What is Indicators Combination? - Definition of Indicators

Forex Indicators - Indicators is a popular technical indicator that can be found on the - Forex Indicators List on this site. Indicators is used by the traders to forecast price movement depending on the chart price analysis done using these Indicators. Traders can use the Indicators buy and Sell Signals explained below to determine when to open a buy or sell trade when using these Indicators. By using Indicators & other indicators combinations traders can learn how to make decisions about market entry and market exit.

What's Indicators? - Indicators

How Do You Combine Indicators with Other Indicators? - Adding Indicators in MetaTrader 4 Platform

Which Indicator is the Best to Combine with Indicators?

Which is the best Indicators combination for trading?

The most popular indicators combined with Indicators are:

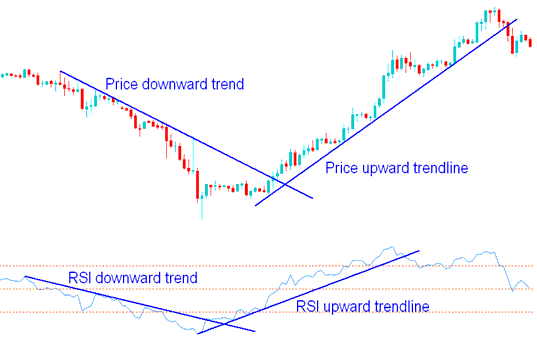

- RSI

- MAs Moving Averages Trading Indicator

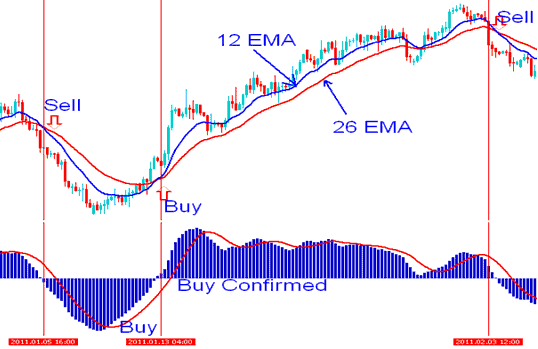

- MACD

- Bollinger Bands Indicator

- Stochastic Indicator

- Ichimoku Kinko Hyo Indicator

- Parabolic SAR

Which is the best Indicators combination for trading? - Indicators MT4 indicators

What Indicators to Combine with Indicators?

Get additional indicators in addition to Indicators that will determine the trend of the market price and also others that confirm the market trend. By combining indicators that determine trend & others that confirm the trend & combining these indicators with Indicators a trader will come up with a Indicators based system that they can test using a demo account on the MT4 software.

This Indicators based system will also help traders to determine when there is a market reversal based on the technical indicators signals generated & hence trades can know when to exit the market if they have open trades.

What is Indicators Based Trading? Indicator based system to interpret and analyze price and provide signals.

What is the Best Indicators Strategy?

How to Choose & Select the Best Indicators Strategy

For traders researching on What is the best Indicators strategy - the following learn guides will help traders on the steps required to course them with coming up with the best strategy for trading market based on the Indicators system.

How to Create Indicators Systems

- What is Indicators Strategy

- Creating Indicators Strategy Template

- Writing Indicators Strategy Trade Rules

- Generating Indicators Buy and Indicators Sell Signals

- Creating Indicators System Tips

About MT4 Indicators Explained with Examples

FX Indicators List & Their Analysis

To learn analysis the first thing which a forex trader should do is to know about all the different analysis indicators & then try to find out the ones that they can use.

A

- Acceleration:Deceleration: AC

- Alligator

- Aroon

- Aroon Oscillator Indicator

- Awesome Oscillator Technical Indicator

- Accumulation Distribution

- ADX

- Average True Range (ATR)

B

- Bollinger Band: Fibo Ratios

- Bears Power

- Bollinger Band

- Bollinger Bandwidth

- Bulls Power

- Balance of Power BOP

- Bollinger % B or %b

C

- Chaos Fractals

- Chandes Q Stick

- Choppiness Index

- Chandes Trend Score

- Coppock Curve

- Chaikins Money Flow

- Chandes Dynamic Momentum Index

- Chandes Momentum Oscillator Technical Indicator

- Commodity Channel Index

D

E

G

H

I

K

L

M

- MACD

- McClellan Histogram

- McClellan Oscillator

- McGinley Dynamic

- Momentum

- Envelopes

- Moving Average Indicator

P

R

S

T

- T3 Average

- Trailing Stop-loss Levels

- Trend Trigger Factor

- Triple Exponential Average TRIX

- Triple Exponential Moving Average MA (TEMA)

- True Strength Index TSI

U

W

You can navigate these tutorials from the right navigation menu.

RSI - Analysis

MACD - Analysis

Indicators Analysis

Most indicators are displayed separately from the trading chart normally below it. This is because the indicators commonly use a different and variant scale than that of the price chart.

Other analysis indicators are displayed on the trading chart itself, such as MAs Moving Averages indicator & Bollinger Bands indicator these are known as price overlays.

Some of the popular ones when it comes to analysis are:

Moving Average (MA) - Using a variety of analysis studies, different types of signals can get to be generated from forex charts using the MAs Moving Averages. The Moving Average reflects buy signals when the prices rise above the MA lines. Sell signals occur when price falls and drops below the MA(Moving Average) lines. Another method to trade with moving averages is using the Moving Average(MA) crossover signals.

MACD is one of the trend following indicators, MACD has got a signal line that is used to generate a buy signal (above the MACD centerline) or a sell trading signal (below MACD centerline).

Volume based market analysis indicators are used to determine the momentum of the trends. High volume, especially near the bottom of market can indicate the beginning of a new trend while low volume might show ranging markets or sideways market movements.

Bollinger Band show potential points where the market movements are likely to change. Technical analysis setups of this technical indicator that show sharp movements in the price action will tend to occur when the bands tighten (the Bollinger bands squeeze). While prices that touch one of the outer band tends to go all the way to reach the other band. Bollinger Band move in a particular direction up or down when there is a trend.

These indicators are some of the most often used indicators when it comes to the daily market analysis. To know more about how to combine these analysis indicators to form a strategy you as a trader can go to strategies section and learn how to create an indicator based trading system.

Learn More Tutorials and Lessons & Courses:

- SX 50 Strategy Courses

- How to Display Instrument if it's Not Listed in MT4 Trading

- What is USDMXN Spreads?

- RSI XAU USD Classic Bullish Trade Divergence and Classic Bearish Trade Divergence

- Learn Basics Concepts

- Forex S&PASX 200 in MT4 Index S&PASX 200 Symbol on MT4 Platform Software

- Inertia Forex Technical Indicators for Intraday