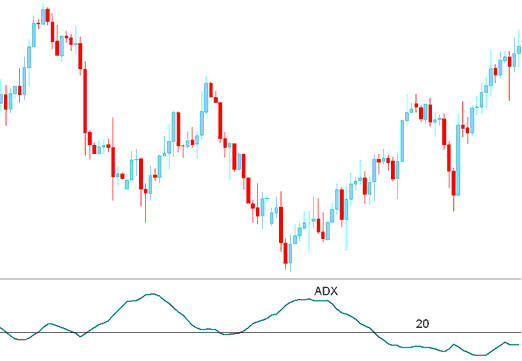

ADX Gold Technical Analysis & ADX Signals

Created and Developed by J. Welles Wilder

This measures how strong a market trend is: it comes from DMI - Directional Movement Index, which has two lines on the indicator.

+DI - Positive Direction Movement Index

–DI - Minus Direction Movement Index

The ADX is computed by subtracting these two values and applying a smoothing function.

The ADX functions not as an indicator of direction but rather as a metric gauging the intensity of the xauusd trend, measured on a scale range from Zero to 100.

Higher the indicator value the stronger the price trend.

A fee of beneath 20 reflects that the xauusd/gold market is not trending however heading in a variety.

A reading surpassing 20 confirms the presence of either a buy or sell signal, suggesting the initiation of a new market trend.

Readings Above 30 Point to a Strong Trend.

When the ADX trading indicator pivots downward after having been above the 30 mark, this signals that the current trend in XAUUSD is experiencing a deceleration in strength.

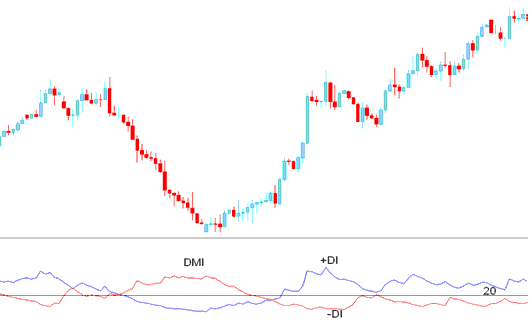

ADX combined with DMI Indicator

Because ADX itself doesn't say which way to go, it's used with the DMI index to figure out which way the xauusd will go.

DMI

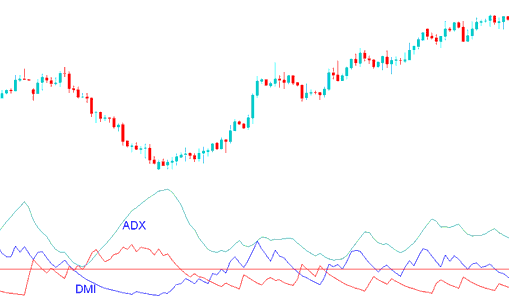

ADX & DMI Index

When ADX is used with DMI, you can tell which way the market is going and then use this tool to see how strong the xauusd trend is.

Technical Analysis and How to Generate Signals

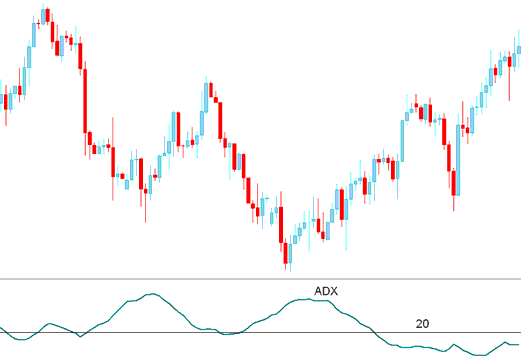

Buy Trade Signal

A buy signal is derived and generated when the +DI indicator reading is positioned above the –DI reading, provided the ADX technical indicator value is above 20.

The exit signal is produced when the indicator declines from above the level of 30.

Buy XAU USD Signal

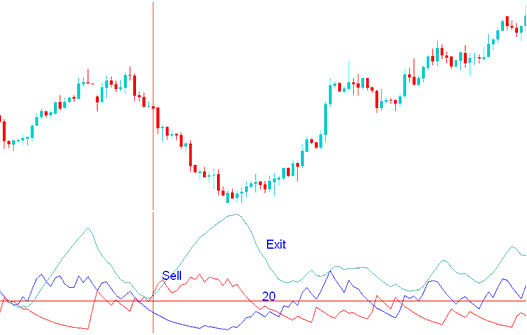

Sell XAU/USD Signal

A short signal is produced when the -DI is greater than the +DI, and the ADX indicator exceeds 20.

The Exit signal gets derived & generated when indicator turns downwards from above 30.

Sell Signal

Get More Topics: