McClellan Oscillator Analysis & McClellan Oscillator Signals

Created by McClellan.

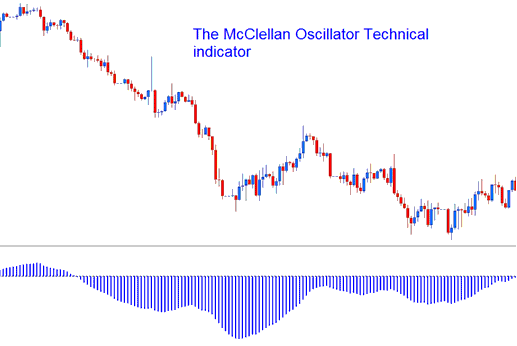

The McClellan Oscillator is an indicator that figures out the difference between the number of rising candlesticks and falling candles. This technical indicator looks a lot like the standard MACD indicator.

McClellan Oscillator

Gold Analysis and Generating Signals

This special tool shows how strong a trend is and can be used for trading like the MACD tool. There are three different ways you can use the McClellan Oscillator to help you find good times to trade.

Zero Centerline Crossover Signals:

Bullish Signals- When the oscillator goes above the zero line, it gives or makes a signal to buy.

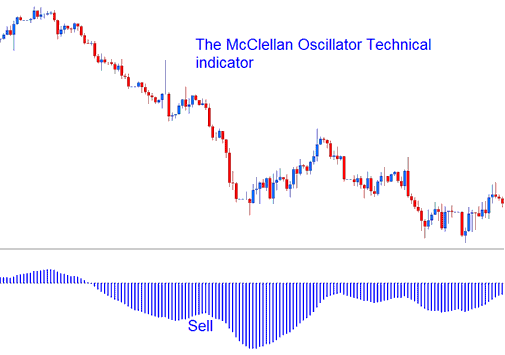

Bearish Signals- When the oscillator goes below the zero line, it means you should likely sell at that point.

Analysis in XAUUSD Trading

Divergence Trading Setup Signals:

Spot mismatches between the McClellan Oscillator and price action. This spots turns or ongoing trends in prices well.

There are different types of divergence-setups:

Classic Divergence ( Regular Divergence )

- Bullish Divergence: Lower lows in price action and higher lows in the McClellan Oscillator.

- Bearish Divergence: Higher highs in price and lower highs on the McClellan Oscillator Indicator.

Hidden Divergence Setup

- Bullish Divergence: Higher lows in price action & lower lows on McClellan Oscillator Indicator.

- Bearish Divergence: Lower highs in price action & higher highs in McClellan Oscillator.

Oversold/Over-bought Levels in Trading Indicator

The McClellan Oscillator also serves a purpose in pinpointing potential overbought and oversold conditions within price action movements. These extreme conditions are signaled when the oscillator reaches peripheral levels and begins to reverse its course: however, in markets exhibiting strong directional trends, the oscillator may remain in these overbought or oversold zones for extended periods. It is generally advised against using these extreme levels in isolation to generate trading signals. The most reliable signals for entry are typically derived from centerline crossovers.

Get More Lessons and Topics:

- Interpretation and Analysis of Pips in SGDHKD: Counting Pips on SGDHKD

- Gann HiLo Activator Analysis in Forex

- What is the FX MACD Indicator?

- True Strength Index (TSI) – Using the MT4 Indicator

- Educational Module Covering FTSE100 Index Trading Techniques.

- What's UsTec 100 Pips Size?

- Locating the S and P AS 51 Index Trade Chart within MT4

- Elucidating the FX Triple Exponential Moving Average (TEMA) Indicator.

- XAU/USD Broker Insights into Low and Tight Spreads Further Evaluated