Inertia Analysis & Inertia Signals

Donald Dorsey created this tool, first for stocks and commodities. Traders later adapted it for other markets.

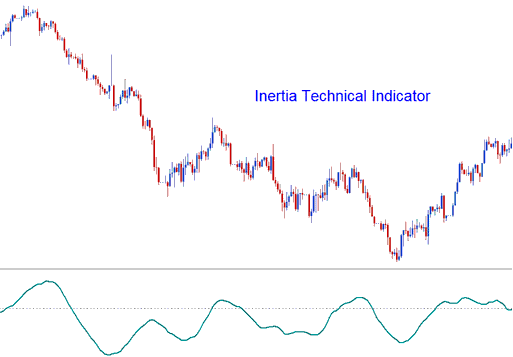

Dorsey dubbed his creation "Inertia" based on his market tendency perception. He posited that overall market trends arise from inertia: therefore, shifting a market that is already trending demands more force than sustaining its current trajectory. As such, a market's trend serves as a reflection or measure of market inertia. This particular indicator operates as an oscillator, utilizing a scale from zero up to one hundred. Trading signals are generated and extracted via crossing the central baseline set at 50.

In physics, the term Inertia is defined in terms of mass & direction of motion. Using the standard trading analysis, the direction of motion of the market trend can be easily defined. However, the mass can't be easily defined. Dorsey claimed the volatility of a financial trading instrument may be the simplest and the most accurate measurement of inertia. This theory led to the use of Relative Volatility Index, RVI as the basis to be used as a price trend indicator. Hence Inertia is comprised of: RVI smoothed by a linear regression.

Forex Analysis and How to Generate Trading Signals

When trading in the currency market using this technical indicator, interpreting the signals generated is relatively straightforward. Below are two chart examples demonstrating how buy and sell signals are derived and executed using the Inertia indicator.

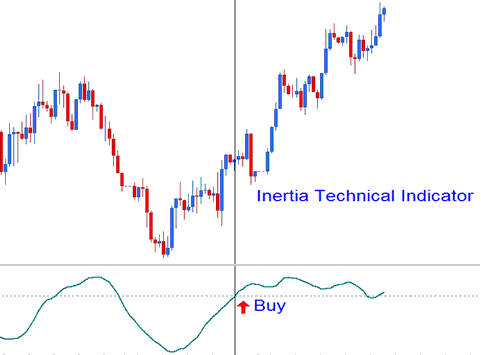

Upwards Trend - Bullish Buy Trading Signal

In cases where the Inertia rises above 50, it signifies positive inertia and characterizes the long-term trend as upward, provided it remains above this threshold. A fall below 50 is interpreted as an exit signal. The chart below exemplifies how a buy signal is generated.

Upwards Trend - Bullish Signal

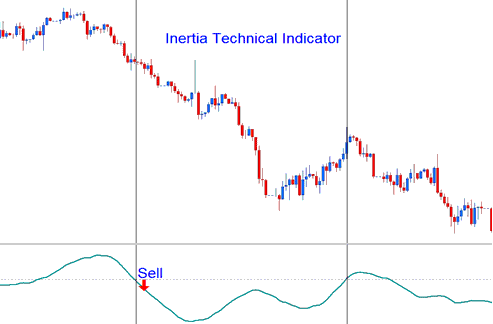

Downwards Trend - Bearish Sell Signal

If the Inertia is below 50, negative inertia is indicated, this hence defines the long term trend as downward as long as the technical indicator remains below 50. If it crosses above 50 then this is interpreted and viewed as an exit trading signal. The currency chart below illustrates how a sell trade signal generated.

Downwards Trend - Bearish Signal

Study More Tutorials & Tutorials:

- SPAIN35 Trading Strategies: Step-by-Step Guide and Download

- Where Can I Find the Choppiness Index in the Platform's Chart?

- Explanation of the Bollinger Band Indicator in FX

- Major Forex Pairs: What They Are and Why They Matter

- How to Add the MT4 Gann Swing Oscillator Tool

- Steps to Open a Managed Forex Account

- Setting Up Forex Chande Momentum Oscillator EA