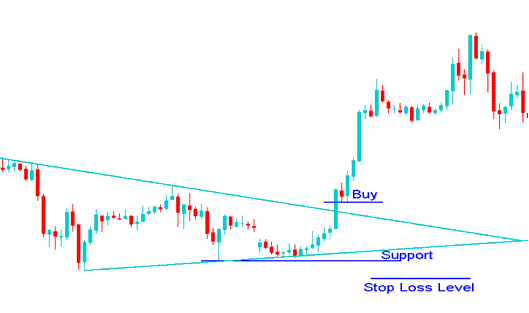

2. Setting Stop Loss using Support & Resistance Areas

Another method for establishing stop losses involves utilizing support and resistance zones on the charts for Gold trading.

Because stop losses often pile up at key levels, when price hits one of these support or resistance zones, it sets off a chain reaction - like dominos. Usually, stop loss orders gather just above resistance or just below support.

A resistance/support zone should act like a wall for how Gold prices move, which is why these levels are used to set stop loss orders. If this wall breaks, then Gold prices could move in the opposite direction of the original Gold price trend. But if these walls (support & resistance zones) don't break, then Gold prices will likely continue moving as expected.

StopLoss Setting using a Resistance Area

Setting StopLoss Orders above the Resistance Area

Stop Loss Setting using a Support Area

Setting StopLoss Orders below the Support Area

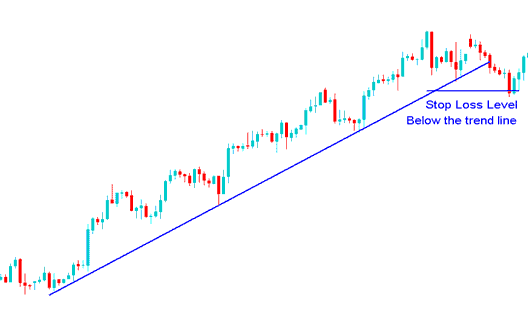

3. Setting Stop Losses Using Trend Lines

A trend line can be used to decide where to put stop loss orders, with the trade order set just below the trendline if it's going up, and above the trendline if it's going down. If the trend line stays strong, then someone trading xauusd can keep making money, while also having this stop loss order in place to protect their earnings if the trendline is broken.

Setting the stop loss order below the Gold price trend line

An explanation of how to place a stop-loss order using trendlines in a rising gold market.

Learn More Tutorials and Lessons & Courses:

- Wondering about the different types of XAU/USD stochastic oscillators? Here's the formula for fast, slow, and full stochastic.

- MetaTrader 4 a Platform/Software Used

- What Is a Chart for the Nikkei225 Indices?

- Information Regarding the S&P ASX 200 Symbol on the MetaTrader 4 Indices Platform

- Adding FTSE MIB 40 in the MT5 App

- Online Forex Description

- SPX500 Trading System Overview

- Finding classic bullish divergence setups and classic bearish divergence setups

- Reading MetaTrader 4 Charts for Effective Trading Analysis

- Place Force Index XAUUSD Indicator on MT4 Charts