How to Draw Trend Lines & Channels on Charts

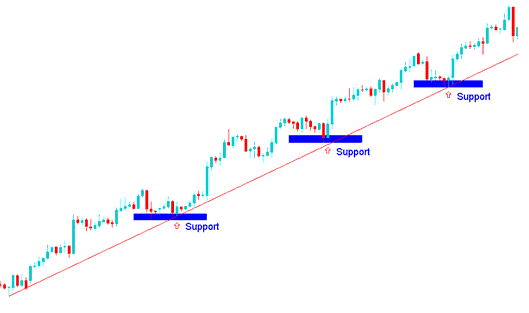

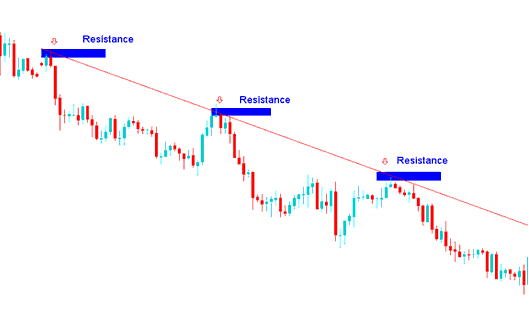

Sometimes support and resistance lines form diagonally, almost like a staircase. When that happens, it creates a trend - a steady move up or down.

A trend line shows where the market price finds support and resistance, based on which way the market is going. If the market is going up, the trend line shows support, and if it's going down, it shows resistance. Many traders use these lines to find these support and resistance spots on charts.

A Trend Line is defined as a straight, angled segment connecting at least two existing price points, which is then projected forward to serve as a potential boundary for either resistance or support. There are inherently two variations: the rising trend line and the declining trend line. In Forex analysis, a trend line is a graphical tool used in line studies to project the probable direction of the subsequent price movement. A trader must possess the requisite skill to accurately draw these lines and correctly interpret the signals they generate derived from this trendline instrument.

This market analysis is built on the idea that markets usually move in certain directions. Trend lines are used to point out three things.

- The general direction of market - upwards or downwards.

- The power of current market trend - and

- Where future support & resistance will be likely located

The market often moves and heads in a specific direction for a period of time if trend lines take shape in that direction, up to the point where that trend line is broken.

Drawing trendlines on a chart helps identify the overall price movement, which may either be upward or downward.

Shown Below is illustration of how to draw these trend-lines on charts

Course: How to Draw Up-wards Trend Line & Trade Upwards Trend Move

Course: Instructions on Drawing Downward Trend Lines and Trading Downward Trend Movements

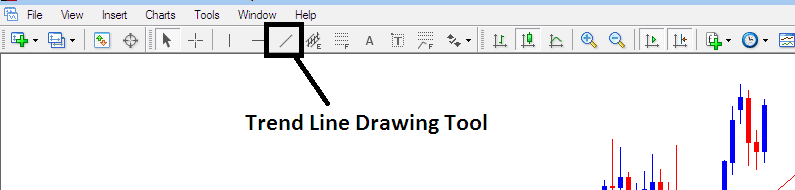

The MetaTrader 4 platform provides charting & trading tools for drawing these trend lines on charts. To draw trend lines onto a chart, traders can use the tools provided on the MetaTrader 4 software that is shown below.

To draw trendlines on a chart just click the MT4 Draw Trend-Line Tools as is shown above on the MetaTrader 4 platform software analysis software & select point A where you want to start plotting the trend-line & then point B where you want the trend line to touch. You also can right click on trend line & on properties option choose option to extend ray by ticking 'ray check box', if you don't want to extend the trend line, then uncheck this option in your MT4 platform software. You also can change other trendline properties like color and width on this property pop up window panel of the trend-line properties. You can download MetaTrader 4 software & learn trend line analysis with it.

Follow the trend. That's a key saying for investors. Never fight it. This approach works best in forex. Once pairs head one way, they often keep going for a while. It opens doors to grab profits.

Guidelines of How Do I Draw Trend lines

Use candle charts

- The areas used to draw the trend-line are along the lows of price bars in a upwards market. An upward bullish market trend move is defined by higher highs and higher lows.

- The points used to draw the trend-line are along the highs of the price candlesticks in a falling market. A downwards bearish trend move is defined by lower highs and lower lows.

- The points used to draw trend lines are extremes points - the high or the low price. These extremes are critical because a close beyond the extreme tells traders the trend of the forex pair might and may be changing. This is an entry or an exit trading signal.

- The more often a trend line is hit but it is not broken, the more powerful its signal.

There are two main ways of trading this trendline analysis set-up:

- The Trend Line Bounce - Trend Line Bounce

- The Trend-Line Break - Trendline Break

Technical Analysis Techniques & Methods of TrendLines

A trend-line bounce functions as a confirmation signal, indicating that the price will rebound off this line and persist in its prevailing direction. During a downtrend, the market will push downwards subsequent to touching this trend line, which acts as the resistance level. Conversely, in an uptrend, the market will push upwards following contact with this trend line, which functions as the support level.

A trend-line break signals reversal. The market crosses the line and shifts direction. An uptrend break turns sentiment bearish. A downtrend break flips it bullish.

In the case of strong trends, a break of the trendline typically leads to a consolidation phase before changing direction. For short-term trends, a break in the trendline may result in an immediate reversal.

These trend line levels serve as support and resistance levels in trading, and they are used in analysis charts for both the trend line bounce and the trend line break.

Entry, Exit & Setting stop loss orders:

This trendline method helps find good spots to start and end trades, and protective stop losses are placed just above or below these trend lines. The trend line bounce is a safe way for traders to start and place entry trade positions after prices have pulled back. Trades are set up along these trend line levels, and a stop-loss order is placed just above or below these lines.

A trend line break signals a possible shift in price direction. Once broken, prices head the other way. Traders use it to close trades early and lock in gains. A cross through the line hints at a reverse move.

This trendline setup formation is only drawn between two chart points on the chart, unlike other analysis indicators where the trend line is computed using a formula.

More Tutorials and Topics:

- Gold RSI Overbought and Oversold Levels: RSI 70 & RSI 30 XAU USD Levels

- Frequently Asked Questions About XAU USD and Gold

- Lesson Tutorial for Learning How to Practice XAUUSD

- Opening a Demo MetaTrader 4 XAU/USD Account

- Buying & Selling XAU USD

- NOK/JPY FX Pair

- Using MetaTrader SWI20 Index SWI 20 FX Software

- An Index Trading Strategy Focused on the HK 50 Instrument in Forex