What Online Forex is All About?

Because of the differences in time areas/zones within the specified global time-zone, FX online trading is facilitated and traded through the inter-bank online exchange market through several internet connections. It is open twenty-four hours a day, every week day, and half day on Sunday.

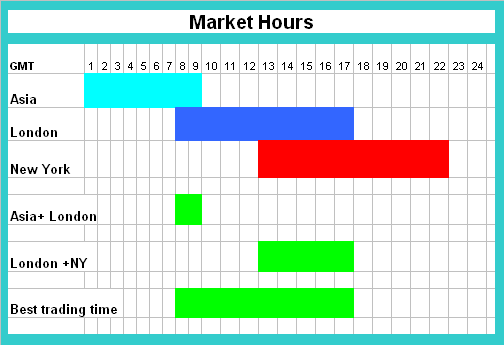

The 24 hr market day has 3 sessions:

- New York Market Session

- London UK Market Session

- Asia Session

New York, London & Asia Sessions

When data centers in Europe are closed, those in US are open & when those in US are closed then those in Asia are open, and this forms the 24 hour day cycle.

What FX is all about?

Forex is when you buy one country's money using another country's money. The word comes from the words foreign and exchange. This way of investing is a bit like investing in company shares. When you buy a currency, it's like buying a share of that country's economy, and the price you see for these currency pairs is called the exchange rate, which is shown on charts.

Just like the stocks/shares investment, currency moves & heads are determined by demand supply and also the economic outlook of that currency and political factors and aspects. However, the online exchange (speculative) exists for the purpose of the very possibility of purchasing a currency at a low value & then selling it at a higher value this demands investors to scrutinize the market trend/direction of the market price through a FX strategy.

Additional instruments continue to be introduced in the online spot exchange trading market. These new trading instruments are transacted in a manner similar to spot currencies. Since around 2013, online brokers have begun incorporating the following financial trading instruments to be traded alongside spot currencies:

Commodities: GOLD & SILVER

Futures: CORN, WHEAT, SBAN

Energies: NGAS, OIL

Indices: DOW, NSDQ, SP, NK,DAX, FTSE, SMI, ESX50 and CAC

These assets are traded in the spot market, with the majority priced relative to the US Dollar (USD). Due to their increasing popularity, these instruments are rapidly achieving near-mainstream acceptance similar to major world currencies.

These tools trade with currencies against the USD. They join the spot market for online trades.

Aspects of Online FX

Brokers provide trading software as one key tool. It lets investors get market data and place orders right on the platform.

Achieving profitability necessitates sound financial management: ultimately, online trading is fundamentally structured to profit from the actions of others, compelling traders to establish robust, profitable trading systems and comprehensive plans.

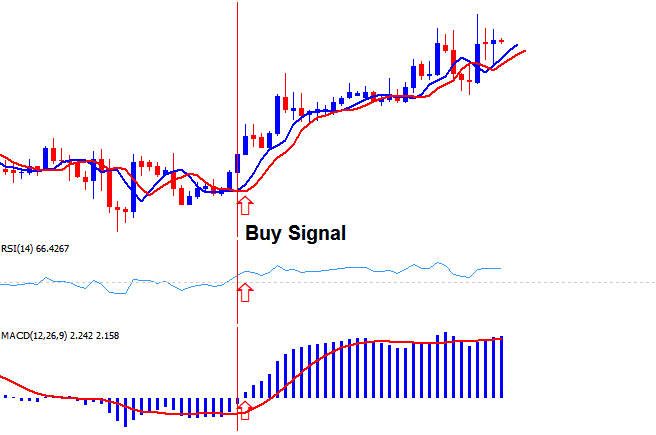

While there are several methods to interpret currencies, the most effective approach is utilizing a trading system. This strategy employs indicators to predict price direction and momentum effectively.

Advantages of Forex

Leverage is a key advantage in trading that enables traders to multiply account capital through the leverage provided by brokers.

All brokerage firms operating under regulation are mandated to satisfy this prerequisite before they are permitted to open a forex account for any new client.

Online trading facilitates working from any location globally using a computer, operating with availability 24 hours during market weekdays, thus earning its designation as the global marketplace.

Steps to Follow to Begin Trading

To begin trading, find an online broker first. We already picked one for you. Check the info on one of the best brokers.

Then follow these steps:

- Open a practice trade account with an broker.

- Train using this tutorial website where you'll find all the training tutorials required to learn.

- Use a system to interpret price movement, the best system is one that you develop & create for yourself.

- Practice until you begin making and earning profits in your practice demo account

- Then invest after considering the amount that you want start with.

Accounts: Forex trading features two primary account types: the demo (practice) account and the real (live) account. Novices commence with a complimentary demo trading account used purely for skill development. No actual funds are committed to a demo account: all capital is virtual, designated solely for practice. Upon concluding their education and demonstrating consistent profitability, an individual may then opt to open a live/real account, fund it with their capital, and begin trading in the actual market.

Tips to make profit

- Follow the trend, How well you as a trader do that will determine how profitable your trading results will be.

- Learn utmost from using free demo trading accounts and free trading training tools and tutorials provided for by this free online studying website to help you as a trader achieve the desired success on your investment. This guide will show you All learning and training lessons & tips.

- do not Forget about indicators and fundamental indicators (news) which are oftenly used to analyze the price moves, these are

- Technical Indicators - used in analysis to figure out price movement.

- Fundamental Trading Indicators - Used to in prediction methods using fundamental economic indicators/economic news reports

About FX Guides

Courses explain the currency market and its risks. For new traders, a solid tutorial starts you off right. It covers Forex basics and key lessons.

All of us have at one time or another already participated in forex/fx trading without us being aware of it. A good example of participating in the forex market which is done and performed on a regular day to day basis in all regions and parts of the world is when a need arises to buy from a different contry & we seek the services of money changers or banks and in that way, we have already exchanged foreign currency & participated in forex trading.

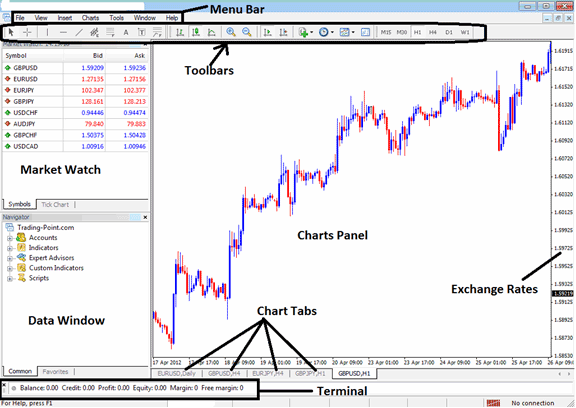

Explanation of Platform

Meta Trader 4 Software Platform

This platform is for streaming price quotes from your broker, these price quotes are also represented in form of charts. The charts are then used to analyze forex pair movements so as to decide which side the market prices are likely to head and traders can place trades in that given direction. To get the platform, just go to your online broker's web site and download this software for free.

While no business endeavor in the world is entirely foolproof - you are bound to experience both gains and losses - the lessons cover certain trading risks and propose strategies for maintaining risk at minimal levels. They outline procedural steps, such as money management trading strategies, to prevent over-leveraging your capital. Although losses are still possible, the advantage is that you will not forfeit more than your predetermined limits, leading to greater long-term accumulation.

FX courses cover all the basics. They start with how to study for profits. They help set a trading schedule too. Pick times with high liquidity and big swings. Those are best for deals.

Before you jump in, make sure you learn the strategies used to build trading systems in the FX world. Below, you'll see an example of a trading system in action.

Tutorials for New Traders - Systems and Strategies

For more information about strategies and systems, navigate to these 2 lessons:

The Process of System Evolution

Study More Lessons and Tutorials & Topics:

- Method for Calculating CAC40 Index Pips

- Analysis of the Williams Percentage R Indicator Applied to XAUUSD Charts

- How Do I Calculate Pip Value in for Standard Lots?

- ZARJPY Pip Calculator for Forex

- Guide to Setting Pending Orders on the MT4 Trading Platform

- How to Calculate and Set a Forex Stop Loss

- Using the S&P ASX 200 Stock Indices on the MT5 FX Trading Platform

- Setting Up US 500 in MetaTrader 5 App

- Elliot Wave Guidelines: 5 and 3 Wave Counts in XAU/USD Trends

- Developing a XAU/EUR Trading Strategy