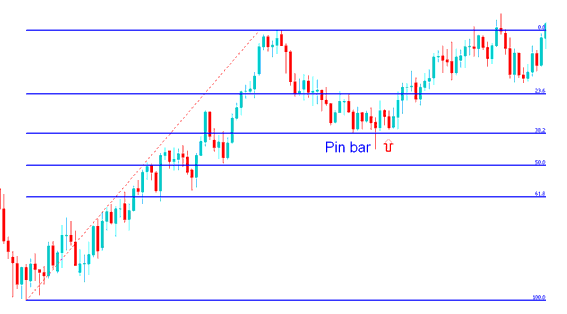

Pin bar price action method

A pin-bar is a reversal signal on a chart which portrays an obvious change in sentiment during that period.

This bar has a long tail with closing price near the opening.

Bar looks like a pin thus the name Pin Bar - forms after an extended move upwards or downwards.

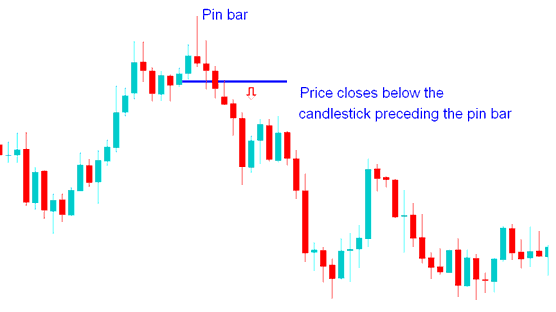

A reversal is confirmed when the market closes below the candlestick that precedes this pattern. Specifically, the reversal is deemed valid if the market closes below the blue candle that came before this candlestick.

Combining Together with line studies:

Pair this signal with lines like support and resistance. Add Fib retracements or trend lines too. Together they help spot buy or sell trades.

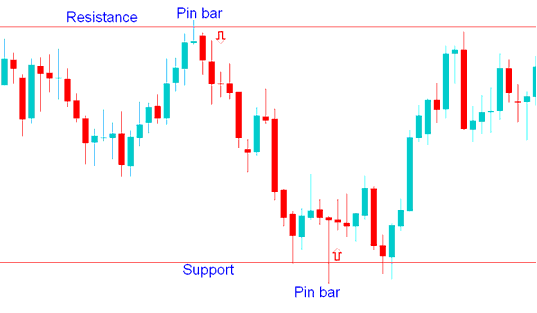

Support and resistance

A pin bar forms when price touches a key support or resistance level. It signals a trade entry. Enter in the direction opposite the tail.

If the market moves upwards this forms a pin bar with tall upper tail, then the signal is to short.

If the market declines and subsequently forms a pin-bar featuring a long lower wick, the resulting trading instruction is to buy (long).

Combining with Support and Resistance

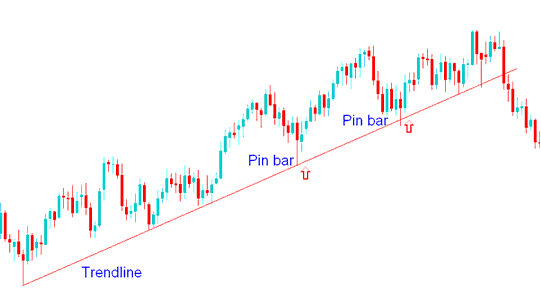

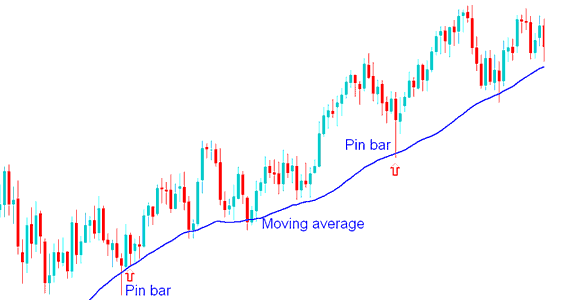

Trend lines and moving averages

Pin-bars appearing subsequent to price testing a trendline or a Moving Average (MA) can serve as valid entry signals into the market.

Combining with Trend-Lines

Combining Together with Moving Averages(MAs)

Forex Fibonacci Retracement Levels

Pin-bars that form after price touches/tests a Fib retracement can also be used as signals to enter the market.

Combining Together with Fib Retracement Levels

These formations frequently manifest near significant market turning points and often follow failed price breakthroughs. Consequently, this configuration is employed to establish trades aligned with the counter-trend direction indicated by the flag's tail.

More Tutorials & Topics:

- Hull Moving Average Explained with Example

- How do I evaluate strategy signals?

- Trading with the Stochastic Momentum Index on MetaTrader 5

- Pivot Points: Key Support and Resistance Levels

- Course for Trading US100 Index

- Analyze Fibonacci Retracement: Read Levels on MT4 Platform

- USDTRY Market Opening and Closing Times

- How Do I Use Stochastic to Generate Crossovers Buy Trading Signals and Sell Signals?

- How do I set up the Ultimate Oscillator on MetaTrader 4 charts?

- Leverage Options for Gold