Bears Power Analysis and Bears Power Signals

Developed and Created by Alexander Elder

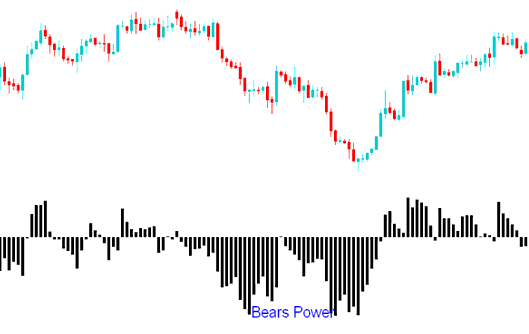

Bears Power is used to measure the power of Bears (Sellers). Bears Power gauges the balance of power between the bulls and bears.

This particular indicator is designed to ascertain whether a prevailing bearish trend is set to persist or if the price has reached a critical juncture potentially leading to a reversal.

Calculation

A break below an uptrend line signals a sell. It often means the uptrend ends or starts to flatten.

Every bar either closes higher or closes lower than the previous and prior bar.

The peak price reached will clearly indicate and reflect the maximum bullish strength (Buyers) observed during that specific trading interval.

The lowest attained price will demarcate the peak influence of Sellers (Bears) observed throughout the trading interval.

This technical indicator employs the Low price and a Moving Average (Exponential Moving Average).

The middle ground between sellers and buyers for a given price range is shown by the moving average.

Hence:

Bears Power = Low Price - Exponential MA

Technical Analysis and How to Generate Trading Signals

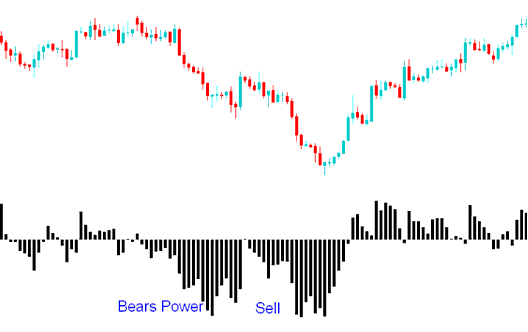

Sell Trade Signal

A sell signal is generated and derived the moment the specified oscillator trading indicator dips below the Zero mark.

In a down-trend, the LOW is lower than EMA, so the indicator is below zero and Histogram Oscillator Technical is located below the zero mark.

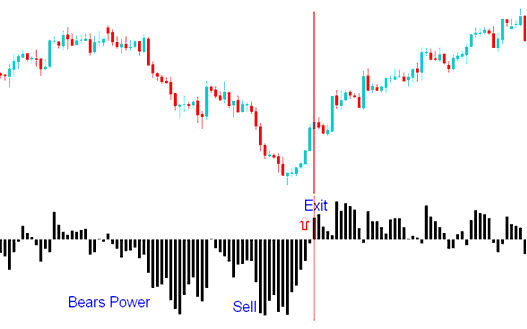

Exit Signal

If the LOW goes above EMA it then means the prices are starting to rise, the histogram rises above zero mark.

The Triple Screen technique for this indicator suggests that identifying the price trend on a higher chart time frame interval (like daily timeframe) and applying the bears power signals on a lower chart time frame interval (like hourly time-frame). Trading Signals are transacted in accordance to the lower time-frame but only in the direction of the long term trend in the higher chart time frame.

Get More Lessons:

- AC Indicator Analysis Illustrated

- Description of Margin Level in XAUUSD

- Choppiness Index MT5 Technical Analysis in Forex Charts

- Detailed Explanation and Illustrations of DeMarker Analysis

- HangSeng50 Methods Ways to Create Hang Seng 50 Plans

- Drawing Lines and Channels That Show an Increasing Trend on XAU USD Charts

- Characteristics of the 3 Major XAUUSD Sessions