Ehler MESA Adaptive Moving Average Signals for Trading Analysis

Mesa Adaptive Moving Averages was created by John Ehler

Originally used to trade commodities & stocks.

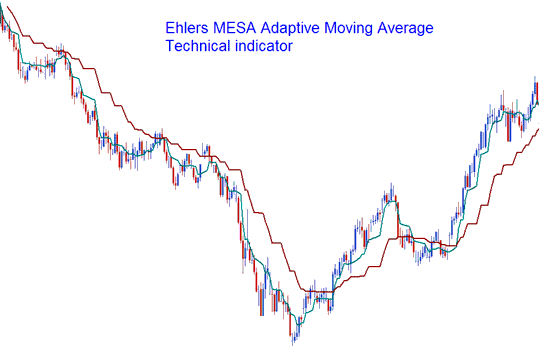

The MESA Adaptive average looks similar to two MAs Moving Averages. The key difference is the MESA moves in steps, unlike the MA Moving Average, which curves. The picture shown below shows how this trading indicator looks when plotted on a price chart.

Ehler MESA Adaptive Moving Average(MA)

The MESA Adaptive Moving Average is a market trend following indicator that adapts to price action movement based on the rate of change of price as rated by Hilbert Transform Discriminator. This technical indicator will generate a signal when the 2 MAs cross one another. Trade Positions should be executed on direction of the MESA averages.

This approach utilizes a fast Moving Average alongside a slow MA, allowing the resulting composite average to rapidly mirror price shifts while maintaining its computed value until the next candle closes. This indicator tends to generate fewer false reversal alerts when contrasted with traditional Moving Averages, owing to the specific mathematical formula employed to gauge the rate of change relative to price movement.

Get More Topics and Tutorials:

- Setting Up Coppock Curve on a Chart

- Tutorial Content for HANG SENG 50 Trading Strategies

- Analyzing new forex orders through MetaTrader 5's iPhone app interface.

- How do you set trailing stop loss levels in MetaTrader 5?

- Elucidating the FX Triple Exponential Moving Average (TEMA) Indicator.

- Trading Systems for NKY225 Index

- Analysis of Stock Index Trading

- Setting Up TEMA Triple Exponential Moving Average(MA) EA

- GBPNOK Currency Pair

- Setting Up Forex Aroon Oscillator EA