FX Market Hours and the Three Major Sessions Explained

New York Close, London Close, Tokyo Close - Sessions for These Markets

The market operates continuously for 24 hours: it starts operating on Sunday evening (5 PM EST) and stops on Friday afternoon (4P.M. EST) - which means it is open for five and a half days each week.

However, even though the market is open 24 hrs a day, as a trader you need to realize that certain times of day are more suitable for placing trades than others and you need to know the most active market hours in order for you to devise an effective and time-efficient trading strategy.

To maximize trading opportunities, it's crucial to identify the busiest market hours when most currency trading activity occurs. These high-activity periods are when the majority of trade positions take place.

Despite the lack of formally established global opening and closing market times, commercial trading activity can generally be segmented into three primary sessions: Tokyo, London, and New York.

Nevertheless, even if it doesn't seem very crucial at first, knowing when to trade is one of the most important skills for becoming a successful trader.

The optimal window for participating in the market is when activity peaks, resulting in the highest trade volume. A highly active market offers superior prospects for realizing gains, whereas a stagnant or sluggish market amounts to a waste of time: at such points, it is advisable to power down your system and forgo trading entirely.

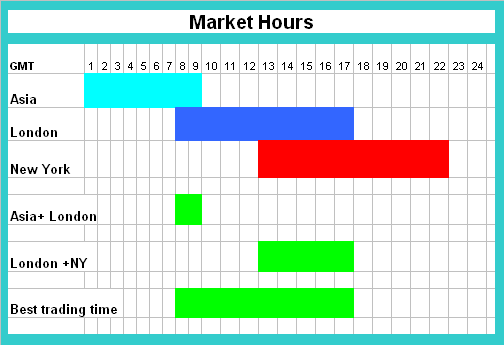

Not all the market times are appropriate for placing trades, that's because the market volatility changes too much during the 24 hours. Below is a guide outlining the schedule of FX Market Sessions. The time used is GMT 0

The 3 major market sessions are:

- Asia Market Session Hours( Tokyo Market Session ): 00:00 - 9:00 GMT

- European Market Market Session Hours( London Market Session ): 7:00 - 17:00 GMT

- U.S. Session Hours( New York Market Session): 13:00 - 22:00 GMT

Best Forex Session Overlaps for Trading

There are hours when two sessions are overlapped:

London + Tokyo over-lap - 7:00 - 9:00 GMT

New York + London overlap - 13:00 to 17:00 GMT

At these over-lapping market hours you'll find the highest volume of currency trade positions and thence there are more likely chances to make winning trades during these hours when there is market session overlaps.

For instance, EURUSD and GBPUSD work well from 13:00 to 17:00 GMT. That's when Europe and US sessions overlap for those pairs.

This means that most of the currency exchange trading happens when both the London market and the US market are open. Naturally, this is the best time for traders to trade if they want to have a better chance of making money when they trade in the market.

Currency prices jump around a lot during the New York and London market sessions. That's when big players - banks, hedge funds, and multinational companies - are all active.

Multinationals will transact currencies during this time to facilitate international business transactions and commerce, hedge funds and managed funds will trade currencies for investment purposes, banks on the other hand will exchange lots of money on behalf of their customers, maybe tourists who want to travel around the world or just anybody wanting to exchange their money so that to purchase and buy something in another country or make a transaction.

This makes the market very liquid at this time when these two market sessions are open and the high volume of trade transactions means that currencies prices move a lot more during these overlapping market session hours. At this time the currencies will in general move in a given direction and form a shortterm trend.

If you're a trader, you'll want to trade when others are, because that's when there's enough money moving around and chances to trade. Traders have a better chance of profitable trades when the market's busiest. Also, lots of money moving usually means currency prices are easier to guess. But when there's not much money moving, prices are harder to guess and may move without a clear direction.

After you trade currencies for some time, you will notice that it's simpler to trade when there is a trend. You have a better chance of making money when the market is either going up or down in a clear direction. On the other hand, when the market is just going sideways and not really moving, you could experience sudden price changes that can confuse your trades.

Asia Session Characteristics:

- Least volatile of the three sessions

- Account for 15% of daily trade position turnover

- Typical 20 -30 pip(point) moves

Europe Session Characteristics:

- Most volatile of the three sessions

- 35% of daily trade position volume

- Typical 90 -150 pip(point) moves

US Market Session Characteristics:

- 2nd most volatile of the three sessions

- Accounts for 25% of daily trades turnover

- Focuses on USA economic news

US and Europe Session Market Overlaps Characteristics:

- Combines the 2 most volatile market sessions

- Accounts for 60% of total daily trade position turnover

- Focuses on USAUS & European economic news

- Fast moving currency prices and currency pair short term trends in a particular direction

- Typical 100 -150 pip moves for major currency pairs

Get More Courses and Tutorials: