Characteristics of the Three Primary Global Market Trading Sessions: Asia, Europe, and USA

Asia Session

During the Asian market session only 8 % of total daily trades go through Tokyo desks. This is the least active market session of the three major market sessions. Most of this 8% only involves yen based currency pairs with very little trade transactions happening for other currency pairs. This is the reason/explanation why it's not suitable to trade during this Asian market session period. Not trading this Asian market session period will save you a lot of time and money.

Europe Session

The London/European market session accounts for the largest volume of deals, responsible for 34% of all trading transactions conducted during its hours. The London time zone is optimally positioned relative to the business hours of both Eastern and Western economies, which leads to session overlaps and, consequently, a high volume of trades during this period. This represents the most liquid and volatile market session for all currency pairs.

The Europe time zone includes European zone countries. The Euro zone has 17 members. Major banks are open, with high liquidity from many trades.

US Market Session

The US market takes up 20% of all trades. Most active time for market is approximately from 8 am to 12 pm when both London & New York dealing desks are open. This is when there is generally the highest volatility in the market as it is also when the majority of the major US economic data reports announcements are released.

European and US Market Session Market Overlap

Even if the forex is open around the clock during the week, there are times when trading volume is higher, giving more chances to turn a profit.

For individuals engaged in day trading, the most opportune trading window is during the overlap between the London and US market sessions. This overlap period represents the peak activity for currency trades, characterized by a substantial volume of transactions and maximal market dynamism.

During the overlap of market sessions, significant fundamental news is released, leading to increased price volatility, with quick movements in currency prices creating numerous trading opportunities. The overlap between the London and New York sessions provides optimal chances for those looking to maximize profits in trading.

The optimum time to trade is when this market session overlaps, since the currencies are truly moving, the movements are decisive, and there is the greatest opportunity to profit.

It is also why Asian traders, will wait until afternoon to start executing their orders, this is the period that will coincide with the Europe and America sessions.

Asian traders won't open trade positions during the Asian session time, therefore as an investor from anywhere in the world it is best stay away also during this Asian market session, after all even the hedge funds and other pro investors from Asia will avoid during this time and wait until afternoon when it is much easier to analyze price moves because of the liquidity available during the US and UK market overlaps.

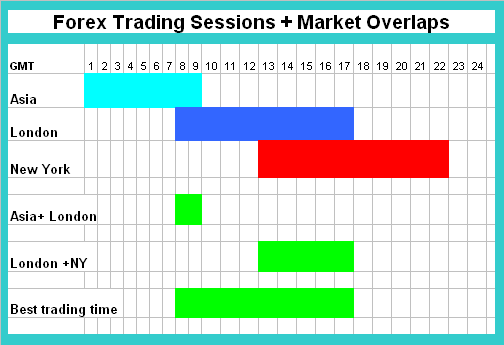

Therefore to come up with the best hours to trade based on these three market sessions just as shown:

FX Market Hours and the Overlaps Between Market Sessions - The Three Primary Market Sessions: Asia, Europe, and the US.

The chart above outlines the schedule of each trading session's start and end times. It also highlights overlapping sessions and identifies the optimal hours for trading based on those overlap periods.

Summary:

Determine Your Schedule

The type of trader you are determines your forex schedule. If you don't have a lot of time to watch the market then a longer term style would suit you best. If on the other hand you have got a lot of time to watch the market then you may decide to set a intraday trading schedule where you open trades during the most active market hours. The above chart shows the best GMT times to be trading in the market - from around 800 GMT & 1800 GMT.

Determine your time frame for your strategy

To establish a trading schedule, it is essential to determine your chart time frame. Experiment with various chart time frames until you identify the one that is most suitable and comfortable for your forex schedule.

Test your trading strategy

Test your strategy on a demo account for a specified duration. Keep a record of each trade and monitor the progress of your schedule. Attempt to analyze and interpret which times yield the highest profitability for your trading strategy.

Your strategy should be specified on the trading plan that you use.

To set up your schedule in a plan, read the Forex Plan guide. This tutorial on writing a plan gives a template example for FX traders.

Study More Lessons and Tutorials and Topics:

- Indicators Useful for Setting Stop Loss Orders Specifically for XAUUSD Trades

- Setting Up Bollinger Bands in MetaTrader 4

- How Do I Get FTSE in MT4 Android Phone Program?

- Summary of using the Bollinger Band indicator for trading Gold.

- Bollinger Band Usage in Stock Index Trading Chart Review

- How do you analyze the McClellan Oscillator gold indicator in XAU/USD?

- AEX Trading Strategies for Stock Indexes

- Looking for NZDCAD open and closing hours? Here's the schedule.

- Gann Swing Oscillator Automated EA

- How to Implement Momentum in Trading?