OBV and RSI an MA Cross-over Strategy

This guide shares a swing trading system example for forex profits. It draws from stock strategies that use volume to predict price moves, based on the idea that volume leads price. Forex lacks a central spot for volume data, so we use the On Balance Volume indicator to estimate it.

Pair this indicator with RSI and Moving Average Crossover for a FX system. Settings for the technical indicator are listed below.

- 5 & 7 LWMA, Linear Weighted MAs

- RSI 14

- OBV

Time-Frame: H4 Chart

Entry Trading Signal

Buy

- Both Moving Average MA pointing up

- RSI above 50

- OBV is in an uptrendline or it has broken downwards trend-line

Sell

- Both MA pointing down

- RSI below 50

- OBV is in a downtrendline or it has Broken upwards Trend Line

Exit Signal

·OBV trend-line is broken

RSI Shows a Signal Against the Market Trend - Crossing the 50 Line

Want to learn more about setting system rules and generating trading signals? Check out the guide on writing system rules.

You also can Study about other Forex Strategies: Strategies List

Explanation of Generating Signals Through This Trading Strategy.

Before checking the examples below with 138 and 177 pips gains, learn how volume leads price. Also understand the OBV indicator.

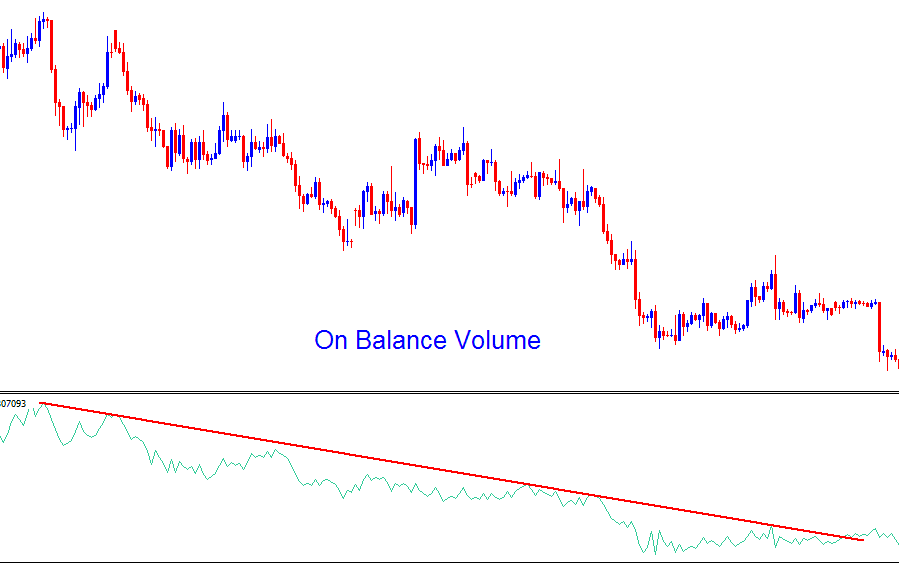

The OBV technical indicator leverages trading volumes to quantify the flow of capital either entering or exiting a specific currency.

The OBV indicator is most frequently employed in the analysis of equities. The fundamental premise underpinning the OBV is that trading volume consistently precedes price movement. When endeavoring to ascertain the forthcoming direction of any financial asset, be it a stock or a currency pair, nothing is more vital to this analysis than comprehending the volumes entering and exiting that instrument. The volumes factored into the OBV calculation can represent monetary value: however, in Forex, where charts move based on tick data, an increased inflow of capital corresponds to a greater number of participating ticks, thus the volume measurement effectively quantifies the amount of tick data involved in a currency pair's movement.

On Balance Volume leads as an indicator. It shows buying or selling pressure in a currency. Since volume comes before price, it helps gauge investor sentiment.

For a Forex system a one requires indicators are calculated differently. For example our system is based on

·RSI - momentum indicator

·MA - direction based indicator

·OBV - volume based indicator

A methodology like this offers a comprehensive view of market dynamics by synthesizing three distinct calculation methodologies, contrasting favorably with utilizing three separate oscillators that base their signals on identical computational methods.

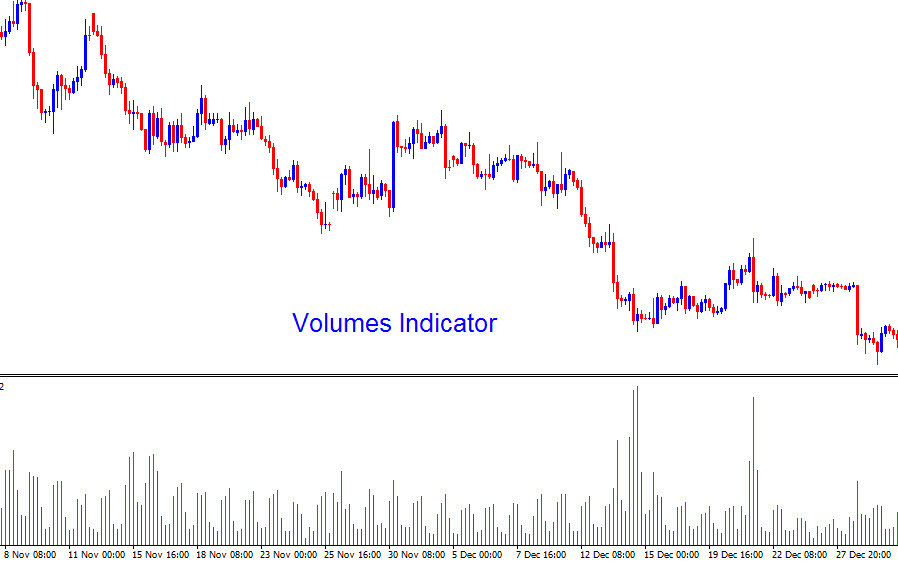

The OBV indicator will measure the tick volumes of a currency, for every candle. If you use the 1H chart time frame, then the volumes will measure the overall total volume for the one hour. If you as a trader use day charts then volume will calculate total volumes for the currency for the whole day.

The volumes indicator shows no direction. It uses colors: green for up candles, red for down ones.

On Balance Volume gives direction to volume. It shows if volume flows into or out of a currency.

Volume Precedes Price

Volumes precedes price, this makes volumes a leading technical indicator. Knowing how to analyze and interpret this helps a trader make better decisions when it comes to predicting where the market move direction is going to be heading to next.

A surge in volume indicates that capital is beginning to enter a currency. The value of a foreign currency will increase after the quantity since the price will come first. A rising OBV indicates that a currency has more purchasers than sellers.

A decline in volume indicates that money is starting to leave a foreign exchange currency. The worth of a fx currency will subsequently decline as a result of the volume preceding the market price. The OBV indicates that more volume is going short than long when it is trending downward.

Later, when a downward trend-line of the On Balance Volume(OBV) is broken, it means that sellers are starting to take profit and close their trades.

Likewise when the upward trendline of the On Balance Volume is broken it shows that the buyers are beginning to close their long positions & take their profits.

Because the On Balance Volume will add direction to the volume and form a general direction, a forex trader can compare the two, the price direction and the OBV direction. The direction of these 2 should correspond together but when there is a disconnect between the 2 then one should pay attention to know when to exit the market or when to open a trade order.

On Balance Volume leads other signals. Traders skip late entries with it. This tool also flags times to take profits soon. It helps keep gains before the market shifts.

Indicator Formation

The On Balance Volume indicator is computed by cumulatively adding or subtracting volume based on the price's movement direction.

Upwards direction - adds volume/ trading indicator moves up

Downward direction - subtracts volume/ indicator moves upwards

Sideways market/Range market - trading technical indicator heads Sideways

Because market prices follow a wave-like trajectory, the OBV technical gauge will similarly exhibit a zigzag pattern.

Price Trading Trend Lines

Most Traders will use these to generate buy and sell signals.

For our system, we'll utilize the OBV indicator to validate these buy and sell signals generated from price trend lines.

We will plot a Trend-Line on both the price action and the indicator itself. A buy or sell decision is made if both yield the same directional cue.

This strategy will be used to identify 2 things.

Continuation of current market trend direction

Reversal of the ruling market direction

Explanation of this Trading Strategy

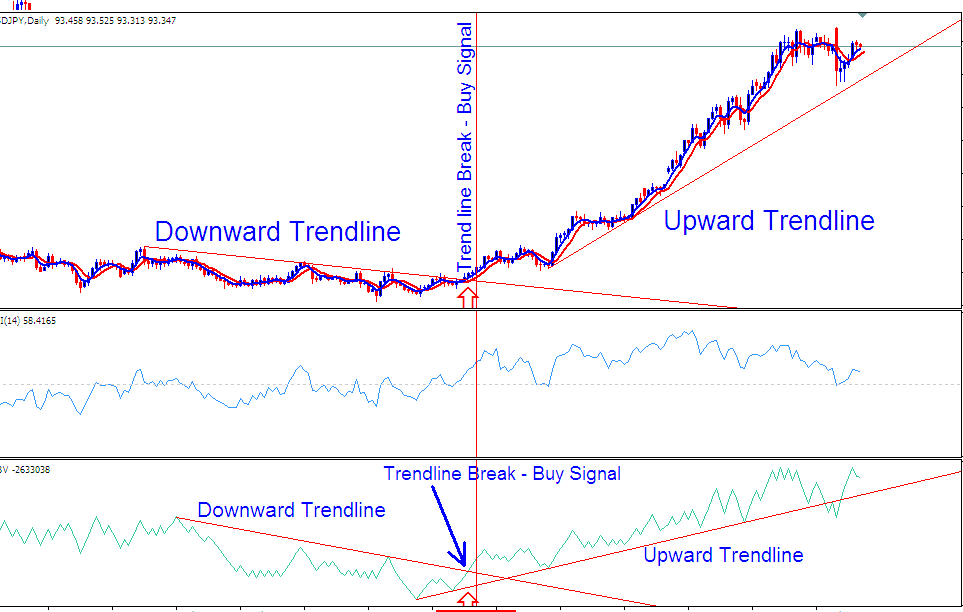

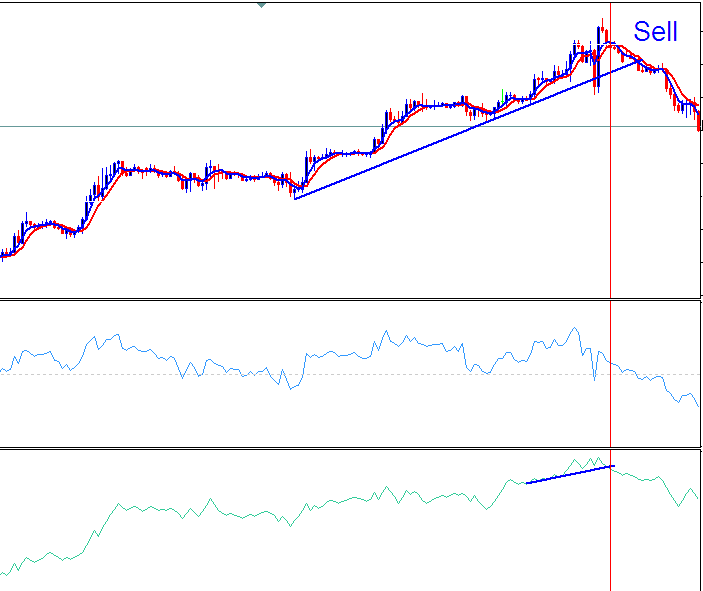

1. Downwards Bearish Market

In the chart shown, the first part of this pair of currencies is going down. This can be seen with the price trend line that points downwards. This downward price trend line is also supported by the downward trend line on the tool - if these two move the same way, then the currency pair is clearly going down.

Volumes lead price moves. A forex trader can keep short trades open. The market won't turn until OBV signals a warning.

2. Trend Change

Midway through the displayed chart, a confirmed change in market direction was observed, which is marked and annotated by a vertical line. This reversal signal was triggered at the point where a visible trend line break occurred, precisely as shown and indicated on the trading chart.

The chart shows OBV signaled a reversal right before the price broke the trendline. That gave a reversal alert. A sell trader would close all positions there.

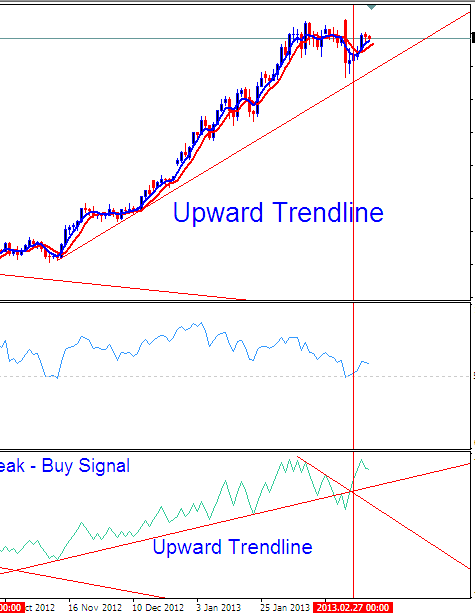

3. Upwards Bullish Market

Trading a market price reversal can be sometimes tricky, but the reversal signal generated above was generated at the optimum time & price continued to move up after this reversal setup was generated.

In this case, you would have bought the fx currency when both trend lines went above, showing a signal to buy. This buy was also a positive sign because the On Balance Volume(OBV) had already made a rising trend line when the downward trend line broke.

The new upward trend line of the On-Balance Volume (OBV) confirms a buying direction for the price. As this trend is maintained, more traders are likely to open buy orders, contributing to further price increases.

Following the issuance of this signal, one can observe that the price subsequently established a distinct upward trend line that corresponded perfectly with the upward trend line shown by the OBV indicator. The market's upward movement remained robust as long as both lines continued their ascent.

Whipsaws

4. At the peak of this uptrend, the OBV sent a false signal. It seemed ready to snap the rising trend line. But if you entered a short trade based on that signal, as pictured above, you would exit your sell positions right away. The OBV then broke the falling trend line too, just as shown. So the sell setup that started to form is no longer good.

One thing which a trader must learn to avoid as with any other Forex strategy is that whipsaws might be generated. Best way to avoid this is to exit as soon as the OBV trend line is broken especially when you're trading the reversal setups.

In the example mentioned above, once you close the short trade, after the new OBV downtrend line was broken, it shows that there were still more buyers present in this currency, and it is better to close any reversal trades that you may have opened. This is because the price could keep moving higher, like shown and illustrated by the indicator going upwards.

Because the OBV still went up even after touching and breaching it a little, the OBV upward trend line still held therefore the upward bullish direction is still intact and in place according to our analysis & any further trades here are still buy. Whether the system is right (I bet you $100 dollars it is) I do not know, this currency pair is USDJPY daily chart, The Date is: 05-March-2013, get MT4 and check if the system got this one right on USDJPY chart. But I can bet you the indicator is sharply moved upwards & Volume Precedes Price, So price will also move sharply up, soon.

You can use it on any timeframe, but for this system the best time frames to trade this strategy is 1H chart, 4 hour Chart & Day Chart. 4 hour chart most accurate with this method some forex pairs are good with strategy other not, major currency pairs are the best for this volume based trading strategy because they have lots of volume full time. 1 hour with this strategy is good for the day traders that are opening transactions/positions for a hours only, the swing technique with this trading strategy requires more capital to hold trade positions.

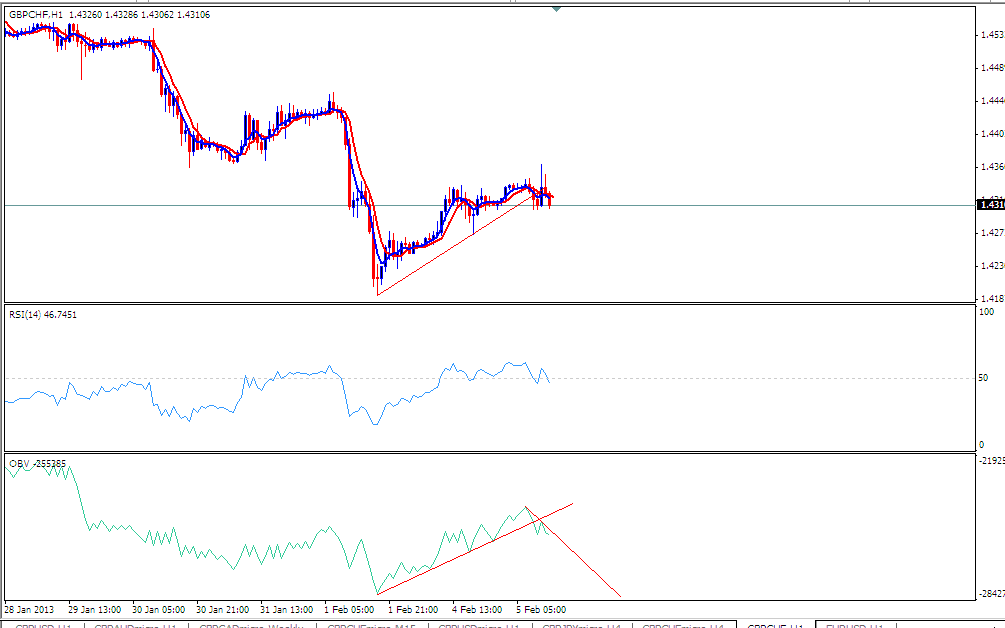

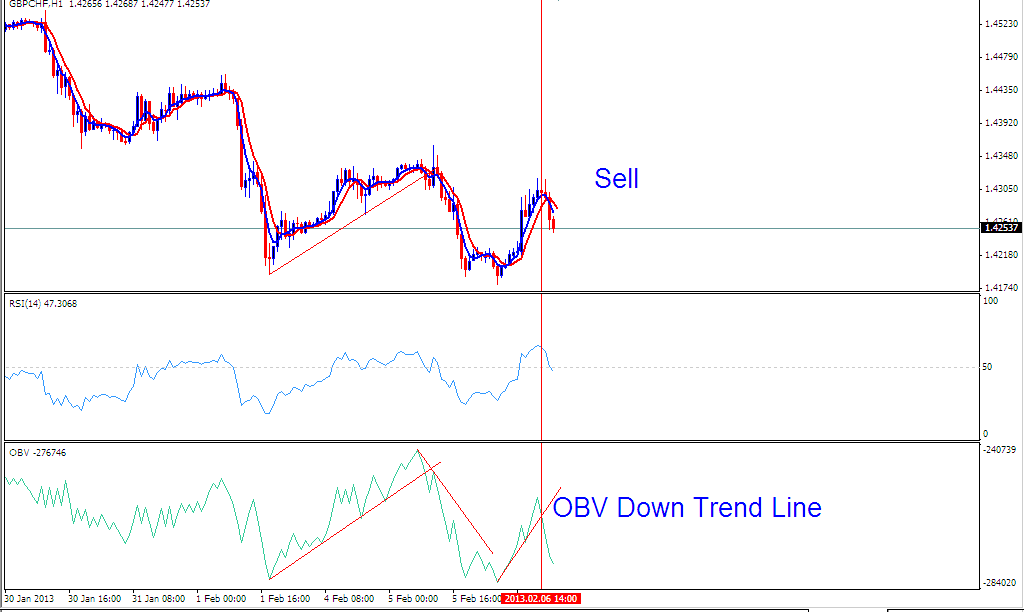

Sell Trade Signal

The system generated a perfect sell on GBPCHF just as displayed below

From the above screen shot the GBP USD then went down about 174 pips, The system was able to generate a sell at the best time with a high risk : reward ratio such as displayed and shown in the picture below.

The system provided an exit signal when the downtrend line on the OBV broke. The price then pulled back up. Soon after, another sell signal appeared, as shown by the vertical line above.

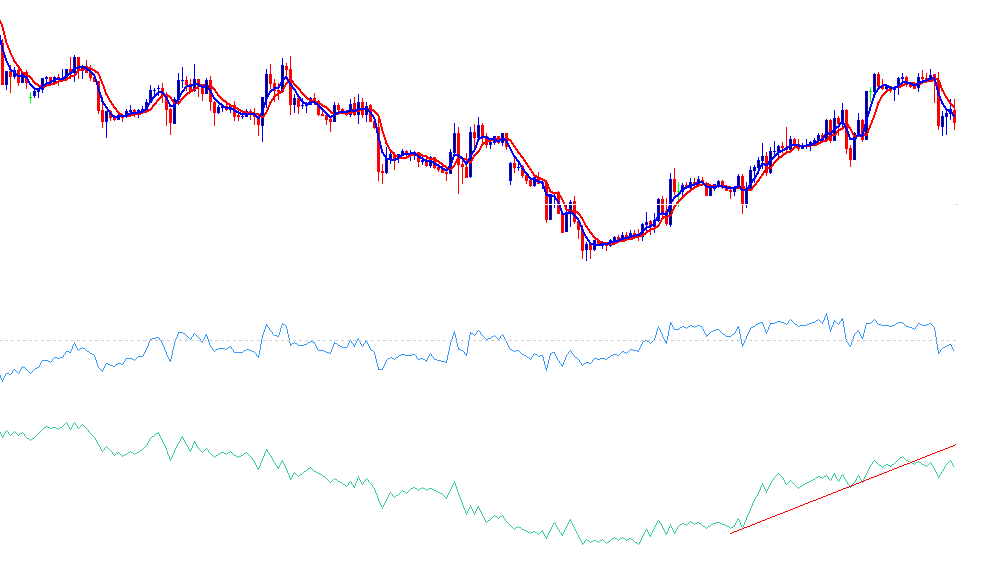

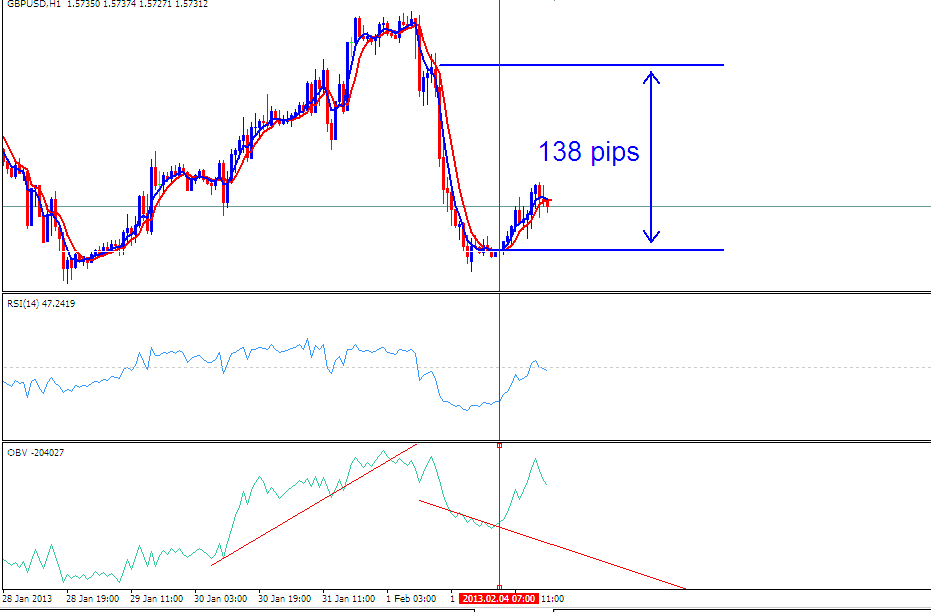

GBP/USD Sell Trade Signal

From the screen shot below a sell was generated/derived on GBPUSD

Traders may hold positions for several hours before receiving an exit signal generated by indicators, such as shown here - a suitable opportunity for a 138-pip take-profit.

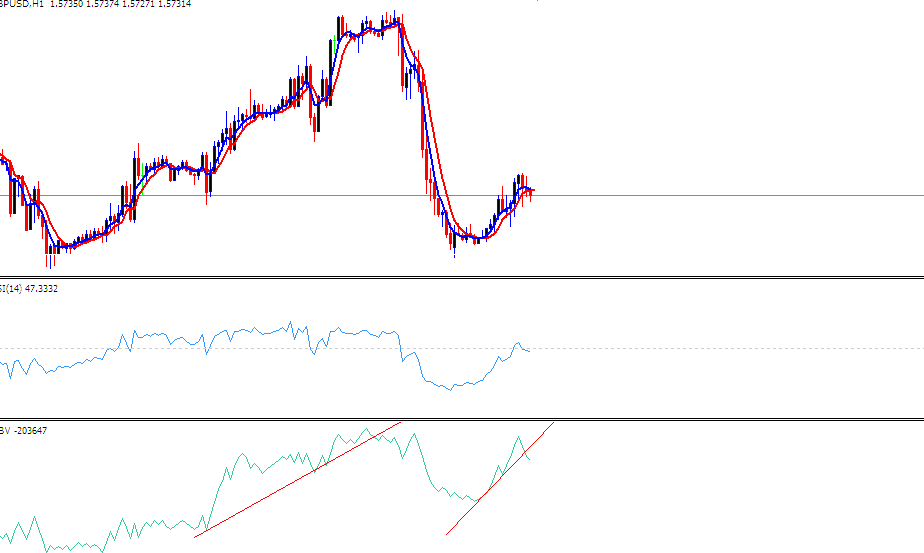

After the signal to exit appeared, a currency trader should have quickly secured their gains, even though it was just a small price move back like the one shown, and shortly after, in just a few hours, the system and the On Balance Volume indicator created another signal to sell. If you draw a line going upwards on this move back, you will see that the system has already created a new signal to sell.

Trend Line drawn on OBV On Balance Volume generating a new sell trade signal.

The signal generated above also gave a good profit when the GPBUSD went downwardss as is displayed & shown on the trading chart below.

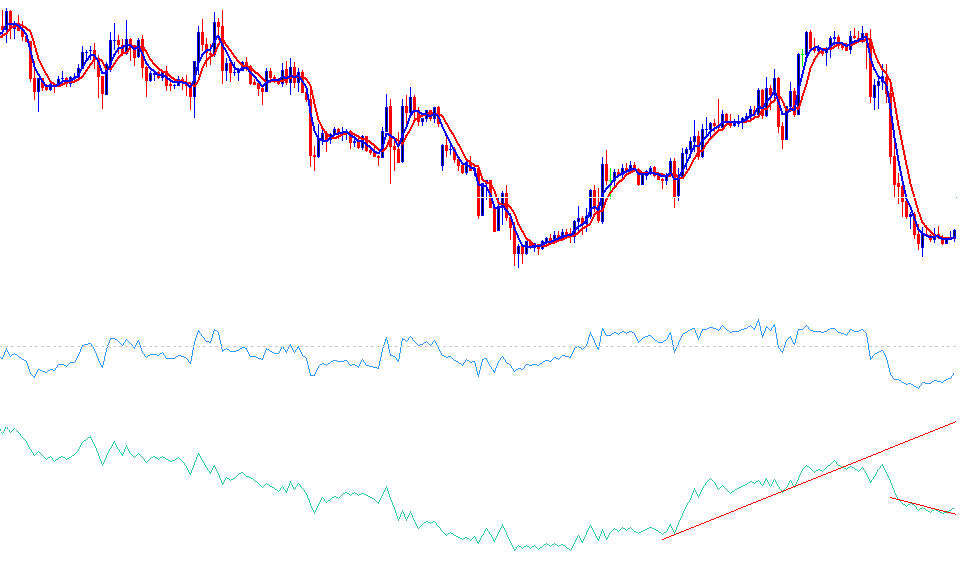

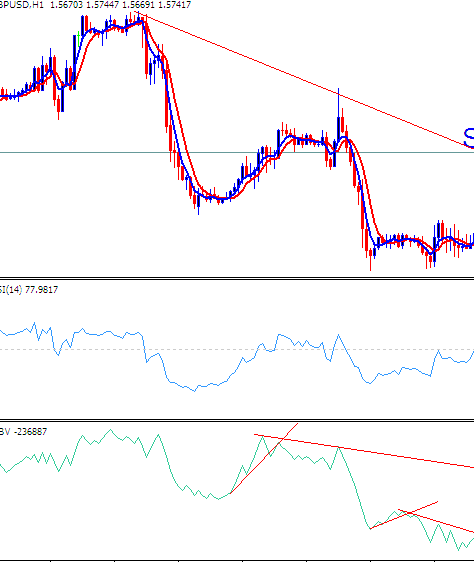

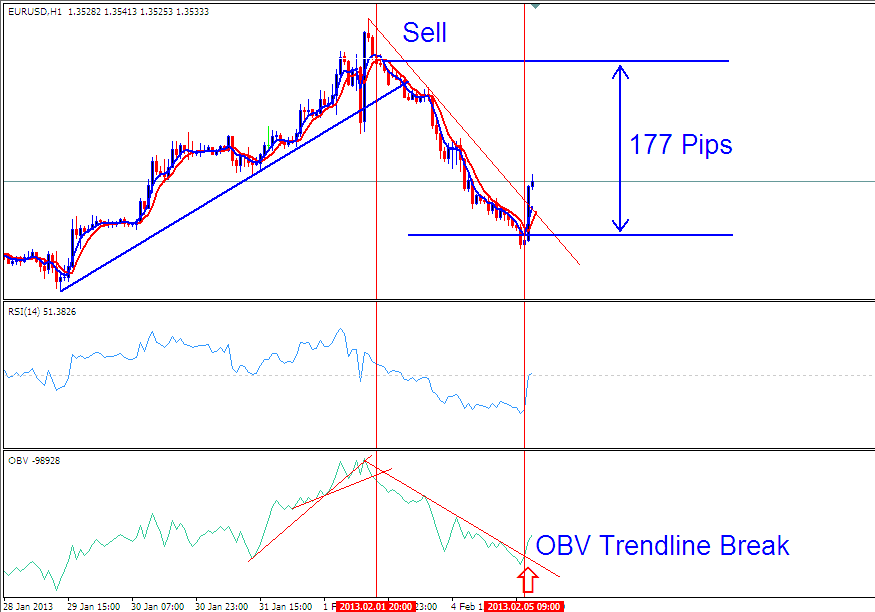

EUR USD Sell Trade Signal

Take profit after hours at 177 pips. An exit signal came when the OBV downtrend line broke, setting the profit level. The next signal looked like a buy, but the downtrend held.

Make a Profit after 177 Pips in a few hours, the signal to Exit appeared when the OBV downtrend line broke, so it was time to use take-profit order.

Learn More Courses & Topics:

- Practicing with a Demo Account on MetaTrader 4 Platform

- Analyzing FX Trading with Balance of Power

- Configuring the FX Trading Stochastic Momentum Index Expert Advisor

- How Can I Use MetaTrader 4 McClellan Histogram Indicator?

- Risk Management and Psychology in Gold Trading

- Strategy for UK100 Signals

- Forex Money Management Rules for Serious Traders

- How to Trade DowJones 30 Course Tutorial to DowJones30 Trading Lesson Guide & How to Trade Dow Jones Tutorial

- Operational Guide: Using the MetaTrader 4 Forex Software on an Android Mobile Device

- How to Set Zigzag Indicator in XAUUSD Chart on MT4 Platform Software