Japanese Candlesticks Patterns Explained

Japanese Candle Patterns PDFBrief History

Candlesticks were created in the 1700s by a famous rice seller called Homma Munehisa to generally show the opening, high, low, and closing market price over a specific amount of time.

The legendary rice trader utilized these methods to forecast future market prices. After establishing dominance in the rice market, Munehisa transitioned to the Tokyo Exchange, amassing significant trading wealth through this analytical approach. It is reported that he achieved over one hundred consecutive successful trades.

Types of XAUUSD charts

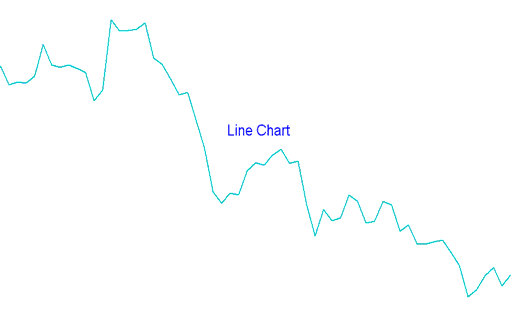

Three types of charts exist used in XAU USD: Line, bar and candles.

The line plots a continuous connection of closing prices for XAU/USD.

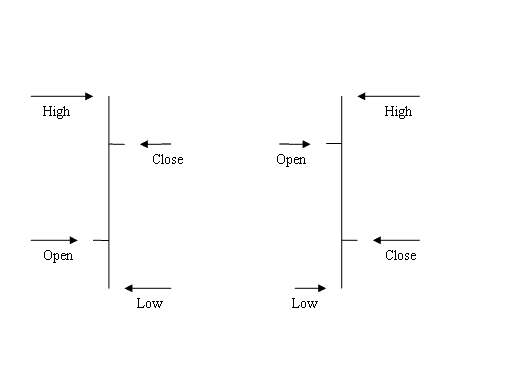

Bars- these are displayed as a series of OHCL bars. O H C L means OPEN HIGH LOW & CLOSE. The price at the start is shown as a small line to its left & the price at the end as a small line to its right.

Main disadvantage of a bar chart is that it is not visually appealing and identifiable, hence most traders don't use them.

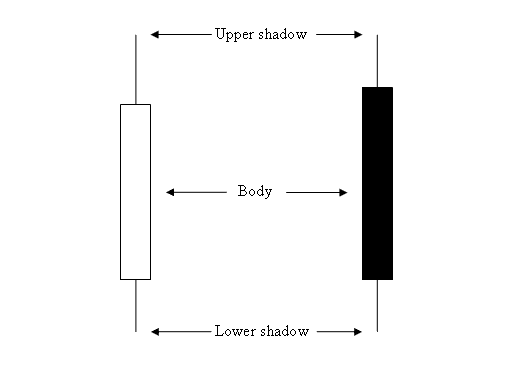

Candlesticks use the same price info as bar charts - open, high, low, and close - but they're way easier to read. They actually look like candles, complete with wicks on both ends, so you can spot trends at a glance.

How to Interpret

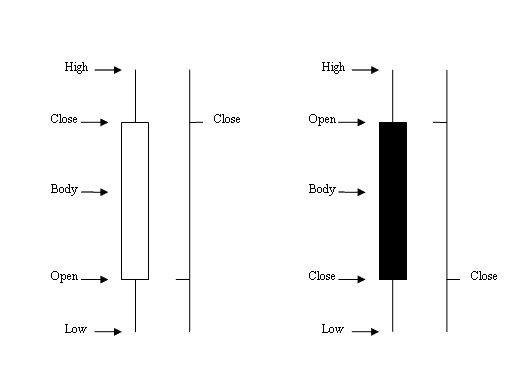

The rectangle section is known as the body.

The high and low are referred to as shadows and are represented as protruding lines.

The color may be either blue or red

- (Blue or Green Colour) - XAUUSD Prices headed up

- (Red Color) - XAUUSD Prices headed down

Most platforms like MT4 use colors for direction. Blue or green means price goes up. Red means down.

Candlesticks Vs. Bar Chart

Utilizing candles makes it significantly easier to discern the direction of price movement (up or down) compared to using bar Charts.

Japanese methods also include numerous setups that traders use when they are trading in the markets. These setups come with varied ways of looking at them, and the most typical are:

The patterns above are why Japanese candlesticks are liked by technical traders, and it's why this kind of analysis is often used to look at the market. Analyzing these pattern setups in xauusd gold trading is the same as analyzing them in stocks trading.

Drawing These Charts on MT4 Platform Software

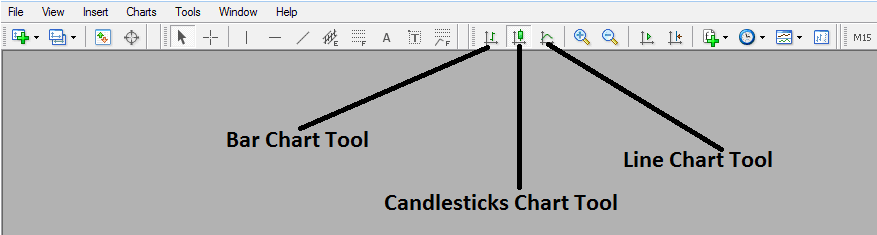

To add these in MT4, grab the drawing tools. Find them in the toolbar shown below.

To show the toolbar in MT4, go to View in the top left menu. Click Toolbars. Check Charts. The bar appears right away.

As a gold trader, you may choose the sort of view you want to see and change it once you see the toolbar. Click on the bar tool button as shown above to change to the bar style. To use the line style, click the line tool button. Select the candlesticks tool button for the Japanese candlestick format.

Find Out More Lessons & Training: