Technical Analysis of the Chandes Dynamic Momentum Index and its Resulting Signals (Chandes DMI)

Developed and Created by Tushar Chande

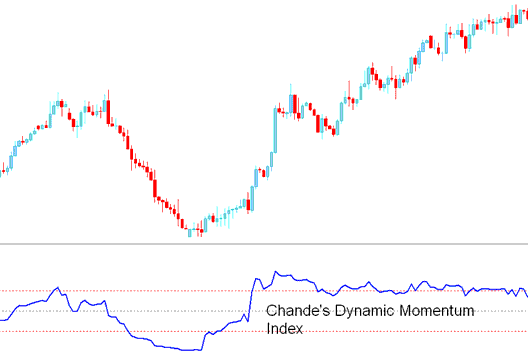

The Chande DMI shares similarities with Welles Wilder's Relative Strength Index (RSI), yet contains one crucial distinguishing feature.

RSI always uses a set amount of price data, but the Chandes Momentum Dynamic Index uses different amounts of price data as the market's price changes.

The number of price periods used by this Momentum Index trading indicator decreases as the market price volatility increases. This allows the indicator to be more responsive to price changes.

The Chandes DMI is more accurate than the RSI, has less whipsaws & is less Choppy

FX Technical Analysis and How to Generate Signals

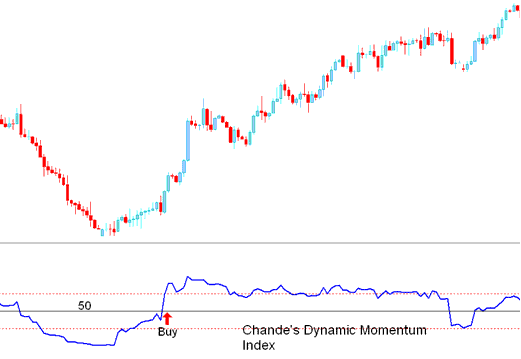

Buy Trade Signal

A buy signal is generated/derived when the DMI crosses above 50 level mark.

Buy Signal

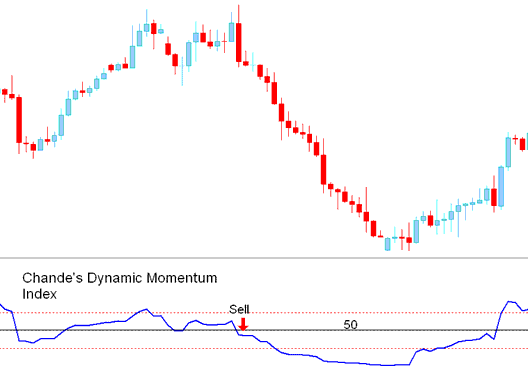

Sell Signal

A signal to initiate a sell position is generated upon the DMI line dropping beneath the 50 level marker.

Sell Trade Signal

More Topics & Courses:

- Trading Platforms MT4 Forex Software Platform

- How to Calculate Leverage and Margin in XAU/USD

- Want a step by step guide for XAUUSD analysis? Here it is, free.

- How Can I Calculate Pip Value in for Mini Lots?

- Nasdaq Course Market Nasdaq Markets Plan Course Class

- Setting Up Coppock Curve on a Chart

- Grasping the Principles of Operating the Carry Trading Method.

- EURGBP Trading Strategy Overview

- A Comprehensive Guide and Tutorial for Learning XAU USD Market Trading

- USDCHF System USDCHF Trading Strategy