Head and Shoulders Reversal Patterns

Head & shoulders Pattern

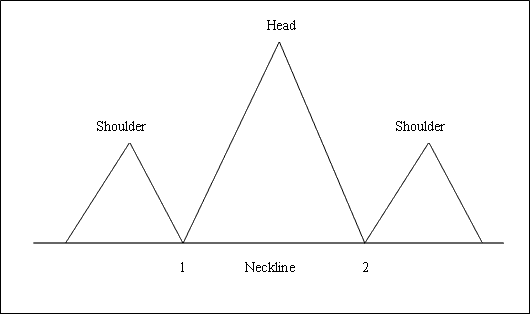

This pattern on a chart shows things are about to change after a long period of rising prices. It has 3 peaks one after the other: a left shoulder, a head, and a right shoulder, with 2 dips between them.

This pattern is seen as finished when the price goes through and drops below the neckline, which is made by linking the two low points between the shoulder formations.

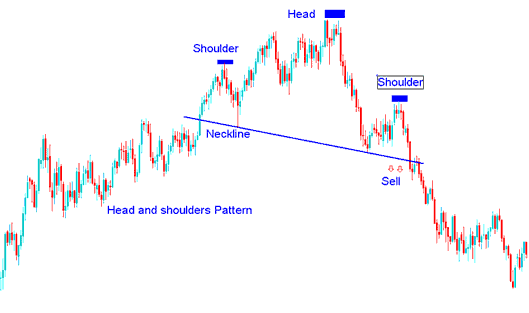

To go short, traders place their sell stop orders just below neck line.

Summary:

- This XAU USD setup forms after an extended move upwards

- This formation shows that there will be a reversal in market

- This formation resembles a head with shoulders thus its title.

- To draw the neck line we use chart point 1 and point 2 such as illustrated & shown below. We also extend the line in both directions.

- We sell when the price breaks-out below neck line point: see the chart below for explanation.

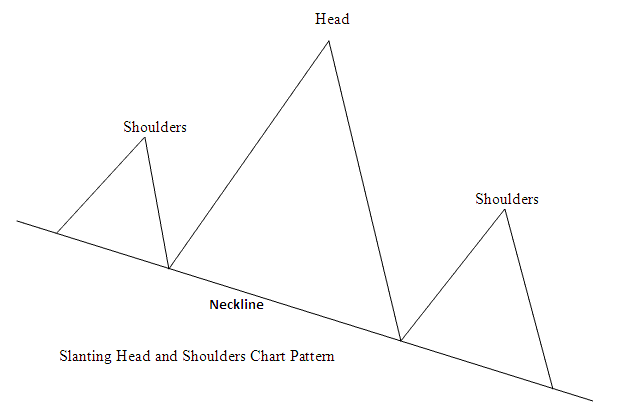

Or the head & shoulders also can form on a sloping neck-line, which include the instance proven underneath:

Example of Head & Shoulders Setup on a Chart

Head and Shoulders Chart Pattern

This pattern works on a slanted neckline too, like the one shown. The neckline does not need to stay flat.

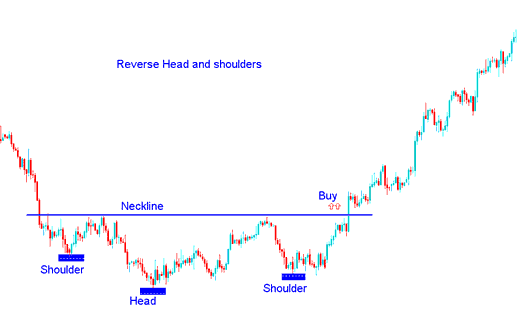

Reverse Head & Shoulders Pattern

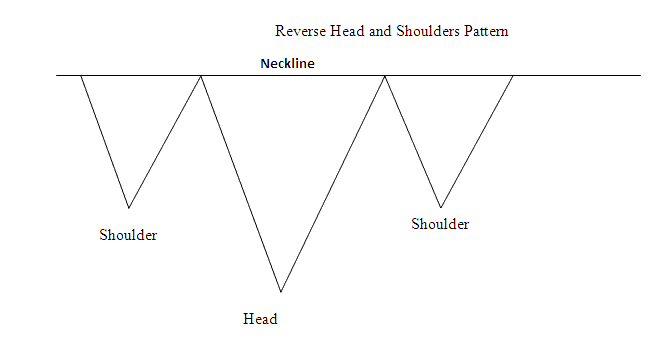

This formation constitutes a reversal Head and Shoulders pattern that materializes subsequent to a protracted XAUUSD decline, manifesting as an inverted version of the standard head and shoulders structure.

This shape is seen as done when the price goes past the line connecting the two high points between the reverse shoulders shape.

To go long buyers place their buy stop trade orders just above neck line.

Summary:

- This XAU USD setup forms after an extended move downwards

- This setup formation indicates that there will be a reversal in market

- This setup formation resembles upside down, thus the name Reverse.

- We buy when price breaks out above the neckline point: see the chart below for an explanation.

Example of Inverse Head and Shoulder Chart Setup on a Trading Chart

Example of Reverse Head & Shoulders Pattern

Learn More Topics and Tutorials: