Gold Price Chart and Analysis - XAUUSD Spot Metal Trading

XAU/USD Analysis

Gold trading keeps getting more popular as an alternative investment, and now most currency brokers offer gold as a standard option on their platforms.

Note: A one-point move in gold equates to $100 per lot, compared to a one-pip move in currency trading, which equals $10 per lot. Despite these differences, the required margin and contract specifications for trading both remain equivalent.

Gold is used by many investors as a hedge instrument to hedge some of the currency trades. Traders may decide to include this spot metal as part of their investment portfolio when trading currencies in the market. Gold being a precious metal attracts a lot of investors especially in the recent time where its prices have been trending just in the same way as the market trends of currencies. Speculators now find this a good financial instrument to speculate and make profits from.

Across the globe, Gold is widely recognized as a store of value: major central banks hold substantial quantities in their reserves, which are utilized to underpin the value underpinning their national currencies. Because these reserves are maintained by prominent central banks and governments, a majority of traders also favor acquiring this precious metal to preserve asset value, particularly when contrasting it with holding wealth in liquid cash during periods of economic downturn. This preference stems from the tendency for the metal's price to appreciate during a recession as a greater number of investors seek to safeguard their assets by converting them into gold.

Note: U.S. traders cannot trade this spot metal with leverage due to some U.S. law that bans it. But they can trade it at 1:1 leverage, which means no real leverage.

Gold Trading and Recession

During recessions, traders purchase Gold to keep its value intact, which is why it is known as a safe place to keep money. Traders prefer to keep value in gold instead of cash because cash can also lose value during economic downturns.

Since many traders quickly buy gold during this bad time, the price of this item will keep going higher and higher.

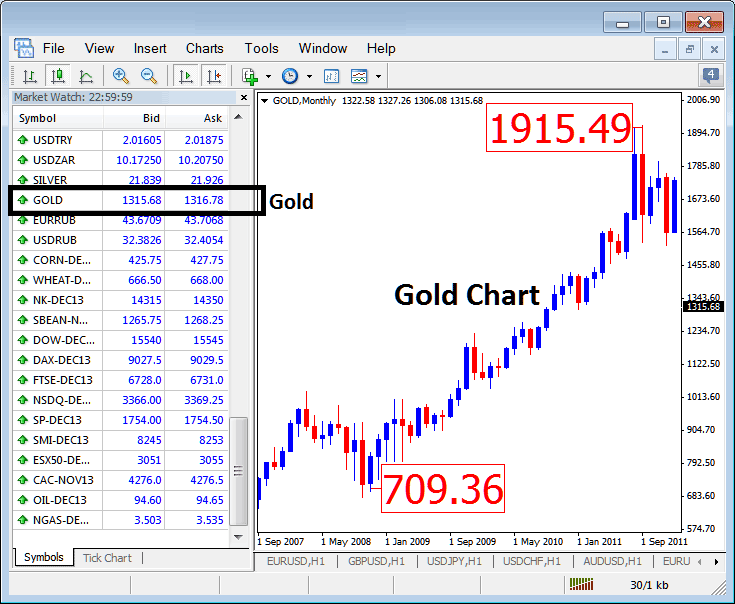

Take the 2008 recession as an example. Gold prices climbed from $710 to $1,915 per ounce. That's over $1,200 in gains during tough economic times.

XAUUSD Price Chart and Analysis of XAUUSD Spot Metal

The Gold prices moved up gaining more than $1,200 dollars in value because investors who were holding cash, currencies, stocks, shares, stock indices, futures and other instruments sold these instruments and bought gold, because it is a safe haven commodity which means it the safest commodity to hold during times of economic recession.

Gold and Economic Boom Time

Gold serves as a safe asset that rises in value during recessions. Yet traders might assume rising prices mean endless gains. Prices do not always keep climbing.

During economic growth, cash, currencies, stocks, shares, indices, futures, and more yield better than gold. Investors sell the metal to grab these options. Even in tough times, those assets beat gold on returns. But recessions made them riskier for holdings. Now with boom worldwide, risks drop for adding them. Traders buy low-risk versions for high gains. They outpace gold in good times. Most go that route.

During market booms, the price of precious metals typically declines as more investors sell in favor of reallocating funds toward higher-yielding financial instruments.

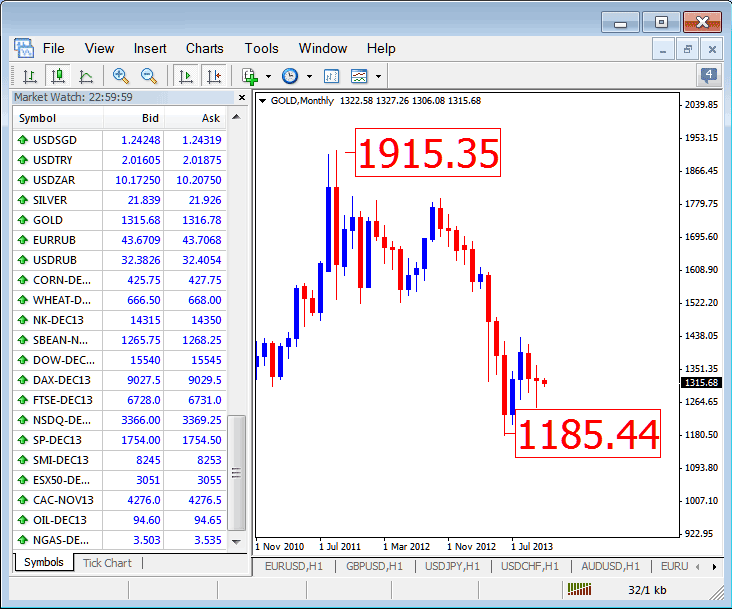

After the economic recession, things started to pick up around 2011 and 2012. Even though recovery was just beginning, traders quickly sold off Gold contracts and started buying stocks. As gold prices dropped, the Dow Jones shot up - stocks were gaining value.

XAU/USD Trend Price Chart - Monthly Chart Prices Trend Analysis

The XAUUSD Price trend direction started to move down after traders started to sell Gold in Favor of higher yielding currencies and assets. The price during this time of economic recovery moved from $1,915 dollars to a low of $1,185 dollars meaning that prices had moved down a total of $730 dollars as traders favored moving their money to other higher yielding currencies, stocks, shares & futures.

Gold Analysis

For The daily trend a trader will be required to analyze the short term market trends cycles on the 1H chart and daily charts, but also consider the fact that gold price is also heavily influenced by economic sentiments such as shown in the above examples.

High volatility and sharp price moves have boosted this spot metal's appeal in the exchange market. It draws many speculators. This rise in interest has pushed brokers to include it in their financial tools.

Remember, one pip in XAUUSD equals $100 per contract. Not $10 like in forex pairs.

As a Spot Metal in Forex, gold prices are quoted in US Dollars. Similar to forex pairs, this commodity is traded as a pair labeled XAU/USD, which indicates the price per ounce of gold quoted in US Dollars.

Hence, on your platform, for example MT4 Market Watch, the Pair will be Marked as XAUUSD. Some Brokers also will Mark it simply using its name.

Open Gold Account

Trading as Contracts

Gold Contracts also are the desired approach of trading this commodity because when you have the equal amount of this valuable metallic in your private home, possibilities are that it'd be difficult to find a consumer, and the purchaser may also deliver a decrease fee if you discover one and it is going to be very difficult to liquidate your Gold. but for spot contracts traded inside the on-line Spot change market, There are usually people willing to buy or to sell at the modern-day charge at any given time. Making Spot trading this metal even extra popular because of and because of this liquidity.

Explore Further Training & Programs:

- How to Interpret/Analyze a Trading Chart using Strategies

- Stochastic Indicator Automated Forex Expert Advisor

- How to Trade DAX 30 Guide for Trading DAX30 Indices

- Trailing Stop Loss Levels MT4 Indicator

- Instructions for Implementing the Moving Average (MA) Indicator on MetaTrader 4 Charts

- Guide to Placing a Linear Regression Indicator on Trading Charts

- NETH 25 MT4: NETH 25's Name in MetaTrader 4 Platform

- How Do I Read MetaTrader 4 Downward XAU USD Gold Channel on MT4 XAU/USD Charts?

- Analyzing Hull Moving Average Indicator Findings within MetaTrader 5 Charts

- Position Sizing Calculator Tool for the SPAIN 35 Index