Inverted Hammer Candlestick vs Shooting Star: Key Differences

Inverted Hammer as Bullish Candle - Shooting Star as Bearish Candle - Bullish and Bearish Patterns

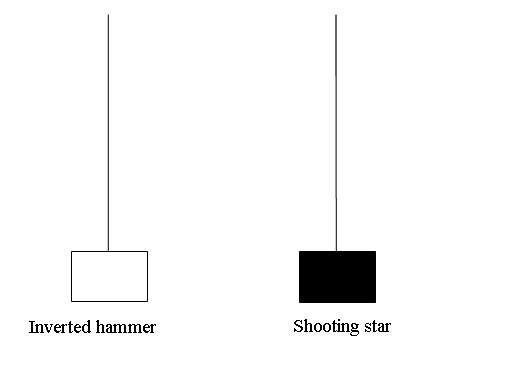

The patterns known as Inverted Hammer Candlestick and Shooting Star Candle Setup bear a striking visual resemblance. These candlestick formations are characterized by a protracted upper wick and a diminutive real body situated near the lower extremity. The inherent color fill of the body is irrelevant: what dictates their interpretation is their location, whether they materialize at the apex of an upward market movement (Signaling a Star) or at the trough of a descent (Signaling a Hammer).

The difference is that the inverted hammer look on a graph means prices might go up, but a shooting star means prices might go down.

Reversal of an Upward Trajectory - Indicated by the Shooting Star Candlestick Pattern

Inverted Hammer Candlesticks Signal a Reversal of a Downward Trend at

Inverted Hammer Candlestick Pattern alongside the Shooting Star Candlestick Setup Signals

Inverted Hammer Candle

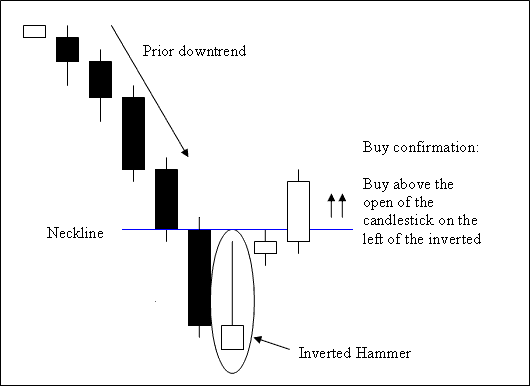

This is a bullish price reversal candle setup. It occurs at the bottom of a trend.

An Inverted hammer shows up at the bottom of a drop and hints that the price might change direction.

Inverted Hammer Candlestick

Analysis of Inverted Hammer Candlestick Pattern

A buy is made when a candle closes above the neck line, which is the pattern's left side opening. This acts as a barrier in the neck area.

Stop orders for the buy trades should be set just few pips just below the lowest price on the recent low.

An inverted hammer candlestick is called & named so because it shows that the market is hammering out a bottom.

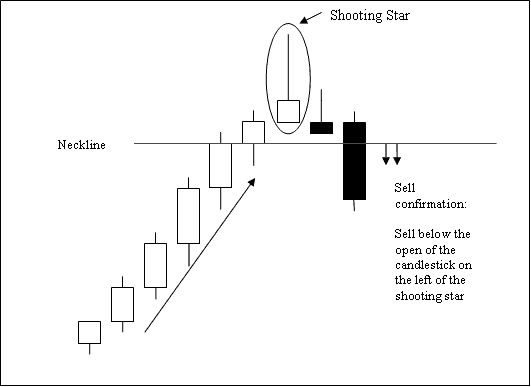

Shooting Star Candlestick

This is a bearish market reversal candle pattern. It occurs at tops of a trend.

It happens at the top of an uptrend when the open price is the same as the low, and the price went up but was then pushed back down to almost where it opened.

Shooting Star Candlestick

Trading Analysis of the Shooting Star Candlestick Pattern

A sell happens when a candlestick closes below the neckline, which is the start of the candle on the pattern's left. The neckline here is a support level.

Sell orders for trading should be positioned slightly above the recent peak price by a few pips.

The Shooting Star candle-stick has this name because it looks like a shooting star in the sky when it shows up at the top of a rise.

More Topics:

- Analyzing Doji and Marubozu Candlestick Patterns

- How to Generate Indices Signal Buy and Sell Trade Signal with Indices Trading Systems

- What's the Pips Value for Crude Oil?

- Forex CADJPY Pip Calculator

- FTSE MIB Course Index FTSE MIB Indices Strategy Lesson Tutorial

- How to Draw Fib Extension Levels in MetaTrader 4 Trade Platform

- Support and Resistance Levels MT4 Indicator