Continuation Chart Patterns: Rising and Falling Triangles - Bull and Bear Flags

These chart patterns, when they show up, tell you that the current trend will likely keep going in its same direction.

These continuation chart patterns are used by traders to spot halfway points of the trend, this is because continuation chart patterns form at the halfway point of a trend.

There are four types of continuation chart patterns:

- Ascending triangle

- Descending triangle

- Bull flag/pennant

- Bear flag/pennant

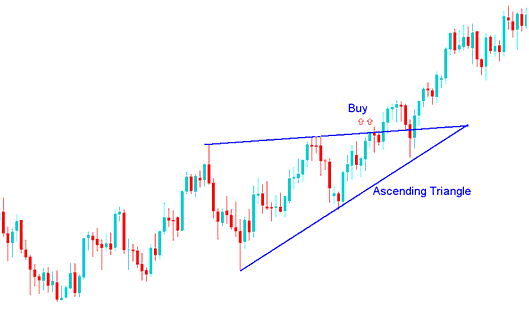

Rising Triangle Continuation Pattern

In an uptrend, the upward-trending market price is predicted by the rising triangle continuation chart pattern.

The Rising Triangle Continuation chart pattern indicates a resistance area that buyers are persistently challenging, pushing it higher with each attempt. Upon a breach of this resistance level, the market is expected to sustain its upward momentum.

The overhead resistance keeps the market from pushing higher for a while, but the rising trend line underneath shows buyers are still active. If the market breaks through the upper line, that's a technical buy signal, showing a breakout from an ascending triangle pattern.

In an uptrend, the ascending triangle acts as a pause. It signals more upside once price breaks higher.

During its uptrend, the market formed an ascending triangle chart pattern, resulting in a continuation of the upward price movement. The opportune moment to buy arises when the price decisively breaks above the upper sloping boundary line, and the market continues its ascent.

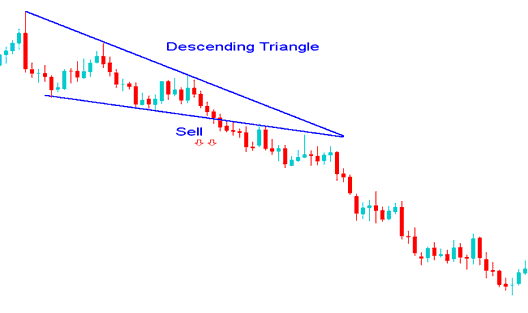

Falling Triangle Continuation Chart Pattern

In a downturn, the falling triangle continuation chart pattern suggests that the price movement will continue downward.

Falling Triangle Continuation chart pattern displays that there's a support level that the sellers keep pushing each time they keep moving it lower, & once this support zone breaks, the price will continue heading downwards.

Support stops the market drop for a bit. The line sloping down above it shows bears still in play. Breaking below the lower line gives a sell signal. It means the descending triangle pattern breaks down with more selling ahead.

Encountered in a downtrend, the descending triangle continuation chart formation manifests as a period of market settling within the existing downward movement, forecasting a subsequent decline in price.

During its downturn, the market created a falling triangle continuation chart pattern, which resulted in additional selling and the continuation of the downtrend. The technical sell signal occurs when price breaks below the downward sloping line and the selling continues to drive the market down.

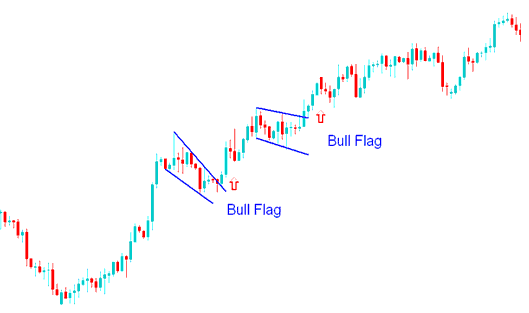

Bull Flag/Pennant Continuation Pattern

Bull Flag continuation chart pattern forms what resembles a rectangle. The rectangle is formed by 2 parallel lines that act as support & resistance for the price til the price breaksout. In general, the bull flag pattern will not be perfectly flat but it will be sloping. Bull Flag Pattern is also known as Bull Pennant Pattern.

The bull flag pattern emerges within an upward market trend. In this continuation setup for the bull flag, the market experiences a minor pullback, characterized by slight retracement and confined price activity that leans slightly downward. The technical entry point for buying this Bull Flag continuation chart formation is triggered when the price breaks above the bull flag's upper boundary line. The section forming the flag contains peaks and troughs that can be linked by parallel, short lines, giving this bull flag pattern the appearance of a small channel.

Bull flag happens mid-uptrend. After breakout, price rises as much as the flagpole height.

The bull pennant indicated above served as a consolidation period before the market gained momentum to break upwards, continuing its prevailing upward trend. The bullish flag pattern was confirmed upon the breakout above the upper trend line.

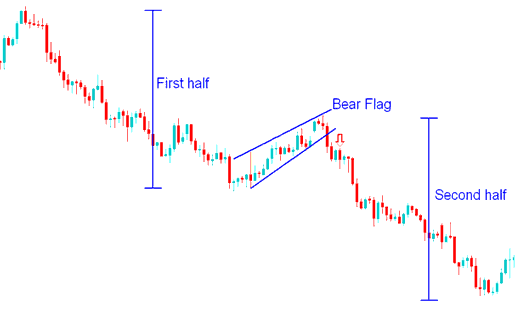

Bear Flag/Pennant Continuation Pattern

Bear Flag continuation chart pattern is found in a downtrend. The bear flag setup is a continuation pattern where the price retraces slightly/a little with a narrow price action which has got a slight upward tilt. The sell point is when the price penetrates the lower line of the inverted flag pattern. The bear flag portion has highs and lows which can be connected by small lines which are parallel, giving the bear flag pattern the look of a small channel.

The bear pennant was a short break before more sells. It confirmed as a continuation when the lower line broke down.

Access More Learning Content, like Lessons, Tutorials, and Courses:

- How to Add MT4 Linear Regression Acceleration Trading Indicator

- MACD MetaTrader 5 Technical Analysis Trade Forex

- Why Host Your Expert Advisor(EA) XAU/USD Bots with Your Broker Provided VPS

- UKX100 Indices Strategy

- DJ 30 Index Spread

- Hang Seng Tutorial Course Index Hang Seng Indices Index System

- Strategy Example for SX5E Index Trading