CCI Trade Divergence Indicator

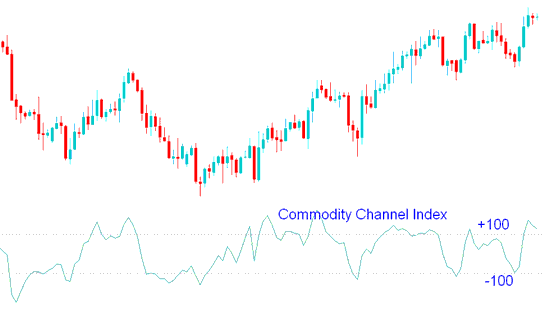

The Commodity Channel Index (CCI) is frequently used as a divergence indicator. Similar to the RSI, this oscillator can be employed to trade divergence in the same manner as the RSI does.

Commodity Channel Index, CCI Analysis & CCI Signals

The CCI functions to quantify the degree to which a commodity's price deviates from its established statistical mean or average.

CCI Oscillator Moves Between High and Low Bounds

When the CCI is elevated, it indicates that the price is considerably high in comparison to the average.

When the CCI registers a low value, it indicates that the current price observation is significantly lower relative to the calculated average.

CCI FX Divergence Indicator

CCI FX Divergence Indicator

CCI Bullish Divergence Setups - CCI Divergence Indicator

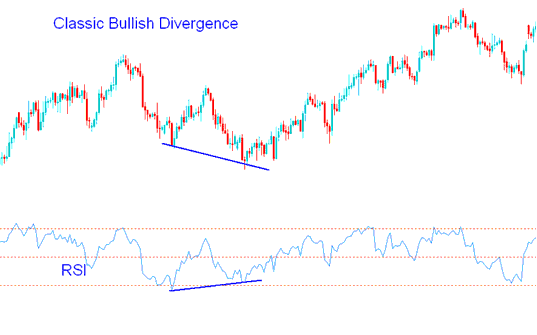

Classic CCI Bullish Divergence

A classic CCI bullish divergence happens when the price makes new lower lows (LL), but the CCI makes new higher lows ( HL ).

Classic Bullish Divergence - CCI Divergence Indicator

The classic CCI bullish divergence indicates a possible change in the trend from going down to going up. This is because, even though the price went lower, there were fewer sellers pushing the price down, as shown by the CCI indicator. This indicates an underlying weakness in the downward trend.

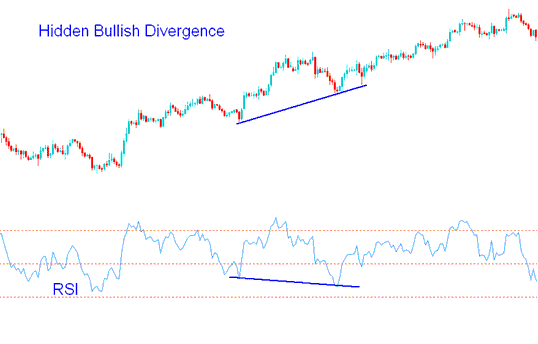

Hidden CCI Bullish Trade Divergence

This setup occurs when the price action is establishing a higher low (HL), yet the CCI trading indicator is simultaneously displaying a lower low (LL).

CCI hidden bullish divergence occurs when there's a retracement in an uptrend.

Hidden Bullish Divergence

This setup confirms the completion of a price retracement, with CCI divergence reflecting the underlying strength of an uptrend.

Bearish Divergence - CCI Divergence Indicator

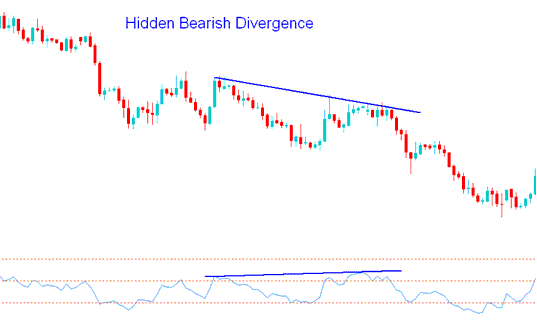

Hidden CCI Bearish Trade Divergence

This happens when the price is making a lower high (LH), but the oscillator technical indicator is making a higher high (HH).

Hidden bearish divergence occurs when there is a retracement in a downtrend.

Hidden Bearish Divergence - CCI Divergence Indicator

This configuration validates the completion of a price retracement movement. This specific divergence reflects the inherent strength of a downward market trend.

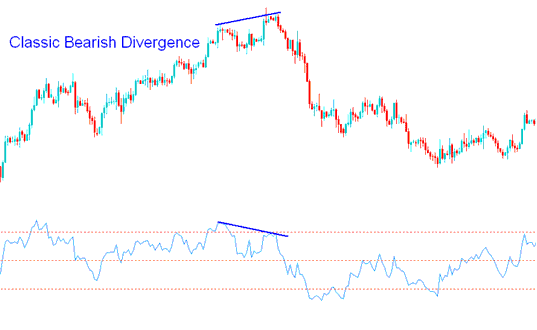

CCI Classic bearish FX Divergence

CCI classic bearish divergence happens when the price makes a higher high (HH), but the CCI makes a lower high (LH).

Classic Bearish Divergence - CCI Divergence Indicator

CCI classic bearish divergence warns of possible shift in the trend from upward to downwards. This is because even though price moved higher the volume of the buyers(bulls) who moved the price higher was less like illustrated by CCI indicator. This is an indicator of the underlying weakness of the upwards trend.

Study More Courses & Courses:

- Automated FX Robots: Trading Forex and Stocks

- Chandes Q-Stick Trading Indicator Forex Technical Analysis

- SX 50 Index Trading Strategy Lesson Tutorial

- How to Use MetaTrader 5 Ehler Fisher Transform Indicator

- Various kinds of brokers for XAUUSD are talked about.

- Choppiness Index MT5 Trading Analysis on Charts

- Strategy for Trading GDAXI30 Index

- Ready to open a live XAU/USD trading account? Here's a step-by-step guide for signing up and setting everything up.