What's T3 Moving Average Indicator? - Meaning of T3 Moving Average Indicator

T3 Moving Average Forex indicator - T3 Moving Average technical indicators is a popular technical indicator that can be found in the - Forex Indicators List on this site. T3 Moving Average is used by the FX traders to forecast price movement based on the chart price analysis done using this T3 Moving Average indicator. Traders can use the T3 Moving Average buy & Sell Trading Signals described below to figure out when to execute a buy or sell trade when using this T3 Moving Average indicator. By using T3 Moving Average and other indicators combinations traders can learn how to make decisions about market entry and market exit.

What's T3 Moving Average Indicator? T3 Moving Average Indicator

How Do You Combine Indicators with T3 Moving Average? - Adding T3 Moving Average on MT4 Platform

Which Indicator is the Best to Combine with T3 Moving Average?

Which is the best T3 Moving Average Forex indicator combination for forex trading?

The most popular indicators combined with T3 Moving Average are:

- RSI

- Moving Averages Indicator

- MACD

- Bollinger Bands Indicator

- Stochastic Oscillator Indicator

- Ichimoku Indicator

- Parabolic SAR

Which is the best T3 Moving Average combination for Forex trading? - T3 Moving Average MT4 indicators

What Indicators to Combine with T3 Moving Average?

Find additional indicators in addition to T3 Moving Average that will determine the trend of the forex market & also others that confirm the market trend. By combining forex indicators which determine trend and others that confirm the trend and combining these technical indicators with FX T3 Moving Average a trader will come up with a T3 Moving Average based strategy that they can test using a demo account on the MetaTrader 4 platform.

This T3 Moving Average based system will also help traders to figure out when there is a market reversal based on the technical indicators signals generated and thence trades can know when to exit the market if they have open trades.

What is T3 Moving Average Based Trading? Indicator based system to analyze and interpret price & provide trade signals.

What's the Best T3 Moving Average Forex Trading Strategy?

How to Choose & Select the Best T3 Moving Average Forex Strategy

For traders researching on What's the best T3 Moving Average forex strategy - the following learn forex guides will help traders on the steps required to course them with creating the best trading strategy for forex market based on the T3 Moving Average system.

How to Develop T3 Moving Average Forex Trading Strategies

- What's T3 Moving Average System

- Creating T3 Moving Average Forex Trading System Template

- Writing T3 Moving Average Forex Trading System Rules

- Generating T3 Moving Average Forex Buy & T3 Moving Average Sell Trading Signals

- Creating T3 Moving Average Forex Trading System Tips

About T3 Moving Average Example Explained

T3 Moving Average Analysis and T3 Moving Average Signals

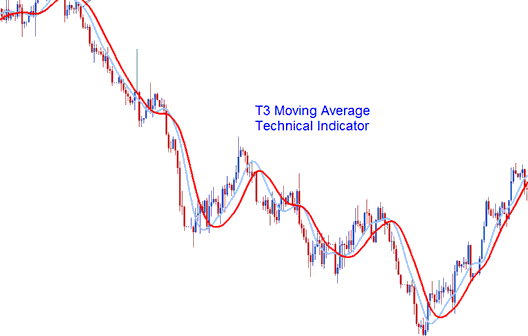

T3 uses a Smoothing factor/technique to produce trading signals that are similar to those of the MAs Moving Averages, but trading signals are more accurate than those of the Moving Average. The T3 is a modification of technique used to calculate the original MA and it has got a smoother curve & it doesn't lag the market as much as the Moving Average. This Indicator follows price action and adjusts itself to the direction of the price.

Forex Analysis and Generating Signals

T3 Moving Average is similar to the initial MA, & it can be traded and transacted in the same way as the initial MA.

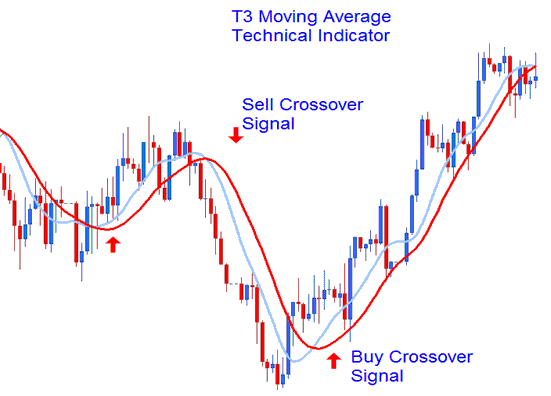

Moving Average Cross-over FX Signal

This Method involves using 2 T3 Moving Average and generating trading signals when the 2 cross each either upwards generating an upward trend signal or cross downwards generating a downward trend Signal.

Cross-over Signal

Cross-over Signal

Bullish Trend - Prices are bullish as long as the price action remains above the indicator. When this move happens and occurs it implies that the market prices are bound to continue heading upwards.

Bearish Trend - Prices are bearish as long as price action remains below the T3 Average. When the price is below the trading indicator it implies that the price is bound to continue heading downwards.

Whipsaws - This is a smoothed indicator which isn't prone to giving out whipsaws, since it's smoothed it is less responsive to the price spikes, therefore a price spike won't skew the data used to calculate and plot it.

Learn More Lessons and Tutorials and Topics:

- How to Draw on MT4 Charts

- What's the Best Gold Leverage for $200 in XAU USD?

- What is XAUUSD Gold Margin Level Meaning in MT4 Platform Software?

- FX Technical Indicators MT4 Momentum Indicator

- USDSEK Opening Time and USDSEK Closing Time

- Forex Moving Average MetaTrader 4 Indicator

- Moving Average Signal in Range Indices Market