Forex Indicators for Setting Stop losses In Trading

Some tools are used to set stoploss orders, so traders do not have to do hard math to figure out where to put these stop loss orders.

A systems trader also can set a stop loss order in accordance to these indicators. Some indicators use mathematical formulas to calculate where the trade order stop loss order should be set so as to provide an optimal exit for a trade. These indicators can be used as the basis for setting stop losses. These indicators follow price action of a currency closely and define the boundaries which the currencies should move along in. When price moves & heads outside these boundaries it's henceforth best to close the open trade positions because price stops moving in that particular direction.

Some of the indicators that can be used to set stoploss orders are:

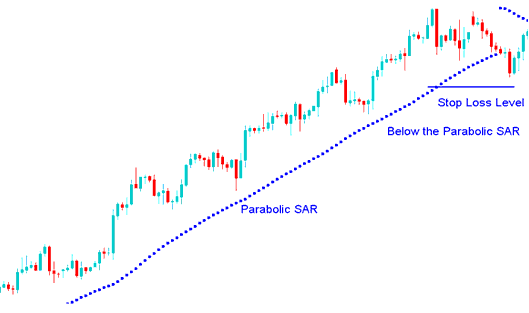

Parabolic SAR - Indicator for Automatic Stop Loss and Take Profit

The Parabolic SAR functions similarly to an indicator that automatically sets both a trailing stop loss and a take profit level.

Parabolic SAR provides excellent exit points.

In an upward trend, close long buy trades when prices drop below the Parabolic SAR indicator.

During a declining market trend, short selling positions should be closed if the price moves higher than the level indicated by the Parabolic SAR indicator.

If you're long then the price is above the parabolic SAR indicator, the parabolic SAR will move up each day, regardless of the direction in which price is heading. The amount the Parabolic SAR indicator moves upwards depends on the amount that the prices moves.

Deploying Parabolic SAR for Stop Placement - Automated Stop Loss and Take Profit Indicator Tool

Picture of parabolic SAR indicator & how this Parabolic SAR is used

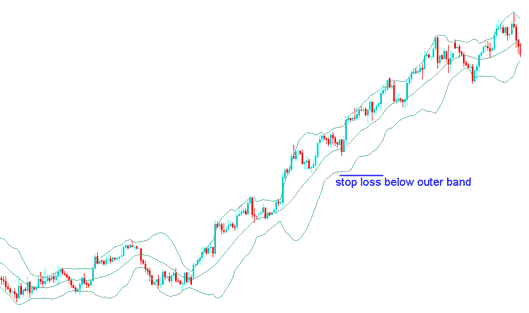

Bollinger Band - Indicator for Setting Stop Losses

Bollinger Bands use how spread out numbers are as a way to see how much prices change. Since how spread out numbers are tells you how much prices change, the Bollinger Bands change on their own, meaning they get wider when prices change a lot and get smaller when prices don't change as much.

Bollinger Bands indicator consist of three bands designed and intended to encompass majority of a instruments price action. The middle band is a basis for the intermediate-term trend, mostly it's a 20 day period SMA, which also serves as the base for calculating the upper band & lower band. The upper band's & lower band's distance from the mid band is determined by volatility of the price.

Since Bollinger Bands wrap around the instrument price, you can set your stop loss just outside these bands.

Utilizing Bollinger Bands for Setting Stop Loss Thresholds - Bollinger Band Stop Loss Placement

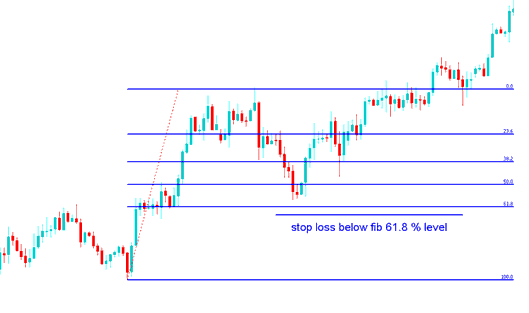

Trading Indicators Based on Fibonacci Retracement Areas - Automatic Stop Loss and Take Profit Indicator Functionality

Fibonacci retracement levels act as areas of support and resistance, which can be utilized to define stop loss points effectively.

The 61.8% Fibonacci retracement level is popular for stop-loss orders. Place your stop just below this level.

The 61.8% Fibonacci retracement level is frequently employed for setting stop loss orders due to its relative infrequency of being reached.

Fib Indicator StopLoss Setting at 61.8 % Fibonacci Retracement Level

Fib retracement level 61.8% - Fibonacci Indicator

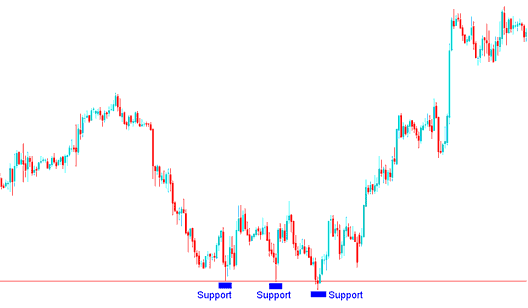

Support & Resistance Levels Lines

You can use support and resistance levels to decide where to put stop loss orders, setting them a bit above/below the resistance/support.

- Buy Trade - Stop Loss order set a few pips below the support level

Buy Trade - Stop Loss set a few pips just below the support level

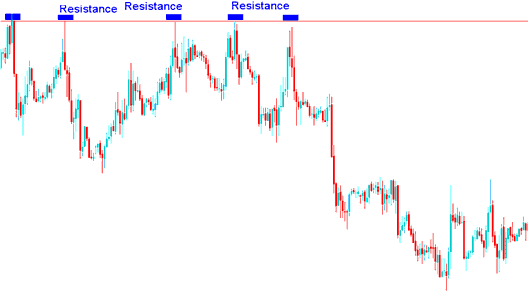

- Sell Trade - Stop Loss order set a few pips above the resistance level

Sell Trade - Stop Loss Order set a few pips above the resistance zone

More Lessons:

- Utilizing ADX: A Step-by-Step Guide

- Trading the NIKKEI 225 Index

- How to Integrate Moving Averages (MA) on Trade Charts Effectively

- Introduction to Gold Trading

- Understanding Gold Margin Accounts

- Availability of Complimentary Live XAU USD Market Signal Streams

- Trading the AEX 25 Index on MetaTrader 4: How to Add the Symbol

- How Can I Add Bollinger Bandwidth Indicator on Chart?

- Application Guide for Utilizing the MetaTrader 4 Hull Moving Average Indicator on the MT4 Platform.

- MetaTrader 5 Software for the EU50 Index