Support and Resistance Areas

One of the most fundamental concepts in Forex trading involves chart levels that act as barriers, preventing asset prices from moving beyond specific points in a given direction.

The analysis of Support & Resistance Levels will be explained in this lesson on learning support and resistance levels, along with instances of support and resistance regions on graphs.

Support Levels

Support levels act as a "floor," preventing an asset's price from declining beneath a specific point by halting downward momentum.

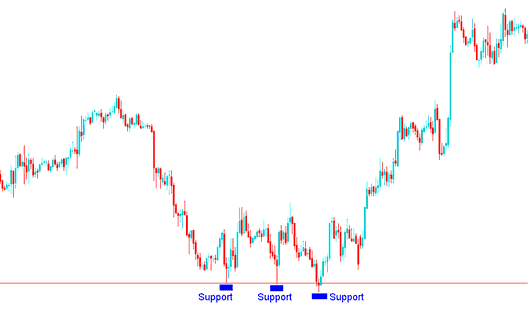

Example of Support Level on Forex Chart:

In this example, price fell until it touched support.

After the price reached this point, it bounced up a bit, and then kept going down until it reached the support again.

The act of hitting a specific price level and subsequently reversing direction is termed 'testing' that support level.

The more times a support is tested and the market bounces up the stronger this support level is - the exemplification laid-out below this support level was tested three times without breaking. Finally the market trend reversed and started heading in the opposite trend direction.

After figuring out where this support level is, traders use it to place orders to purchase the currency and they also put a stop loss a few pips under it.

In the example shown, the market did not go lower than this specific price. This is a price level where the currency's price cannot go below.

These zones are key reversal points in a downtrend where the currency might gain support and begin to move upward.

At this juncture, the demand for purchasing the forex currency pair will be heightened, thereby presenting an opportune moment to initiate a buy trade, with stop-loss orders positioned a few pips below this support level.

Those who sell also use this level as where they plan to cash in their earnings from their sell trades.

This is another reason why the trend might change direction or stay in the same area, because when the sellers(bears) finish their selling, the downward trend slows down, and the price stays about the same: then, the trend will probably go in the opposite direction.

Resistance Area

There are certain levels that act as a price ceiling, preventing an asset from breaking upward past those points. These levels serve as resistance points that hinder further market movements upward.

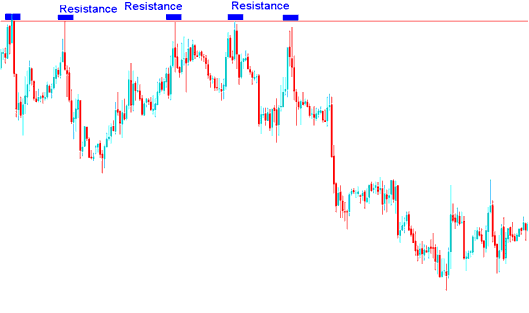

Explanation of a Resistance Level on Forex Chart:

In the subsequent illustration, a forex trader can observe that the price advanced until it encountered a defined resistance barrier.

After hitting this resistance level, the price slightly retraced before climbing back up to touch the resistance again.

The established resistance level has successfully withstood five attempted breaches or tests without yielding.

The more times a resistance level is tested the stronger the it is.

Once this resistance level has been determined traders put their orders to sell at this level & at the same time putting a stop loss a few pips above it.

As shown above, the market didn't go past this spot. This spot shows a place where the price of the currency couldn't go any higher.

These levels often mark points where an uptrending currency may reverse after meeting resistance and start moving downward.

This shows strong sell demand for the Forex pair here. It makes a solid spot to start a sell trade. Set stops a few pips above resistance.

This resistance level is also used by the buyers(bulls) as a target where to place and set their take profit orders for their bullish trades.

This presents another contributing factor as to why the price action might stall or enter a period of consolidation at this juncture: when the buyers (bulls) begin exiting their long positions, the forward momentum of the uptrend naturally diminishes. This reduction is often followed by price consolidation, after which the trend is highly likely to change direction and begin moving downwards.

Study More Lessons and Tutorials & Topics:

- How Can I Analyze/Interpret a Downwards Trend on a XAUUSD Chart?

- Understanding Forex Spreads Associated with FX Trading Pairs.

- How Do I Trade FX Pairs Quotes?

- What are Commodity CFDs?

- Kurtosis MT4 Indicator With an Example

- How to Use MT4 Live Charts in Trading

- ECN vs STP vs Non-Dealing-Desk vs Dealing-Desk Brokers

- Trading in MetaTrader 5: A Guide

- Choosing & Selecting The Best FX Platform Software To Study Trading with

- Commodity Channel Index (CCI): Spotting Divergence