Trading Reversal and Continuation Patterns - Distinctions Between Reversal and Continuation Patterns

Forex Patterns - Analysis Setups StrategiesForex chart patterns are visual examples of price actions that repeat, and they are often used to understand how prices move in the market.

Forex Setups is one of the studies used in technical analysis to help traders learn how to recognize these repeating Setups formations.

These specific 'Setups' are crucial in trading because when the market stagnates in a specific direction, it is often forming a recognizable chart pattern. Understanding these Setup formations is vital for forecasting the probable next market movement.

Price charts show natural patterns that repeat. These setups help technical traders forecast moves.

Forex traders often study these Setups formations to measure supply & demand forces which form the basis for price fluctuations.

These Setups are classified into 3 different categories:

1. Reversal Patterns

- Double tops Setups

- Double bottom Setups

- Head and Shoulders Patterns

- Reverse head & shoulders Setups

2. Continuation Setups

- Rising triangle Setups

- Falling triangle Setups

- Bull flag/pennant Setups

- Bear flag/pennant Setups

3. Bilateral

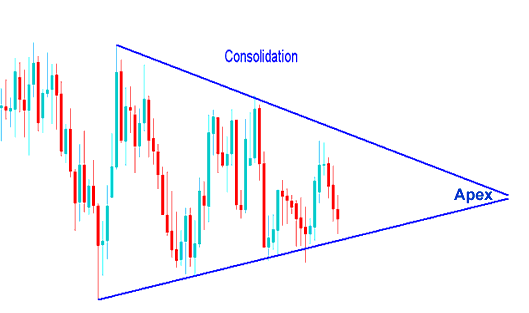

- Symmetric triangle - Consolidation Setup Patterns

- Rectangle - Range Patterns

Reversal Patterns - Reversal Patterns - confirm the reversal of the trend once this reversal chart setup is confirmed. These Reversal Patterns are formed after extended market trend either upwards or downward & these reversal patterns signal that the market is ready to reverse.

Continuation patterns Setups - are formations which set-up the market for a market trend continuation move in the direction of the previous trend. These Continuation Setups are formed & shaped when the market is taking a pause before continuing in same direction of previous trend.

Consolidation patterns Formations - happen when the market is pausing before deciding which way the market trend will go next. When these Consolidation Formations are created - the market is trying to decide in which direction it will trade.

Technical Chart Analysis of Patterns

There are 2 types of chart analysis in trading, these 2 may seem similar but aren't: the 2 are:

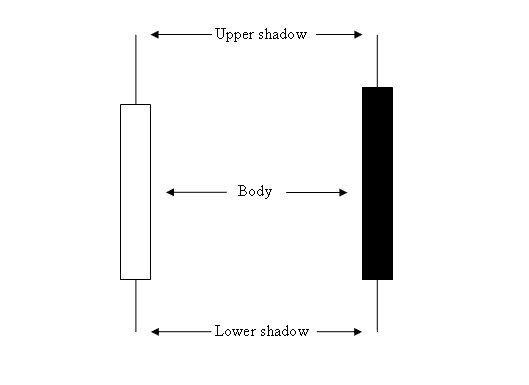

- Japanese Candlesticks - Study of a single candle - Understanding Japanese Candlestick Patterns

- Forex Patterns - Study of a series of candlesticks formations

(This learn tutorial is about the second option above - Setups)

The different guides for these 2 types analysis are:

Japanese Forex Candles

Forex Setups Tutorials

- 56. Chart Setups for Standard Head and Shoulders Patterns and Inverse Head and Shoulders Configurations

The examples illustrated below compare differences between two distinctive technical analysis techniques and setups.

Candles Patterns - Study of a single candlestick

FX Setups - Study of a series of candle s

More Lessons:

- Support and Resistance Levels in MetaTrader 4 Indicators

- List of IBEX35 Strategies and Best Strategies for Trading IBEX

- Best Bollinger Band Indicator Combinations Explained

- How to Trade News Breakouts on Forex Trading Charts

- Bollinger Percent B (%b) analysis for MT5.

- USDJPY System: Your Go-To Trading Strategy

- How to Add USD/SEK Quotes to MetaTrader 4

- How Can I Use Chande Momentum Oscillator Technical Indicator in?