How Can You Generate Index Signals with Systems?

The only way to trade indices is through signals. Learn to create your own. That way, you avoid depending on other traders.

Creating trading signals takes skill in technical analysis. It demands experience as well. Start practicing early to generate index signals on your own.

One effective method for honing signal generation skills is to create a free demo account, allowing you to test trading signals without the risk of losing money. After assessing and confirming the profitability of your trading strategies in this demo environment, you can implement those strategies in a live account as a stock index trader.

The method of how to practice generating these Index signals and also how to back test them on the demo account using the MT4 platform is discussed below:

So, How Can One Generate Index Signals?

The top way to create signals comes from systems. You can learn to build index systems in the lesson on creating systems. Find it in the right navigation menu under indices key concepts.

An indices strategy mixes one or more indicators with written rules for how those indicators will generate trades.

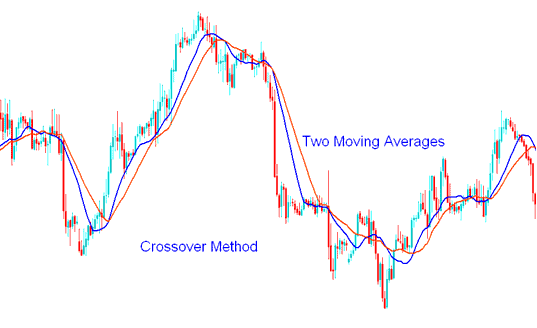

Consider the most basic strategy, known as the Moving Average (MA) crossover method. A trigger to buy or sell is generated when two moving averages intersect: a buy signal follows an upward crossover, and a sell signal follows a downward crossover.

Example of Generating Indices Trade Signals Using Moving Average Cross over Method

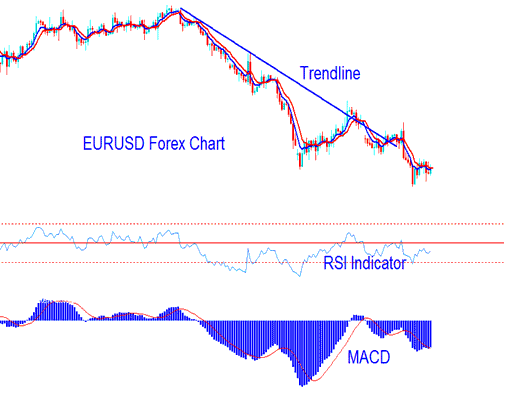

The example below shows a system that uses the MA strategy with RSI and MACD to generate buy and sell trades for indices.

Example of Online Systems & Indices Trading Strategies

Example of Online Systems & Indices Trading Strategies

To produce buy and sell signals, Indices traders should employ simple Index systems for this purpose.

Generating a Index Trade Signal - Buy & Sell Signals

Index Trading Systems

A functional, straightforward Index system combines the following elements:

- Moving Average(MA) crossover trading strategy method

- RSI

- MACD

The written rules are:

Generating Index Signals Strategy - Indices Trade System Examples

Index Trade Rules:

Buy Signal is Generated when:

- Both Moving averages heading upward

- RSI above 50

- MACD above centerline

Sell Signal is Generated when:

- Both moving averages MAs going down

- RSI below 50

- MACD below center-line

Generating Buy and Sell Indices Trades - Explanation of a System

Exit Signal

An exit signal is generated when the Moving Average (MA), RSI, and MACD Indices indicators collectively issue a signal indicating movement contrary to the established market trend.

Use 1-hour or 15-minute charts for trades. Choose by your trading style.

If a new trader follows these listed trading rules, they will get good signals about when to buy or sell Index trades: all a trader has to do is be disciplined and follow the given rules for Indices signals exactly as they are, and they must wait for their strategy to show when to buy or sell Indices, and only trade after the signals appear, not before.

Get More Topics:

- MetaTrader 5 Alligator indicator usage simplified for better trading results.

- NETH25 Index Trading Strategies Best Methods to Trade NETH 25

- XAUUSD Basics: Essential Tutorials for XAU/USD Traders

- How You Can Figure Out Pip Values for Mini Forex Accounts When Trading Mini Lots

- SMI 20 Index Trading Strategy Guide

- XAU USD Analysis of ROC, or Rate of Change, Indicator

- How to get and use an automated expert advisor

- How to Interpret/Analyze Pips on EURCHF How to Count Pips on EURCHF

- FX Trade Platform Platform MetaTrader 4 Terminal Window Panel

- What is the FX Chandes Trendscore Trading Indicator?