Reversal Candles Confirmed: Hammer and Hanging Man Patterns Explained

Hammer Bullish Candle-stick Setup Patterns

Reversal candlestick formations are only valid if they emerge following an established, prolonged market trend: thus, the prerequisite for any candlestick configuration to qualify as a reversal pattern is the existence of a preceding trend.

These reversal candlestick setups are:

- Hammer Candlestick Pattern Hanging Man Candlestick Pattern

- Inverted Hammer Candle Pattern and Shooting Star Candlestick Pattern

- Piercing Line Candlestick Pattern and Dark Cloud Cover Candle Pattern

- Morning Star Candle & Evening Star Candles

- Engulfing Candles Patterns

Hammer Candle Pattern & Hanging Man Candlestick Pattern

Hammer Candle Patterns signify bullish reversals, while Hanging Man Candlestick Patterns indicate bearish reversals despite their similar appearance.

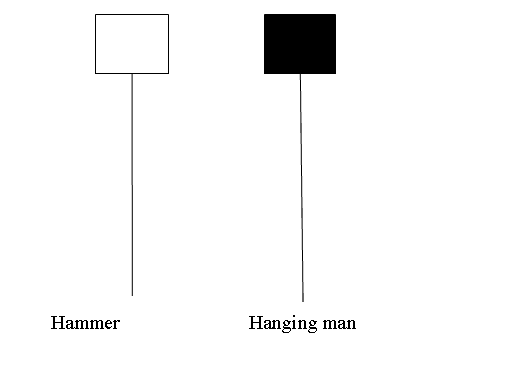

Hammer Candlestick Pattern & Hanging Man Candlestick Pattern

Hammer Candle

A Hammer is a sign that the price might go up, and it happens when the price is going down. It's called that because the market is finding a bottom.

A hammer has:

- A small body

- The body is at the top

- The lower shadow is 2 or three times length of real body.

- Has no upper shadow or very small upper shadow if present.

- The colour of the body is not important

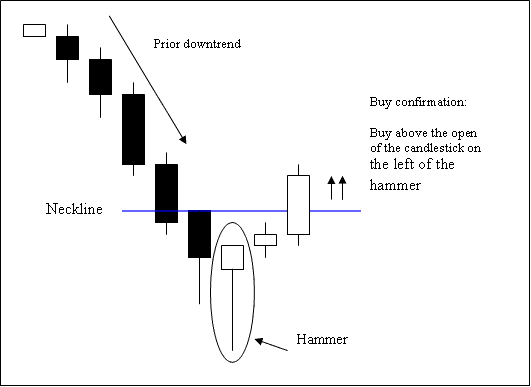

Hammer Candle

Technical Analysis of the Hammer Candles Pattern

The signal to buy is verified when a candlestick ends above the starting price of the candle to the left of the hammer pattern.

Stop orders should be set few pips just below the low of hammer candle.

Hanging Man Candle

This pattern might signal a market reversal to a downward trend, and it happens when prices are generally going up. It gets its name because it resembles a person hanging from a high noose.

A hanging man candle-stick has:

- A small body

- The body is at the top

- The lower shadow is 2 or three times length of real body.

- Has no upper shadow or has a very small upper shadow if present.

- The color of the body isn't important

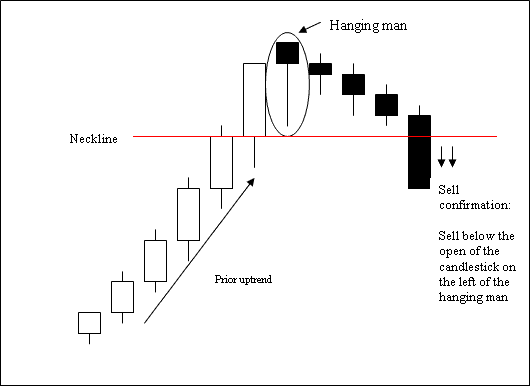

Hanging Man Candlestick

Trading Analysis of the Hanging Man XAUUSD Candles

The sell signal is validated when a bearish candle closes beneath the opening of the candlestick to the left of the hanging man candlestick pattern setup.

Stop orders ought to be placed a few pips above the peak of the hanging man candlestick.

Learn More Topics and Lessons: