Image of Evening Star on a Chart

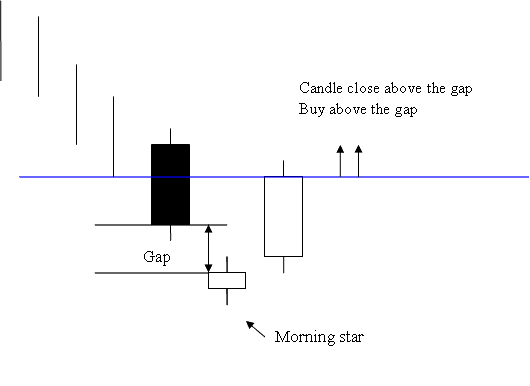

Morning Star Bullish Candlestick Patterns

Image of Morning Star on a Chart

Image of Morning Star on a Chart

Image of Morning Star on a Chart

Morning star is a 3 day bullish market reversal pattern.

The initial day features a long black candlestick.

The second day forms a morning star. It gaps down from the long black candlestick.

Third day is a long white candle that fills the trading gap.

Filling of the gap & closing of the white candle above gap is a strong bullish.

Investors and traders should start a buy trade after the market price closes above the gap made by the morning star candlestick pattern. This confirms the buy signal from this Morning Star Candlestick pattern.

Image of Evening Star on a Chart

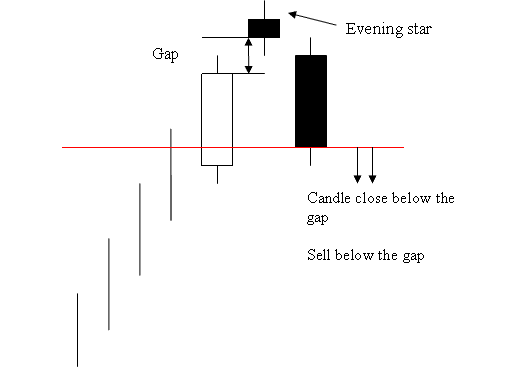

The inverse of the pattern known as the morning star.

Image of Evening Star on a Chart

Image of Evening Star on a Chart

Evening star is a 3 day bearish market reversal trading pattern.

The initial day features a long white candlestick.

Second day is the evening star that gaps away from long white candlestick.

Third day is a long black candle that fills the trading gap.

Gap Fill and Black Candle Close Below It Signals Strong Bear Move.

Investors & Traders should start a sell position when the market closes below the trading gap of the evening star candlestick pattern. This confirms the sell signal from this Evening star candlestick pattern.

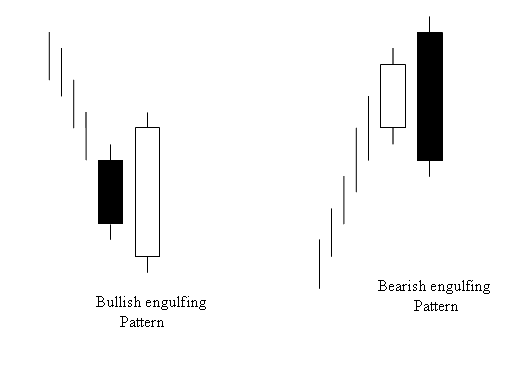

Engulfing Pattern

Engulfing is a candlestick pattern that signals a reversal. It's bullish if it appears after a downtrend, and bearish if it shows up at the end of a gold rally.

Bullish & Bearish Engulfing Pattern

Bullish & Bearish Engulfing Candlestick

The colour of first candlestick reflects the trend of day.

The second candle must fully encompass the first one and display a color reflective of the opposing market trend.

For Bullish Engulfing color of candle-stick should be Blue

For Bearish Engulfing color of candle should be Red

More Courses and Topics: