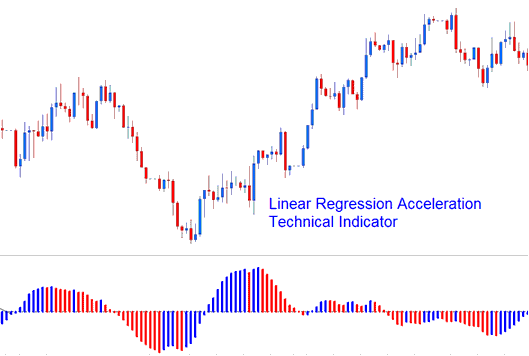

Linear Regression Acceleration Analysis & Signals

The Linear Regression Acceleration tool finds changes in the regression line's slope on the current price bar compared to its slope on the previous price bar. The value used to figure out the linear regression is called the normalized acceleration value, and it's shown for each price bar on the chart.

Linear Acceleration Regressed

If the adjusted acceleration is 0.30, then the regression line's adjusted slope will go up 0.30 for each price bar.

A normalized slope of -0.40 means the regression line falls at -0.40 per price bar.

To calculate the normalized acceleration between price bars, subtract the previous candlestick's slope value (0.20) from the current price bar's slope (0.40). In this example, the resulting acceleration would be 0.20.

Important Note: It is crucial to understand that a positive acceleration value does not automatically imply a positive slope: it merely signifies that the rate of change of the slope is increasing. Conversely, a negative acceleration value does not mean a negative slope: it indicates that the steepness of the slope is reducing.

An Examination of the Implementation of the Linear Acceleration Regression Indicator

The Linear Regression Acceleration indicator allows for the following: price choice, regression periods, smoothing of the raw price before applying the regression function and the choice of smoothing type.

The resulting regression slope is presented as a bi-colored histogram that oscillates above and below zero.

reference line is set at the 0 mark.

- A rising upward slope: (greater and higher than its previous/prior value of one bar before) is displayed & shown in up slope color.

- A declining/falling slope: (lower and lesser than its previous value of one bar before) is put to display using the downward slope colour.

Get additional tutorials and lessons at:

- Support and Resistance Levels in XAU USD

- How to Use MetaTrader 4 Aroon Oscillator Technical Indicator in MetaTrader 4 Software

- What is Gann Swing Oscillator Technical Indicator?

- SMA vs Exponential Moving Average EMA vs Linear Weighted Moving Average LWMA

- How to Find and Get SP 500 Index in MT4 Platform

- Aroon Trade Forex Robot Expert Advisor