Candlesticks Chart Setup Patterns

Candlesticks Consolidation Shape and Candles That Continue a Current Trend

A XAU/USD candle's size and form show buyer or seller power. You can spot hidden weak spots in either side too.

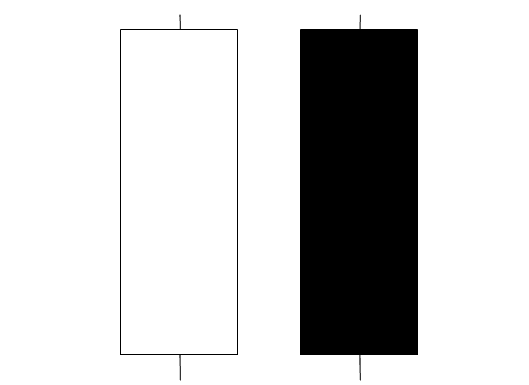

Long Body Candlesticks

Candles that are long show that there were many buyers or sellers, depending on what color the candle is.

A big shift from open to close price shows strong buyers or sellers.

Long Blue Candles - Strength of Buyers

Long Red Candles - Strength of Sellers

Long Body Candles

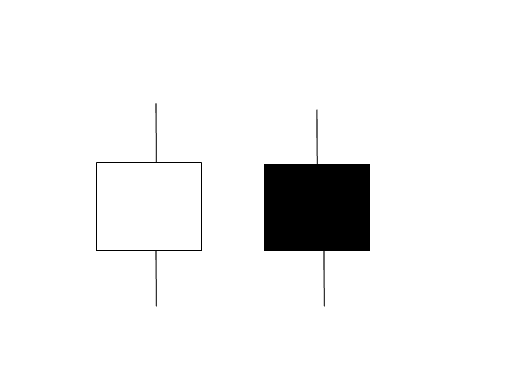

Short Body Candles

Candles with short bodies indicate minimal activity from buyers or sellers, resulting in little price movement from opening to closing.

These show that the buyers/sellers were not very strong.

Short Body Candlesticks

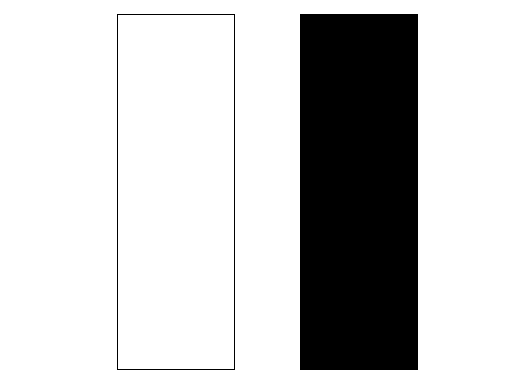

Marubozu Candlestick

Marubozu are long candlesticks that haven't any top or lower shadows, Like depicted & shown below.

Marubozu Trading Candle-sticks

Marubozu candlesticks signal that price will keep moving in the same direction as the bar itself. They come in white/blue or black/red, depending on which way the trend is going.

Marubozu Candlesticks

The white marubozu indicates that the opening price is also the lowest point, while the closing price is the highest.

Marubozu signals no pullbacks in that price span. It means buyers held full sway over prices.

White Marubozu is a sign of continuation, meaning that the next candlestick will likely keep moving in the same upward direction.

Black marubozu - the opening price is the highest, and the closing price is also the lowest.

Marubozu means the price did not move back at all, showing that sellers were totally in charge of the price.

The black Marubozu signals continuation too. The next candle should follow the downtrend.

Get More Lessons & Courses:

- Foundations of XAU/USD Trading Strategy Basics

- How to Place DAX in the MT5 DAX Application?

- What's the Pip Value on a Standard Forex Account?

- Drawing Upward Forex Channels in MetaTrader 5 Platform

- Chart Analysis for EU50 Indices

- NETH25 Course Tutorial & Trade NETH 25 Lesson Tutorial

- A list of plans for SWI 20 and ways to trade SWI20 effectively.