Islamic Swap Free Account - What is Swap in Forex Trading?

In Forex, there is the payment of every day swaps: this is the interest rate of a currency which the currency earns per day. This interest for a currency like the Australian Dollar is 5 %, this means that every day a fraction of this five % is paid to anybody holding this Australian Dollar.

Interest payments raise issues in Islam. The faith bans earning or paying interest. For Muslim traders, a swap-free account fits their rules. It follows Islamic values.

For accounts structured this way, a trader neither incurs overnight rollover interest nor earns any interest payments. This structure is referred to as Shariah Compliant, meaning it adheres to principles forbidding the payment of RIBA (interest) - these are also known as Islamic Accounts.

For a forex trader to secure an account that is exempt from swap charges, the trader must locate an Islamic broker and specifically select the 'Islamic Trading Account' option. This selection is typically presented within the broker's Accounts Section, which also outlines the necessary steps for successfully opening and registering such an account.

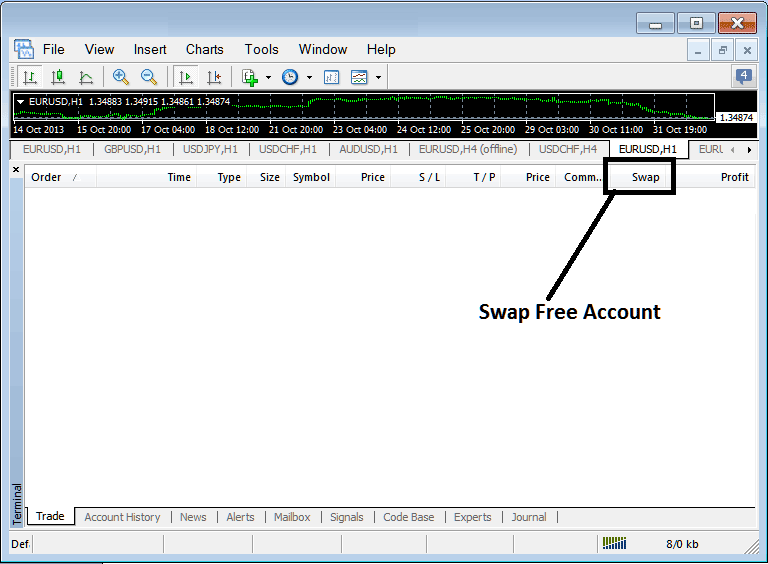

Once a trader opens a this trading account, then Forex rollover fee interest is removed. Once this non paying & being paid of interests is set, if one is using a platform like the MT4 then the roll over fee record will be set to zero.

The rollover fee is levied daily at the close of the trading session for any secured currency position where a swap charge is applicable. If a trader wishes to avoid this rollover charge, they must fully close their trade positions before the end of the day: by doing so, the associated rollover interest will not be incurred as the currencies are no longer held. Since the currency market ceases operation on Saturdays and Sundays, the rollover calculation for these two days is aggregated and applied on Wednesdays. Consequently, on Wednesday, a trader will incur the rollover fee for Wednesday, Saturday, and Sunday combined, meaning this rollover fee interest is paid three times over on Wednesdays.

These specific trade placements inevitably incur a roll-over fee and are frequently referred to by traders as Overnight Positions. Day Traders typically liquidate all their market positions before daily market closure. Conversely, Swing Traders might keep their trades open for multiple days, thus allowing these transactions to carry over overnight to capitalize on potentially larger price movements.

Once a trader finds a swap free Forex broker & opens and Islamic Trading Account, the FX trader will have the same trading conditions as those of other traders, except for the payment of roll-over fee. This means a fx trader will use the Meta Trader Four Software like all the other traders, the trader can trade all currencies, all stock indices, all CFDs, all metals and all the other Financial Instruments provided for by the Islamic broker.

But, be careful when picking a swap-free online broker, because some add a fee or increase the spread to cover the swap (Swap Fee Online Broker). This shouldn't happen, since a currency trader would still be paying interest, even if it's hidden as a different fee. Good forex Brokers don't add fees or increase spreads.

Another point to note is that some brokers impose a rollover fee, otherwise known as a swap fee, if a forex trader keeps a position open beyond five or seven days. This should not occur, and the online broker ought not to levy any carry-over interest, even when trades are held open beyond the five or seven-day period. Traders interested in establishing a swap-free account with an Islamic broker should thoroughly examine any supplementary trading terms and conditions pertaining to the Islamic Account they intend to open to confirm that the selected online broker truly adheres to a no-swap policy.

Islamic Trading Account

Swap free accounts were introduced by brokers after demand for carry over interest free accounts grew among Islamic currency traders. The traditional account entailed paying of rollover interests in what is referred to as roll-over interest. This led to introduction of Interest Free Trade Accounts that Islamic traders could open and still keep inline with their rules on no paying and getting paid interest.

Check Out Extra Tutorials and Lessons

- How to Build Your Own Forex Trading System

- Index Strategy Strategy

- XAGEUR System XAGEUR Trade Strategy

- What's the Pips Value for USD/HUF FX Pair?

- Gann Trend Oscillator MT5 FX Chart Technical Indicator

- FX Market Overlaps & The Three Major Forex Sessions

- How Do I Calculate Pips Value for Cent FX Trade Account?

- 1:100 Leverage vs 1:500 Leverage Described

- Trading the DJ 30 Index: A Quick Tutorial

- What's FX Market Trading?