Guide to Setting the Momentum Indicator on MetaTrader 4 Charts: Incorporating the MT4 Momentum Indicator

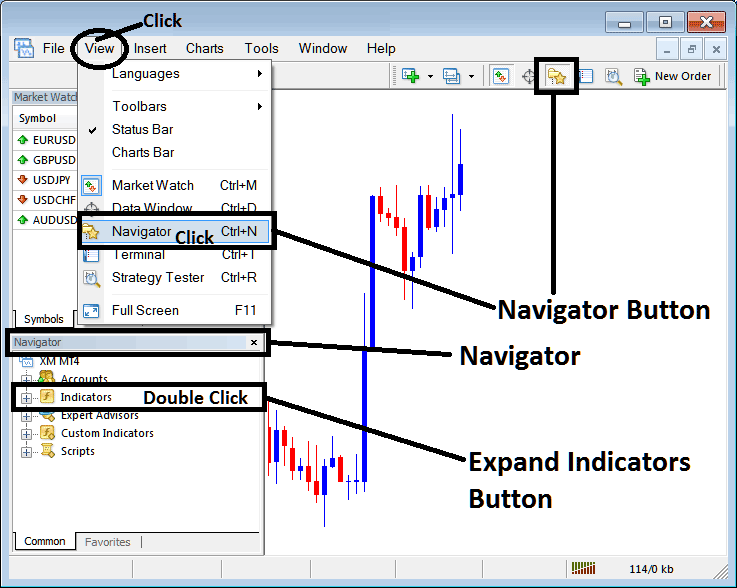

Step 1: Open the Navigator Window on Trading Platform

Open Navigator panel like is shown & shown: Navigate to 'View' menu (click on it), then select 'Navigator' panel window (click), or From Standard ToolBar click 'Navigator' button or press key board short cut keys 'Ctrl+N'

On Navigator panel, choose 'Indicators', (DoubleClick)

How to Set Momentum in the MT4 - MetaTrader 4 Momentum Indicator

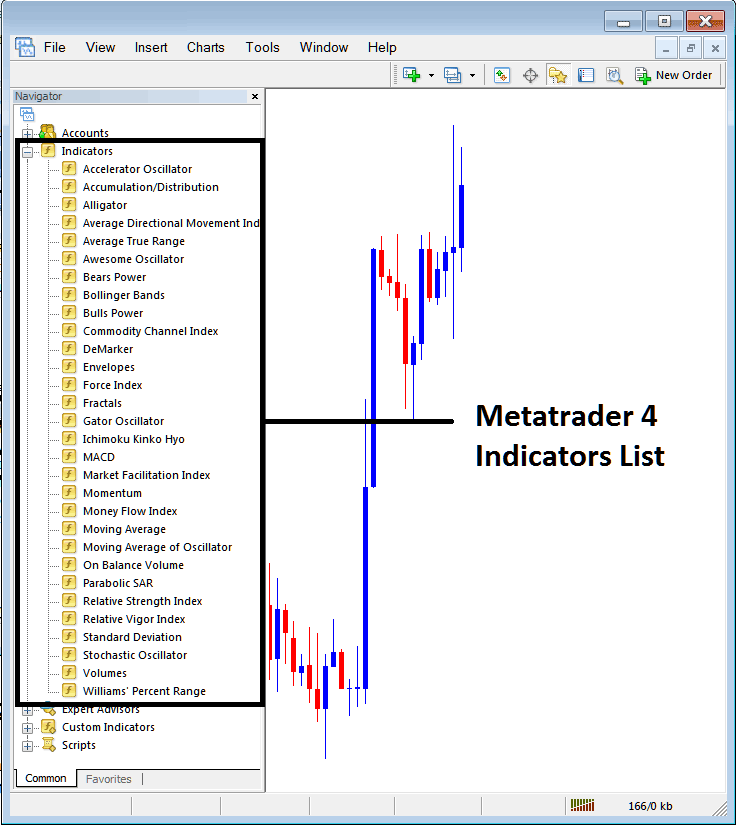

Step 2: Open Indicators in Navigator - Add Momentum to MT4 Chart

Expand the menu by clicking the protract button tool marker feature ( + ) or double-click the 'indicators' menu, after that this particular specified button will appear and be shown as (-) & will now display a list just as shown - choose the Momentum technical indicator from this list of trading technical indicators so as to add the Momentum to the chart.

How to Specify Momentum Settings – From the window displayed above, you can then assign the desired Momentum setting to the chart.

How to Set Custom Momentum to MT4 Software Platform

If you're adding a custom indicator like Momentum, you must first upload it onto the MT4 platform and compile it, allowing it to appear in the list of custom technical indicators in the MetaTrader 4 software.

To learn how to install Momentum indicators in the MT4, how to add Momentum panel to MT4 and how to add Momentum custom indicator in MetaTrader 4 Platform - How to add a custom Momentum on the MT4 Software.

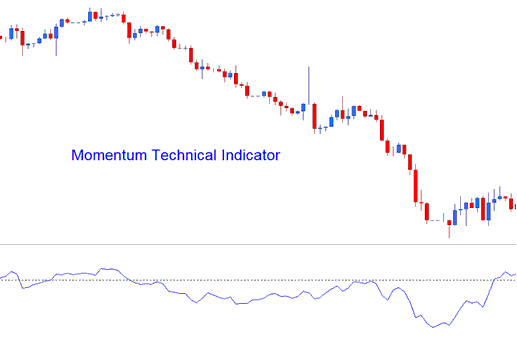

About Momentum Tutorial Explained

Momentum Analysis and Momentum Oscillator Indicator Signals

The line of drawing is determined using mathematical formulas by the momentum indicator. The pace at which prices fluctuate is measured by momentum. This is calculated by subtracting the average/mean price from the current price candle over a selected and chosen number of previous price bars.

Momentum measures how fast a currency's price changes over time. Quick price rises boost momentum. Sharp drops reduce it even more.

As the pace of price movement decreases, so too will the momentum, causing it to revert towards a central value.

Momentum

FX Analysis and How to Generate Trading Signals

Traders use this tool to spot buy and sell signals in technical analysis. In forex, the top three ways to create these signals are:

Zero Center-Line Crossovers Signals:

- A buy trade signal gets derived/generated when the Momentum crosses above zero level

- A sell trade signal gets generated/derived when the Momentum crosses below zero mark

Over-bought/Oversold Levels:

Momentum is used as an overbought/oversold indicator, to identify the potential overbought & over-sold levels based on previous readings: the previous high or low of the momentum is used to figure out & determine the over-bought and oversold levels.

- Readings above the overbought level mean the forex currency pair is over-bought & a price correction is pending

- While readings below the oversold level the currency is oversold and a price rally is pending.

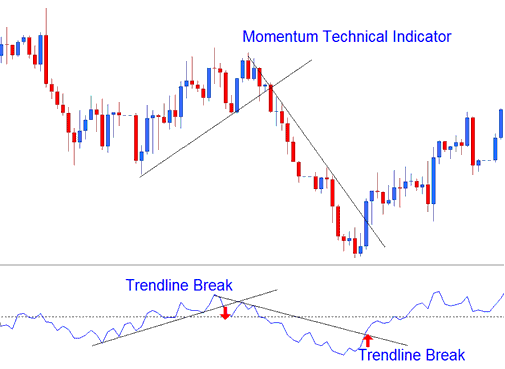

FX Trend Line Break Outs:

Trend-Lines can be drawn on the Momentum trading indicator connecting these peaks & troughs. Momentum begins to turn before price thenceforth making it a leading indicator.

- Bullish reversal - Momentum readings breaking above a downwards trend line warns of a possible bullish reversal setup while

- Bearish reversal - momentum readings breaking below an upwards trendline warns of a possible bearish reversal signal.

Analysis in FX Trading

Get More Tutorials & Tutorials:

- Exploring CAD/JPY Market Open and Close Times

- Instructions on Setting US 500 on the MT4 Android Trading Application

- How to Use MT4 Choppiness Index on MetaTrader 4 Platform Software

- How to Add Moving Average Oscillator Gold Indicator for XAUUSD Analysis

- FX Trading Balance of Power(BOP) Expert Advisor Setup

- How do I trade stocks on MetaTrader 4?

- Learning About Index Signals

- Calculation Method for Pip Profit in Forex Trading Corresponding to 100 Pips on a 1 Micro Lot?

- How to Create a Signal for a Stock Index Using Index Indicator Systems

- Exploring CAD/JPY Market Open and Close Times