Japanese Candlestick Patterns Guide - Candlesticks in Tech Analysis

Reading Candles in Forex Trading - Interpret Forex Candles Guide

Brief History

Candles came from 18th-century rice trader Homma Munehisa. They sum up open, high, low, and close prices over a set time.

They were used by the legendary rice trader to predict future market prices. After dominating the rice market, Munehisa then eventually moved to Tokyo exchanges where he then gained a huge fortune using this market analysis. It is said that He made over a hundred consecutive winning trade transactions.

Types of charts

There are Three types of charts which are used in Forex: Line, bar & candles.

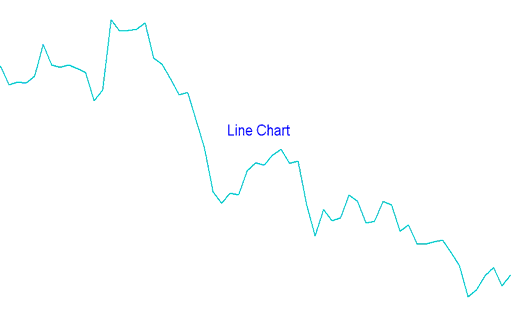

Line - This feature constructs a continuous path linking the closing prices of a specified forex currency pair.

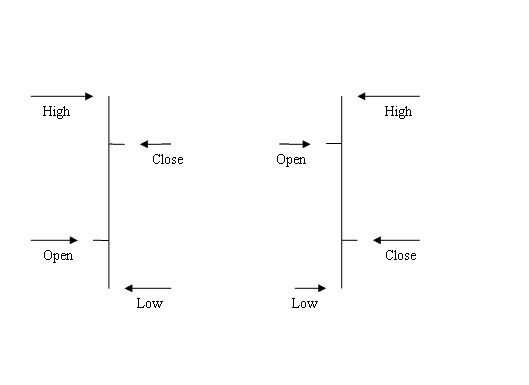

Bars- shown as a series of OHCL bars. O.H.C.L. stands for OPEN HIGH LOW and CLOSE. The opening price is shown as a line to the left, and the closing price is shown as a line to the right.

Bar charts may lack identifiable clarity, which prompts many traders to opt for alternative formats like candlestick charts instead.

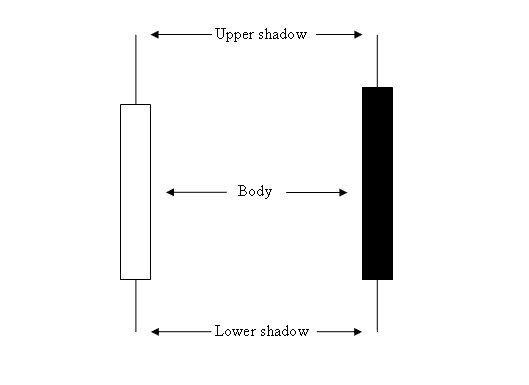

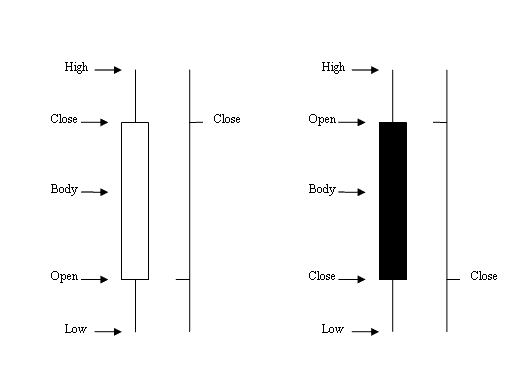

Candlesticks - These utilize the identical price data as bar charts (open, high, low, and close), but they present this information in a visually more engaging format resembling a candlestick, complete with upper and lower wicks.

How to Analyze

The rectangle section is referred to as the body.

The high & low are explained as shadows & drawn as poking and protruding lines.

The colour is either blue or red

- (Blue or Green Color) - Prices headed upward

- (Red Color) - Prices went downward

Most trading platforms like MT4 use color to show direction. The colors used are blue or green when the price goes up, and red when the price goes down.

Candles Vs. Bar Chart

When candlesticks are used it is very easy to see if the price went up or down as compared to when a bar chart is used.

The Japanese methods also have very many formations which are used by the FX traders to trade the markets. These patterns have different trading analysis explanation and the most regular are:

| Reversal Setups |

The patterns mentioned are what contribute to the popularity of Japanese candlesticks among technical traders, making this style of analysis widely employed in currency exchange market assessments. The examination of these formations in Forex trading aligns with the method used in stock trading.

Drawing These Charts on MT4 Platform

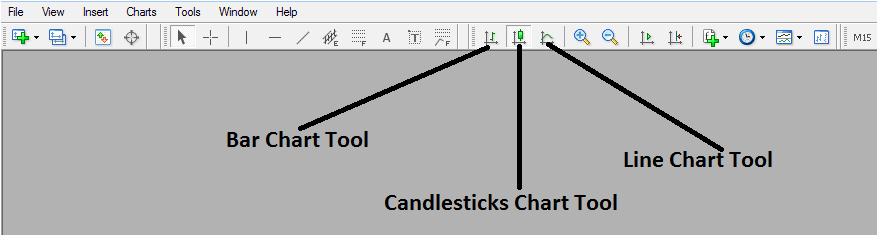

To draw these on MT4, pick the chart drawing tools from the MetaTrader 4 toolbar, like in the example below.

a To see this tool-bar on MetaTrader 4, go to the View Next to File in the upper left corner of the MT4 software, select View, then select Tool-Bars, then select the Charts button. The aforementioned toolbar will be displayed.

Once the aforementioned toolbar becomes visible, you can select the chart visualization you prefer. If you, as the trader, wish to see the data represented as a bar chart, activate the bar tool button as indicated previously: for a line graph visualization, click the line tool button: and for the Japanese candlestick format, select the "candlesticks tool button key."

Explore Further Training & Programs:

- MetaTrader AEX Index AEX 25 MT5 for FX Trading

- MetaTrader Dow Jones Index DowJones 30 MetaTrader 4 Forex Software

- How to Use MetaTrader 5 Alligator on MetaTrader 5 Platform

- How Do I Place William Percent R Indicator MetaTrader 4 Indicator on MT4 XAUUSD Charts?

- How to Trade Continuation Patterns in Practice

- How can one calculate the profit from Forex pips in a trade for 100 Forex pips?

- What is the Optimal Time to Trade the GBP/USD Forex Pair?

- How to Add SPX 500 in MetaTrader 4 PC

- How to Find and Get MT4 Stocks Trade Chart

- Japanese Candlesticks How to Use Japanese Candlesticks in Gold