Forex Lots and Contracts: Lot Size, Leverage, Margin, Spread, Bid and Ask Prices Explained

Explanation of Forex Lot Sizes and Contracts - Defining Standard, Mini, and Micro Lots

Forex uses standard lots. One lot equals 100,000 currency units. It's also called one contract.

The FX Lot or Contract is how much of a currency a fx trader wants to buy or sell in the online market where currencies are exchanged.

Lot Size Forex - A standard lot equals $100,000 in currency, but again, you're not actually exchanging that amount. The contract just stands in for it.

The terms 1 Standard Lot Forex and 1 Contract Forex are entirely interchangeable as they both signify the identical valuation: a $100,000 Dollar trade transaction within the market.

Why Trade Forex in Units of Currencies of $100,000

The reason/explanation why such large contracts are used in forex trading is so as to increase the value of one pip (profit).

Shifts in Currency Valuation are quantified through Pips, which stands for Price Interest Points.

100 Forex Pips Equals 1 Cent, so price changes are figured out and measured using very small movements in price (which are called pips).

EURUSD currency pair will be quoted as 1.3452

The last decimal is the PIP (4th Decimal Place)

Brokers added parts of a pip for finer moves. These are called pipettes now.

EURUSD currency pair will be quoted as 1.34520

The last decimal in the currency quote is the PIPETTE (5th Decimal Place)

To explain why currencies are traded in batches of $100,000 units, we will use the illustration that follows to help explain things:

Few currencies move over 1 cent daily. That's 100 pips. Typical forex moves range from 40 to 80 pips.

Example:

- For one contract (standard lot forex) of $100,000

Value of 1 forex pip = 0.0001 USD

If 1 unit is used of 1 Euro then the Value of 1 pip = 0.0001 USD

If 100,000 units (equivalent to one Forex contract) of Euros are traded, the value of a single forex pip equals 100,000 * 0.0001, resulting in $10 USD.

NB: 100,000 units of Euro are used but the profit is calculated in USD, the quote currency and because the Exchange Trade is EURUSD.

Therefore you as a forex trader can see that if you are trading with only 1 Euro your profit per 1 PIP forex price movement would have been 0.0001 USD, not even equivalent to 1 Cent, But when you trade with a standard lot of 100,000 Units of currency then the profit is equivalent to $10 dollars per 1 Forex PIP.

This explains why Forex trades are commonly executed and settled using contracts/lots equivalent to 100,000 Currency Units.

But How Can any Trader afford $100,000 to Invest With?

That is a very good question, the answer is Forex LEVERAGE and MARGIN

You don't need $100,000 to trade forex: with leverage, you only need $1,000 to trade a contract, but how does that work?

We shall describe using the trading example:

In Forex, you can control a much bigger trade with just a small amount of money: this is called Leveraging, and it lets traders have a chance to make good profits while also keeping the amount of money at risk low. The trader will trade with borrowed money: if a trader has $1,000, they can borrow more by using leverage, like 100:1, which means they borrow 100 dollars for every 1 dollar they have, so they will control a total of $100,000 after using leverage of 100:1, and that is how leverage works.

Forex leverage is expressed as a ratio, such as 100:1, meaning that for every dollar a trader holds in their account, the broker allows them to trade with $100.

FX margin is the cash your broker needs to let you trade with leverage. It's the deposit to open an account. If you put in $1,000, that becomes your margin.

Leverage lets small traders join the market. A 100:1 Forex leverage gives you $100 for every $1 you put in. In return, the broker asks for $1 margin per $100 they lend. This keeps you in control of the borrowed funds for trading.

Forex Margin Example:

If you deposit $1000 in your account, & the broker provides you leverage of 100:1 then it means you now have $1,000*(100) = $100,000 Dollars which you can trade with.

Because you are controlling $100,000 with $1,000, which is 1%, this means that your forex margin requirement is 1 percent.

A forex broker may specify that their margin account requires a 1% margin, equating to a 100:1 leverage ratio. If they require a 2% margin, this corresponds to 50:1 leverage (calculated as 1 being 2% of 50 in a 50:1 leverage scenario).

Hence, with Leverage and Margin just as is shown above traders are not required to deposit all the cash for the whole trade position they are going to trade. The account they open will therefore be referred to as a Forex Margin Account meaning they are trading on margin - the funds in their account is the margin for the leverage they are using for trading.

Spread - Forex Spreads - What is Spread?

The spread represents the discrepancy between the price at which you are permitted to buy and the price offered by the broker for selling.

What is Spread? - Forex Spread is the gap between the Bid Price and the Ask Price, these prices are shown in the image below, and the spread is figured out by looking at the gap between the two prices.

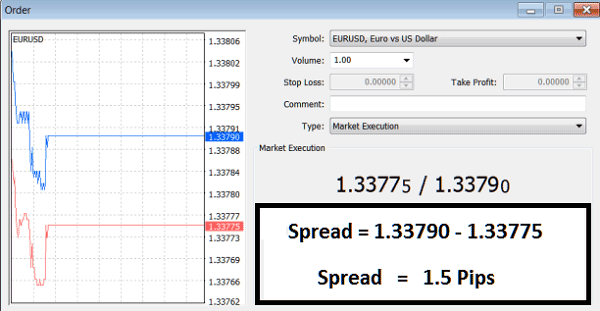

Example of Forex Spreads on MetaTrader 4 Software - What is Spread?

EURUSD Currency Pair - Calculating the Bid Ask Spread of 1.5 Forex Pips - What is Spread?

Explanation of How to Calculate Spread:

If The Bid Ask Quote of EURUSD is 1.2914/1.2917

The Spread is 1.2917-1.2914 = 3 pips

The broker earns profit from these 3 forex pips. If you wanted to buy EURUSD, you would buy it at 1.2917. If you wanted to sell the EURUSD, the broker would buy it back from you at 1.2914, which is 3 pips less than you paid, so the broker makes money. The typical spreads charged are about 2 pips for major currencies.

Fractional pips were introduced to provide more competitive trading spreads. With fractional pips, brokers now offer spreads like 1.8 pips instead of rounding to 2 pips.

In This MT4 Bid-Ask Spread, the Spread Measures:

1.33790/1.33750

Spread is 1.33790 - 1.33750 = 1.5 Pips

The majority of brokers now utilize fractional pips, featuring Five Decimal Place Quotes, allowing them to offer traders tighter spreads, often referred to as "tight spreads," such as a 1.8 Pip Spread instead of the older standard of 2 Pips spread.

Example Illustrations of Average Spreads (Major Currency Pairs) in the Market

- EUR USD - 2.0 Pips Spread

- USDJPY - 2.0 Pips Spread

- GBPUSD - 3.2 Pips Spread

- USD/CHF - 3.2 Pips Spread

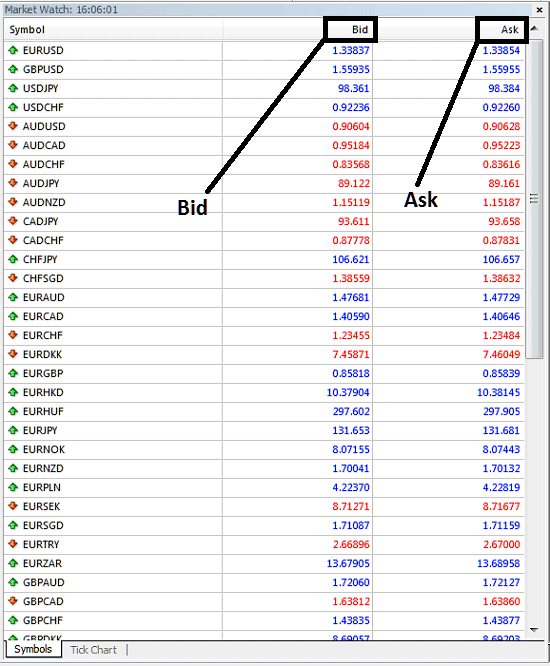

Bid/Ask Price

Bid is the price at which you sell

Ask is price at which you buy

If the bid ask quote for EURUSD is 1.29140/1.29170

Bid/ask= 1.29140/1.29170

Hence:

Bid Price =1.29140

Ask Price =1.29170

Example of Bid Ask on MT4 Platform - Bid Ask Price MT4 Example

Bid and Ask Prices for Forex Pairs in MT4: Simple Explanation

Forex Mini Lots and Micro Lots - Mini Lot vs Micro Lot

It's worth noting that brokers offer fractions of a Forex Standard Lot, making it more accessible for traders with limited capital, enabling micro lots trading starting as low as $5.

A small part of a regular lot is known as a Mini Forex Lot, which is 1/10 of a standard lot, and a Micro Forex Lot, 1/100 of a Standard Lot.

Mini Lot Lot = $10, 000 Units of the Currency

Micro Lot Lot = $1, 000 Units of the Currency

These micro lots were introduced to make the market more accessible to the retail forex investors & retail traders and also attract more and more retail traders and retail investors. Maybe this is why Forex has become very popular, even with as little as $100 dollars a beginner trader can enter this online market & start online trading.

More Topics and Courses: