How to Use Support and Resistance to Trade Forex

Interpreting Support or Resistance Breaks: When a support level is broken, it turns into a resistance level: conversely, when a resistance level is broken, it transforms into a support level.

In the preceding trade illustrations, we examined instances where support and resistance levels remained intact. These particular support and resistance points held because they possessed sufficient structural strength.

However, sometimes support & resistances levels aren't strong enough to stop movement of the price heading in a certain direction. When price heads past these support & resistance levels we say that these levels have been broken. That is why we always use a stop loss order when trading these technical levels, just in case these levels do not hold.

However, what consequence arises when these established support and resistance barriers are penetrated? Such levels typically transition roles: for instance,

- When a support is broken it turns into a resistance level

- When a resistance is broken it turns into a support level

Charts Show What Happens at Broken Support and Resistance Levels

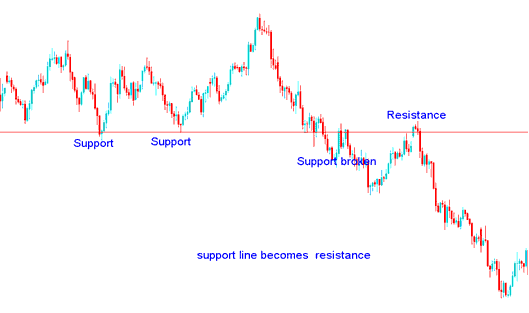

Support Level is broken it becomes a Resistance Level

In the illustration put on display below, using the GBPUSD chart, the support level that had been tested two times could not hold the third time, the sellers(bears) were able to push price down past this support level.

However, the price bounced back upward again, but this time price couldn't go up beyond this line. The price was there after quickly pushed downward by the sellers(bears). This was because the line that was a support level had now turned into a resistance level.

When a support level breaks in trading, the stop losses below get wiped out too. That drains the buyers' energy, giving sellers a shot to short the currency. They'll usually put their stops just above this new resistance level.

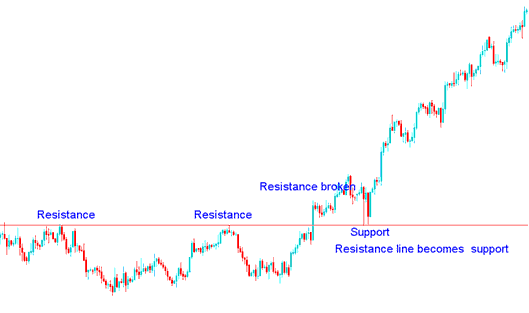

Resistance Level is broken it becomes a Support Level

In the EURUSD chart example below, a resistance barrier, which had successfully defended price action after being tested twice, ultimately failed on the third attempt, allowing buyers (bulls) to successfully drive the price above this prior resistance point.

When the price tried to fall again, it could not drop below a certain point. Then, buyers quickly pushed the price higher. This happened because what was once a resistance area had become a support area. In Forex or stock trading, when a price goes past a resistance level, that level then acts as support.

Traders who have already ended their trades where they were selling will now start trades where they are buying, setting their stop losses just under this point.

Major & Minor Resistance Levels

On charts for currencies, the areas of resistance and levels of support that form are either big areas or smaller levels of resistance or support.

Major Resistance/Support levels

Prices often pause at key Resistance/Support areas for some time, either staying steady at these levels or forming a rectangle pattern when they reach this point. A significant support or resistance area is tested many times before it either breaks or holds, and the price cannot move beyond this zone.

The above examples are good example of major Resistance and Support Areas.

Minor Resistance/Support levels

At minor support and resistance, prices form these fast in short time frames. They also pass through these spots quickly.

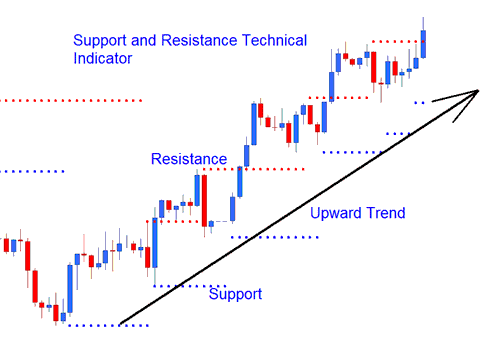

Upwards Trading Trend: The arrangement of these minor resistance and support points will create a sequence of levels that generally point upwards.

Upward Trend Series of Support and Resistance in Up Trend

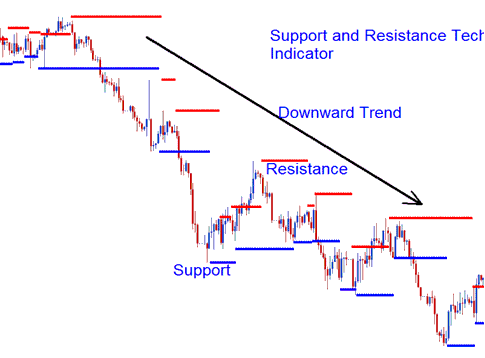

In a downward trend, minor support and resistance levels form a downward series.

Down-wards Trend Series of Support and Resistance Areas in Down Trend

Access Extra Tutorials and Lessons

- Window Menu for Transacting Charts

- What's Relative Vigor Index RVI Indicator?

- Analysis of the FRA 40 Trading Indicator within MetaTrader 4 Indicators

- UK100 Signals Trading Strategy

- Gold Technical Analysis Method of XAUUSD Chart

- How Can I Use MetaTrader 4 McClellan Histogram Technical Indicator?

- How to Set S and P ASX200 Index in MT5 Platform

- How to Use MetaTrader 4 Charts While Trading Forex

- What are ROC, Rate of Change Buy and Sell FX Trade Signals?