TIPS: MAXIMIZING PROFITS OF Stock Indices SYSTEMS

Tips for Trading Systems for Beginner Traders - How to Improve Your Trade System When Trading Online

1. Define Simple Index Rules and Follow the Trend

The simpler the system is the better. If the trading system is too complex, it'll be very difficult to stick to the trading rules. Complicated Indices trading systems are also very confusing. A simple system makes it easy to follow the rules.

2. Eliminate Risk Quickly and Let Profits Run

Minimizing risk is far more important than making money. Our first objective in Indices trading is to make the Stock Index trade less risky. We achieve this by only entering high probability trade patterns, setting stop loss orders, cutting losses quick & never average down, & letting the profitable trade transactions run for a while, just long enough, but not very long, in order and so as to increase the profits. Profitable Index trade positions are only held open as long as the system shows the market trend is in place, these trades should be closed immediately once and as soon as your exit trading signal criteria is generated and given by the system.

3. Select/Choose the Right Index

Once you have your system, you'll want to begin testing it on a practice demo trade account. Stock Index have their own characteristics different from others. A system will give different results for each Indices.

- EURO STOXX 50 Stock Index

- DAX 30 Index

- Dow Jones Industrial Average 30 Index

- FTSE 100 Stock Index

- Nikkei 225 Index

- S&P ASX200 Index

- FTSE MIB 40 Index

- S and P 500 Index

- NASDAQ 100 Stock Index

- CAC40 Index

- SMI 20 Stock Index

- AEX25 INDEX

- Hang Seng 50 Index

- IBEX35 Index

To maximize the profitability of your trade system find the most active market trading times for a chosen and selected Indices & trade during that market session only.

4. Use Index Money Management Guidelines

Always risk less than 2% per Stock position. With compounding, you'll be surprised to see how quickly your account grows once you begin to trade with a profitable system.

5. Keep a Journal

Keeping a log of all your Index trade positions will help you to become a better & better & will help you as a trader follow the trading rules of your system. A journal will also keep track of your profitable Indices trade positions & losses & you as a stock indices trader can analyze and interpret why a trade setup was profitable and why it wasn't.

6. Set take Profit Targets

Establish a daily, weekly, monthly trade profit targets when trading the market. Once you as a trader hit this target, stop trading & take a break. This will stop you from overtrading and will also stop you giving back your trading profits to the market. Keep your risk:reward ratio high, a 3:1 risk reward ratio is best. This means only opening indices trades only when you have the probability of making 3times more than what you are risking.

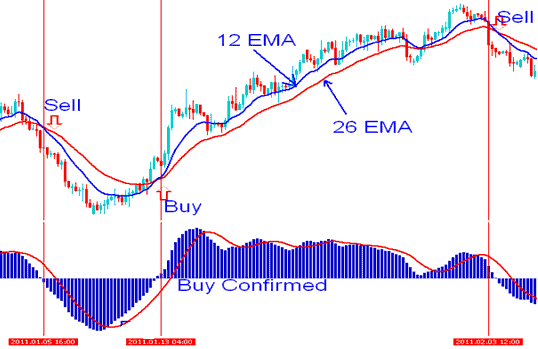

Explanation of signals generated by our system

Example 1: Buy Trading Signal and Sell Signal Generated By System

Buy signal is generated by the technical indicator based system, then an exit trading signal is derived and generated before another reverse sell signal is generated on this trade chart

Example 2: Two buy signals generated by System

Two buy signals are derived/generated during the upward market trending market

Example 3: Exit Signal Generated by Trade System

Example of Indices Trade Signals Derived and Generated by a Trade System

Get More Guides and Tutorials: