Instructions for Implementing the ATR Indicator on MetaTrader 4 Charts: Adding the MT4 ATR Indicator

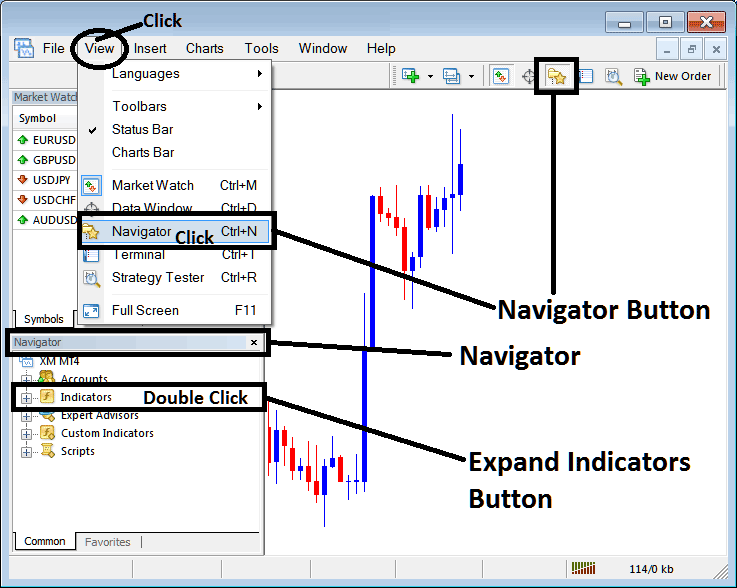

Step 1: Open the Navigator Window on Trading Platform

Open the Navigator panel like is shown: Go to the 'View' menu (click on it), then select 'Navigator' panel window (press), or From Standard ToolBar click the 'Navigator' button or press key board short cut keys 'Ctrl+N'

On Navigator window, choose & select 'Technical Indicators', (Double Click)

How Do You Add ATR Indicator on the MT4 - MT4 ATR Indicator

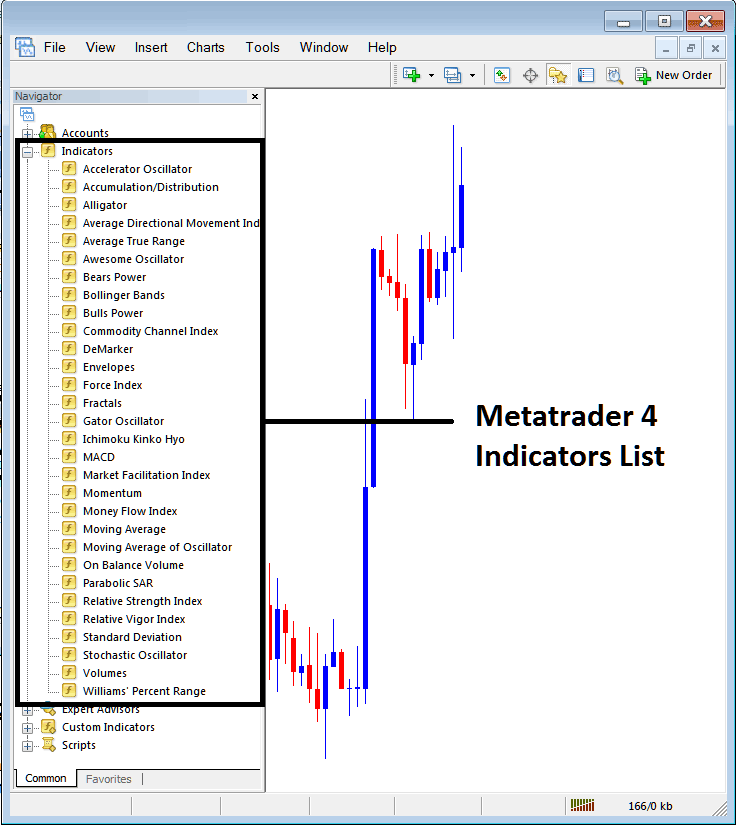

Step 2: Open Indicators in Navigator - Add ATR Indicator to MT4 Chart

To expand the menu, just click the plus sign or double-click the ‘indicators' menu. Once it opens up, you'll see a list - find the ATR technical indicator and add it to your chart.

How Do I Add ATR Technical Indicator - From the Above window you can then place ATR indicator that you want on the chart

How to Set Custom ATR Indicator to MT4

If you aim to incorporate a custom technical indicator, such as the Average True Range (ATR), you must first add this indicator to the MetaTrader 4 software and then compile it. Once compiled, the ATR custom indicator will be available in the list of custom indicators within the MT4 software.

Learn to install the ATR indicator in MT4 here. This includes adding the ATR panel and custom ATR to the MetaTrader 4 platform.

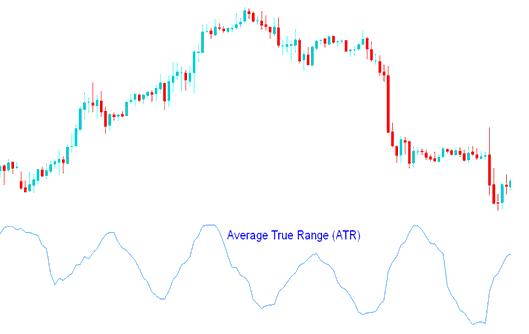

About ATR Indicator Example Explained

Average True Range - ATR Technical Analysis & ATR Signals

Created and Developed by J. Welles Wilder

This indicator is an estimate of the volatility - it gauges the range of the price movement for a particular price period. The ATR is a directionless indicator & it does not determine/figure out the direction of the trend.

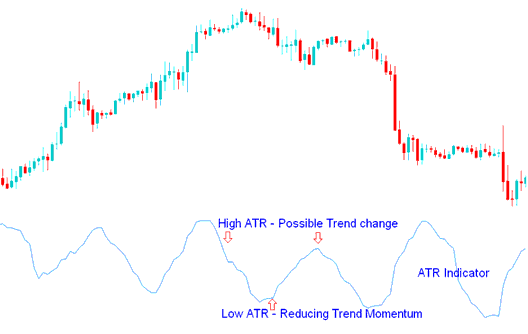

High ATR indicator values

High Average True Range values indicated market bottoms after a sell-off.

Low ATR readings

Low Average True Range values indicated long periods of price movement that stayed within a range, similar to what is seen at market peaks and during times of consolidation. Low readings on the ATR indicator are common during extended periods of sideways movement that occur at market tops and during consolidation.

Calculation

This technical indicator is calculated using the following:

- Difference between the present high & the current low

- Difference between previous closing price & the current high

- Difference between previous closing price and the current low

The final Average is determined by summing these values and calculating the mean.

Technical Analysis and How to Generate Trading Signals

ATR trading indicator can be analyzed/interpreted using the same principles as the other volatility trading indicators.

Possible trend change signal - The higher the value of the indicator, the higher the probability of a market trend change:

A measure of trend momentum – A lower indicator value corresponds to a weaker price trend movement.

Technical Analysis in FX Trading

Get More Courses & Lessons:

- Japanese Candlesticks How to Use Japanese Candlesticks for Gold

- Writing down the rules for your XAU/USD system and how to make them better.

- Margin Level Calculator Tool for Gold within the MetaTrader 4 Environment

- Setting Stop Loss Levels and Reading FX Buy/Sell Signals

- Finding the Trade Chart for the DowJones30 Index in MT4

- Steps to Add S&P to the MetaTrader 4 Mobile Application

- Understanding 1:25 Leverage in XAU/USD Trading

- Trading the S&P ASX200 Index: A Guide

- Analysis of the Keltner Bands Indicator Applied to XAUUSD Charts