Bollinger Bands Technical Analysis & Bollinger Signals

Created by John Bollinger

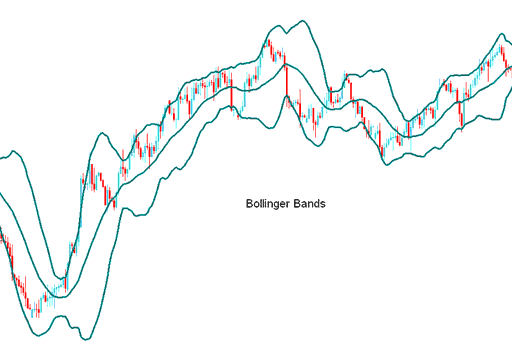

Bollinger Bands are made up of 3 lines. The line in the middle is a MA(Moving Average) - a Simple MA of 20 periods.

Then, lines are marked at a certain distance from the moving average(MA). These lines create the top and bottom boundaries.

The distance for band plotting is determined by another indicator called standard deviations. Standard deviation quantifies market volatility, including that of xauusd.

Because the price of things in the market is always changing, how spread out the numbers are will also change, and because Bollinger bands use this spread to figure things out, the bands will move closer or farther apart based on how unstable the market is.

when prices grow to be extra risky, the bands widen and that they contract all through much less risky periods.

The 3 Bands are made to hold most of the price movement inside them. The middle band shows the market's trend, and is usually a 20-period moving average.

This central band also constitutes the foundation upon which the outer upper and lower bands are constructed. The extent of the separation between the upper and lower bands relative to the middle band is governed by market volatility. Specifically, the upper band is plotted two standard deviations (+2) above the middle band, while the lower Bollinger Band is fixed two standard deviations (-2) below the middle band.

XAU USD Analysis and Generating Signals

- Bands provide a relative definition of high & low

- Used to identify periods of high & low volatility

- Used to identify periods when prices are at extreme regions

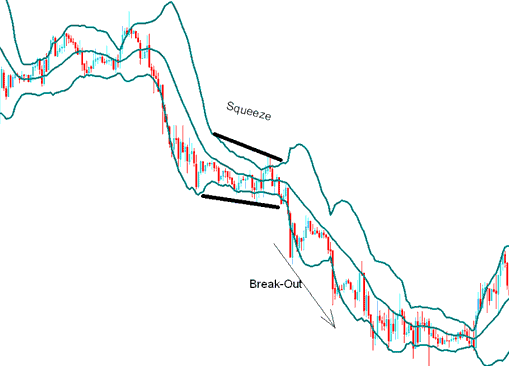

the Squeeze

The bands squeeze closer as price swings get smaller, which shows times of little price change. Big price jumps usually happen after the bands squeeze.

Pattern of Consolidation

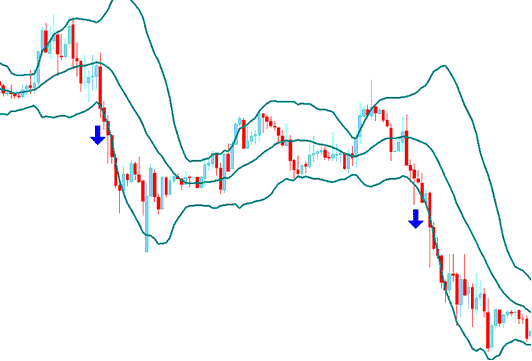

the Bulge

If the prices push past the top or bottom band & head past the bands, it's probable the current direction of the market will keep going.

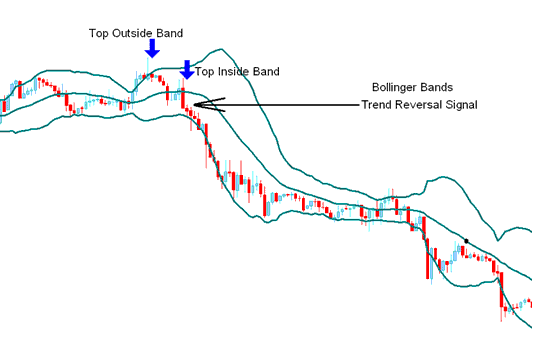

Double Tops & Double Bottoms

When prices go past the bands and then stay inside, it could mean the trend is going to change.

The Head Fake - Gold Whipsaw

Traders should remain vigilant for false breakouts, commonly referred to as whipsaws or head fakes.

After the market enters a Squeeze phase, price often initially breaks out in one direction. Many traders may anticipate this breakout to persist, but it quickly reverses, leading to a more significant breakout in the opposite trend direction.

Traders reacting quickly on the initial breakout often and commonly get caught on the wrong side of the price action, while those traders expecting a "false breakout" can quickly close-out their original position & enter a trade in the direction of reversal. It is always good to combine Bollinger bands with other confirmation Indicators.

Additional Topics, Tutorials, and Lessons:

- MetaTrader 4 Parabolic SAR Indicator for Day FX

- AUDJPY Market Hours Open and Close

- WallStreet 30 Stock Indices Trading Trading Strategy How to Create Stock Indices Trading Strategy for Trading WallStreet 30

- MetaTrader 4 XAUUSD Platform/Software Install Software Platform Tutorial Course

- MA Indices Signal

- How to Work Out Amount of Pips in FX Pairs Moves

- SMI XAU/USD Technical Indicator Analysis