Guide to Adding the Ultimate Oscillator Technical Indicator on MT4 Charts - Integrating the MT4 Ultimate Oscillator

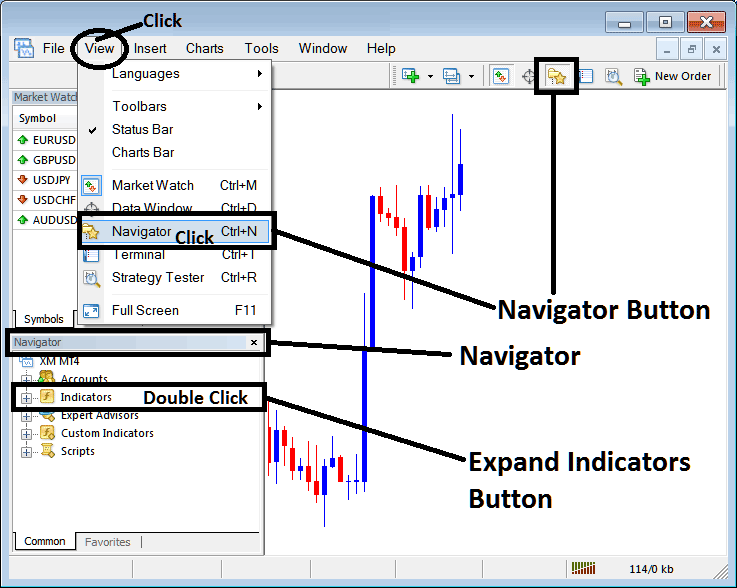

Step 1: Open the Navigator Panel Window on FX Trade Platform

Open Navigator window just as shown: Go to the "View" menu (press on it), then choose the "Navigator" panel (press), or From Standard Tool Bar click "Navigator" button or press key board shortcut keys "Ctrl+N"

In the Navigator window, pick Indicators. Double-click it.

How to Add the Ultimate Indicator on the MT4 Platform - Instructions for integrating the MT4 Ultimate Oscillator Indicator.

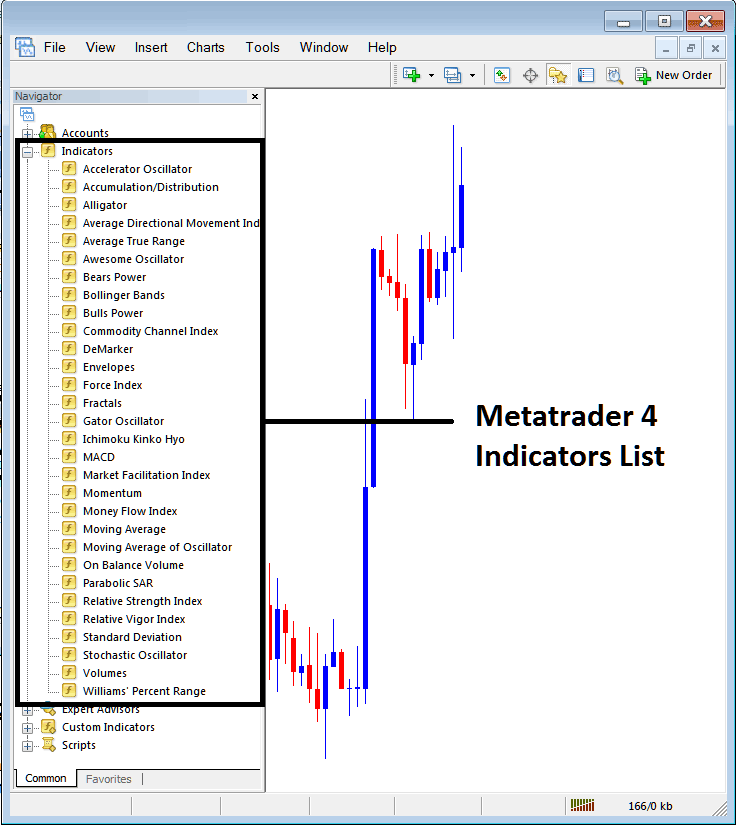

Step 2: Open Indicators in Navigator - Add Ultimate Oscillator to MT4

To add the Ultimate Oscillator forex chart indicator, expand the menu by clicking the plus sign or double-clicking the "indicators" menu, which will then display a list. Select the Ultimate Oscillator from the available indicators to incorporate it into your forex chart.

How Do I Include the Ultimate Indicator - From the window shown above, you are able to add whichever Ultimate Oscillator you want to the Forex chart

How to Set Custom Ultimate Indicator to MT4

For a custom indicator like the Ultimate Oscillator, add it to MetaTrader 4 first. Then compile it. This makes the new custom Ultimate Oscillator appear in the MT4 list of custom indicators.

To learn and know how to install Ultimate Oscillator Indicators in MT4, how to add Ultimate Oscillator panel to MT4 and how to add Ultimate Oscillator Technical custom indicator in the MT4 - How to add a custom Ultimate Oscillator in MT4.

About Ultimate Oscillator Described

Ultimate Oscillator Analysis and Ultimate Oscillator Signals

Initially created and utilized for trading in the commodities and stock markets.

This oscillator tries to find a middle ground between early signals and late signals given by common technical indicators.

- Leading - some indicators lead the market & give signals earlier than the ideal optimum time

- Lagging - some trading indicators lag the market so far that half of the move is over before a signal gets generated.

This is the balance that this oscillator technical indcator aims to strike, not to lead the market too much or lag the market too much - this way this oscillator indicator will always give a signal at the ultimate time, thus its title.

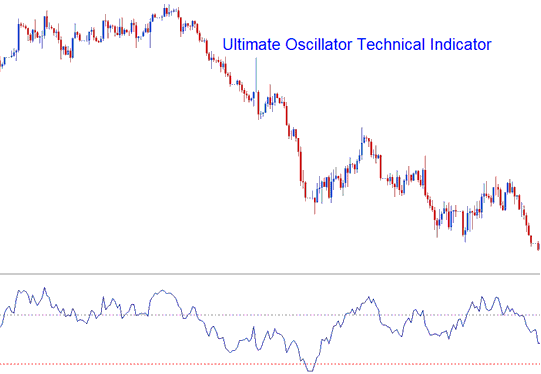

This calculation utilizes a specific count ('n') of recent candles, deriving weighted averages from their price movements, which are then mapped onto a scale spanning from zero to one hundred. Readings exceeding seventy are interpreted as indicating an overbought market condition, whereas readings below thirty suggest oversold territory.

The ultimate oscillator uses three time periods. Seven for short trends, 14 for medium, and 28 for long ones.

Forex Technical Analysis and Generating Signals

This technical tool facilitates the creation of both purchase and sale trade indicators through various techniques.

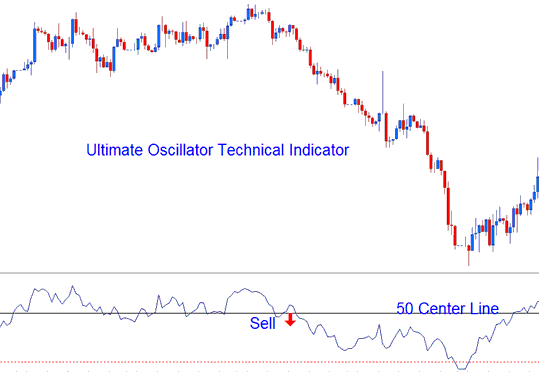

Center line Forex Crossover Trading Signal

Buy Signal - readings above 50 center-line level

Sell Trade Signal - readings below 50 centerline level

Center line Forex Crossover Trading Signal

Over-bought/Oversold Levels in Technical Indicator

Over-bought - levels above 70 - sell trading signal

Over-sold - levels below 30 indicate a buy signal

Divergence FX Trading

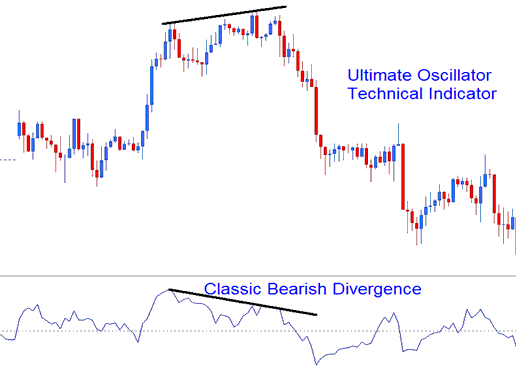

Oscillators can also be applied to trade divergence forex signals. Below is an illustration of a classic bearish divergence signal.

Technical Analysis

Courses and Courses to Learn More:

- What's FX Trend Trigger Factor TTF Indicator?

- What's the Pips Value for USD HUF FX Pair?

- What's XAU USD Signals Meaning?

- Calculating Leverage in Forex: Understanding 1:200 and 1:100 Forex Leverage

- Why Host Your Expert Advisor(EA) XAU/USD Bots with Your Broker Provided VPS

- EURHKD Opening Time and EURHKD Closing Time

- GOLD XAU/USD Trading Spread

- How to Set Standard Deviation Technical Indicator in MT4 Chart

- Support and Resistance Levels in XAU USD

- Where to See and Access a MetaTrader 4 Forex Pair List