FTSEMIB40 Stock Index

FTSE MIB index tracks top 40 most liquid stocks in Borsa Italiana - Italian Stocks Exchange Market. This Stock Index is also referred to as the Italian 40 Index. The 40 stocks included in this stock index are selected from most liquid stocks from the most profitable industries in the Italian economy.

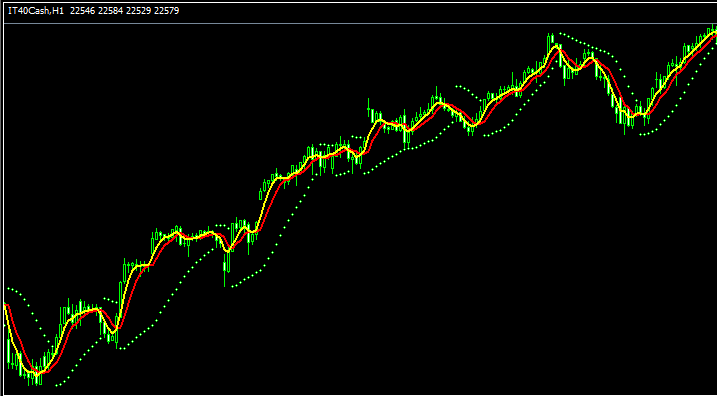

FTSE MIB 40 Chart

FTSEMIB40 Indices trade chart is illustrated and shown and illustrated above. On the above example illustration this financial instrument is named IT40CASH. As a trader you want to find a broker that provides FTSEMIB40 Indices trade chart so that you as a trader can begin to trade it. The example That is illustrated above is that of FTSEMIB 40 Indices on MT4 FX Platform Software.

Other Data about FTSE MIB 40 Stock Indices

Official Indices Symbol - FTSEMIB

The 40 component stocks that makes up the FTSEMIB 40 Indices are selected from top Italian companies that are most lucrative. These stocks are also picked from most lucrative industries within Italian economy.

Stock Indices Trading System for Trading FTSE MIB 40 Index

FTSEMIB40 stock index in general will keep heading and moving upwards over long-term because the stocks chosen for this stock index represent the best sectors of the Italian economy and therefore in general this stock market index will keep heading and moving upward over time - because these particular sectors of the Italian economy will be doing good business.

As a trader wanting to trade this stock index, you want to be more biased toward upwards trend direction of this stock index.

As a trader you want to keep buying as the stock index moves upward. When Italian economic environment is doing & performing well (most of the times it is doing well) this upwards trend is more than likely to be the one that is ongoing. A good stock indices trading strategy would be to keep buying and buy the dips.

During Economic Slow-Down & Recession

During economic slowdown and recession periods, corporations begin to report slower earnings and lowers growth projections. It is due to this reason that investors begin to sell stocks of companies that are announcing lower profits and hence Indices tracking these specified stocks will also start to move & go downward.

Therefore, during these times, trends are more likely to be going & heading downwards and you as a trader should also adjust your trading strategy accordingly to suit the prevailing downwards trends of the index which you as a trader are trading.

Contract Specifications

Margin Requirement for 1 Lot - € 250

Value per Pips - € 1

Note pips size of IT 40CASH is € 1 compared & analyzed to the pip value of the other Stock Indices like Germany DAX and EUROSTOXX 50 whose size of one pip per lot is € 0.1 - However, the average pips movement for this stock index is much lower as when compared to other Indices such as DAX30 & EURO STOXX.

Note: Even though general and overall trend is generally move upward, as a trader you've got to consider and factor on daily market price volatility, on some of the days the Indices might move in a range or even retrace and pull back, the market pullback/retracement move might also be a substantial one at times & therefore as a trader you need to time your trade entry strictly using this trade strategy & at same the time use suitable and proper and appropriate money management methods and guidelines just in case of more unexpected volatility in the market. About indices equity management rules courses: What's equity money management guidelines and principles & money management strategies.

Learn More Lessons and Courses:

- How Can I Add SPAIN 35 on MetaTrader 4 App?

- Where is FTSE in MT5 Platform?

- Keltner Bands FX Trading Indicators Lesson Guide

- Which is the Best XAU USD leverage for $400 XAUUSD Account?

- Regulated Gold Broker Data

- Gold Trading Analysis Method of XAUUSD Chart

- Free Live XAU/USD Signals Platform Software Forex XAU/USD Signals Free