Analysis Comparing the Piercing Line Candle Pattern with the Dark Cloud Cover Candlestick Pattern

Piercing Line for Bulls and Dark Cloud Cover for Bears

The Piercing Line Candlestick Setup and Dark Cloud Cover Setup appear similar but differ significantly. The Dark Cloud Cover occurs at the peak of an uptrend, while the Piercing Line forms at the bottom of a downtrend.

Upwards Trend Reversal - Dark Cloud Cover Candles

Downwards Trend Reversal - Piercing Line Candles

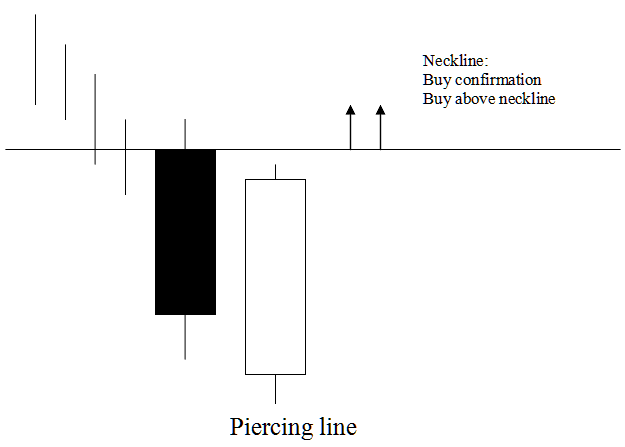

Piercing Line Candlestick

Piercing line is a long black body which is followed by a long white body candlestick.

The white body pierces the midpoint of previous black body.

At the conclusion of a market downturn, this is a bullish reversal pattern. It demonstrates that the market begins at a lower level and ends at a higher point relative to the center of the black body.

This means the strength of the price decrease is getting weaker, so the price will probably go the other way and start to increase.

This setup is shown referred to as a piercing line signifying and signaling that the market is piercing the bottom signifying a market floor for the fx currency price downwards trend.

Piercing Line Candlestick

Analysis Piercing Line Candle Setup

A buy signal is confirmed once price closes above the neck line which is the opening of the candlestick on the left of the Piercing Line candlestick.

This is a positive arrangement, and prices should keep rising. A trader who places a buy trade should also place a stop loss order just below the lowest price level.

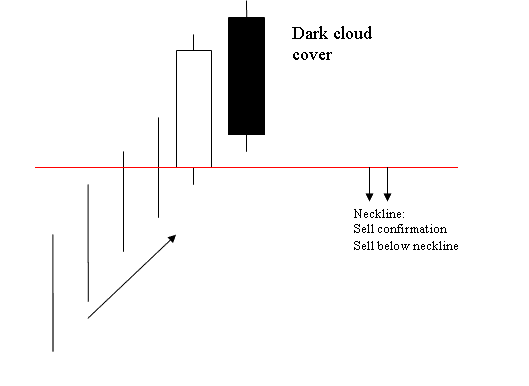

Dark Cloud Cover Candle

Opposite of piercing candlestick.

This candlestick is a long white body that is followed by a long black body.

The black body pierces the midpoint of the prior white body.

This is a bearish reversal pattern which forms at the tops of an uptrend.

It shows the market opens higher and closes below the mid-point of the white body.

This observation implies that the upward thrust of the trend is diminishing, suggesting a high probability that the market direction will reverse into a downward path.

This specific configuration is referenced as a cloud cover, implying that the cloud acts as a ceiling restraining further upward movement in the currency's price.

Dark Cloud Cover Candle

Analysis Dark Cloud Cover Candlestick Pattern

A sell signal is confirmed when the price closes below the neckline, specifically at the opening price of the preceding left candle.

This is a negative configuration, and prices should keep falling. In addition, anyone who enters a sell trade should set a stop loss order just above the highest price point.

More Topics: