Carry Factors - Interest Rates and Carry Unwinding

For carry trades, check more than just currency interest rates first.

Something you should check is the direction of the forex currency pair you're thinking about using for a carry trade. Checking the direction of the pairs you're looking at is important because you want to profit from the interest rate difference and from your trade: you should always think about these things to make a profit.

Assessing the trend is necessary because if the forex currency pair depreciates in percentage more than what you earn from interest, you could still incur a loss in your capital while earning interest. This situation can lead to a total loss, even if you are profiting from the interest rate difference.

Factors of This Strategy

With this strategy there are two objectives. These factors are:

- Make money on the interest differential

- Gain a profit from the capital appreciation.

We know how to profit from rate gaps with this strategy. Now, see how to gain from capital rises.

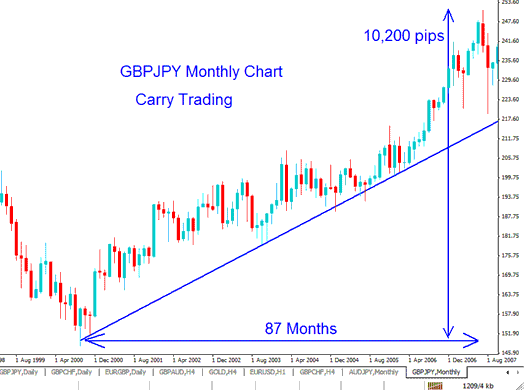

Example of This Strategy GBPJPY from 2000 to 2006, difference of 4 percent

GBPJPY Monthly Chart

The example above shows buying GBP, which offers higher interest than JPY. This captures the strategy's core. The holder earns 5% on GBP. They pay 1% to sell JPY. The 4% gap (5% minus 1%) helps figure the full profit from the deal.

If the difference averaged 4%, with a $100,000 account and 4 contracts totaling $400,000, 4% of $400,000 equals $16,000 interest profit per year. Over 6 years, that's 6 times $16,000, or $96,000 from interest. Add profits from 10,200 pips: 4 lots at $10 per pip times 10,200 equals $408,000. Total profit comes to $408,000 plus $96,000, or $504,000.

Even if you didn't get the whole price change and only got half, you'd have made your money back, which is why this plan is so well-liked.

Carry trades unwound starting in 2007, right up to the 2008 recession. That's when UK interest rates began to drop.

Gain a profit from the capital appreciation

To make money from capital gains we must open positions in the same direction of the trend. From our previous AUDJPY example, to make a carry we should buy the AUDJPY. Therefore the trend of AUDJPY should also be upwards so as to ensure profit from capital gains as well from the interest gains.

If the trend of AUDJPY is a bearish downtrend then you should not open this trade because profits from this strategy will be cancelled out by capital losses brought by the AUDJPY trend going downward.

If the value of the foreign exchange pair appreciates, this translates to a superior return on the initial capital outlay. Associated with this endeavor is the inherent risk of failing to achieve one or both established objectives, potentially resulting in monetary losses if those two targets are not met is present. Successfully meeting these dual objectives - profit capture from Forex carry and directional movement - constitutes a defined strategy for mitigating the hazards of initiating a position.

Since interest rates can fluctuate, it's crucial to monitor yields prior to opening a position. Even after initiating a transaction, keeping track of rate changes is beneficial, as they may be revised multiple times annually.

These are intended for long-term capital deployment, and the related currency may experience both depreciation and appreciation. These inherent volatilities in the currency introduce risks specific to Forex trading.

What is Carry Unwinding?

When the economy slows down, interest rates are cut to help it grow by making more money available and encouraging trading. During this time, people get out of their positions in a process called carry unwinding. That is why it is not a good idea to use this method when the economy is in a downturn. For example, after the 2008 economic slump, the rates for the British pound were lowered to 0.5%, the same as the Japanese yen, because the difference is nothing, there was no carry trading of this money. Investors actually closed their existing deals in a move called Carry Unwinding. This unwinding means the value of higher-paying currencies drops fast because they are now paying about the same, and there is not much benefit to keeping them.

On the other hand, when there is economic growth, economies hike their interests so as to control inflation. when inflation goes up prices of commodities in that country go up, when the goods of a country become expensive, people from other countries don't buy goods from that country, henceforth affecting the trade balance. To counter this governments hike rates, which controls inflation, which ensures positive trade balance for that country. For Example before the 2008 economic recession the AUD rate was about 7.5% against that of JPY of 0.5%, the difference was therefore a 7% positive yield which made this currency pair a very profitable one.

Also, when a country raises interest rates, people trust that country's money more because it suggests the country's economy is growing. Also, higher rates mean more profit, just like a bank savings account with higher interest on savings. When this rate goes up, more investors will add to their open trades because the money will simply make more profit than before.

That's why currencies from exchanges with high interest rates, like the AUD, usually become more valuable over time because they give better returns compared to currencies with lower interest rates, like the JPY, which give lower returns. Investors will search for currency pairs where the difference between the two interest rates is greatest and make their trades with that pair.

The most often used currencies for this kind of strategy are those having the JPY, which has interest rates as low as 0.5%. The AUD is roughly 7% while the GBP is about 4%: therefore, AUDJPY and GBPJPY are the most profitable carry pairs. Another thing to keep in mind is that central banks keep changing these rates, so it's advisable to check other online sources for the most recent rates before you start.

In the absence of broad economic downturns, currencies offering higher interest rates will consistently appreciate, leading to profits derived from both capital accumulation and active trading. This underlying principle explains why instruments such as AUDJPY and GBPJPY often follow prolonged, sustained uptrends during such times, paralleling the scenario previously illustrated.

Broker Markup on Interest

An additional element to consider is the markup applied by your broker on interest rates. For example, if AUD is offering a 7% yield, your broker might impose a markup, say 1%, meaning you would ultimately receive 6% after their deduction. Conversely, if you are scheduled to pay 0.5% interest on JPY, your broker might add a markup of approximately 0.5%, resulting in a total payment of 1% due to the broker's added charge.

This means that for this plan, instead of making 6.5% on your open positions, you will now make 5%. Some brokers might even add a higher fee, so if you want to use this method, find a broker with a low fee. You can find out the rates for different currencies online from charts and economic calendars.

Popular Currencies for This Trading Strategy

The most popular pairs for this strategy are the Yen Crosses, These are:

GBPJPY - Great Britain Pound vs Japanese Yen

AUDJPY - Australian Dollar vs Japanese Yen

NZDJPY - New Zealand Dollar vs Japanese Yen

Learn More Tutorials and Lessons & Lessons:

- What are Forex Signals to Buy and Sell Based on Trend Triggers?

- How to Configure the Heikin Ashi Indicator on a Chart within the MT4 Trading Environment

- Reversal Patterns: Head & Shoulders Setups & Inverse Head and Shoulders Setups

- Explanation of the RSI MT5 Trading Analysis

- Analyzing the Moving Average Envelope Indicator for XAU/USD

- How Do I Add US100 in MetaTrader 5 Mobile?

- Inertia XAUUSD Tool Study on XAU/USD Charts Described

- Learn XAUUSD and Strategies Guide Tutorial

- How Can One Analyze MT4 Fibonacci Retracement on the MT4 Platform?

- Hidden Bullish Divergence RSI & Hidden Bearish Divergence RSI