Characteristics of the 3 Major Market Sessions: Asia, Europe & America Market Sessions

Asia Market Session

During the Asian session, only 8 percent of the total daily financial transactions occur through the Tokyo desks, making it the quietest of the three major sessions. The majority of this 8 percent involves yen-based forex pairs, with minimal trading activity for other financial instruments such as gold. This explains why trading of gold during this time is not recommended. Avoiding trading during this session can save you both time and money.

European Session

The London/European trading period handles most of the world's financial activity: specifically, 34% of all financial deals happen during this part of the day. London's time zone is also good for business because it overlaps with both eastern and western business hours, which means lots of financial deals happen then. This is when there's the most trading and the biggest price changes for all currency pairs and also Gold metal.

The Europe time-zone also has the countries in the euro zone. The Euro zone has 17 countries, and the big banks in these countries are open, so there's a lot of trading happening as many transactions take place.

America Session

The USA market session takes up 20 % of all financial trading transactions. The most active time for trading is approximately from 8 am to 12 pm GMT when both London and New York dealing desks are open. This is when there is in general the highest volatility as it is also when the majority of the major US economic announcements are released.

European and USA Market Sessions Overlap

While the online exchange market operates 24 hours a day during the week, certain periods exhibit higher trading volumes, thus providing more opportunities for profit.

If you're day trading gold, your best shot is during the time when the London and New York markets overlap. This is when things really heat up - tons of trades fly through, the market's buzzing, and gold prices become a lot more lively. There's also a flood of economic news during this window, which stirs up even more price swings. In short, if you want the most action and the biggest chance to make a profit, this is your window.

The top times to trade gold fall during market overlaps. Prices shift a lot then, with clear moves that give good profit odds.

This explains why traders from Asia, such as the Japanese, typically wait until the afternoon to start placing their trading orders: this timing aligns with the European and US trading sessions.

Asian traders generally refrain from initiating positions during the Asian trading session. For global investors, it is recommended to adhere to this practice and delay trading until later in the day. Liquidity significantly enhances during the overlapping hours of the U.S. and U.K. sessions, creating more favorable market conditions for trading.

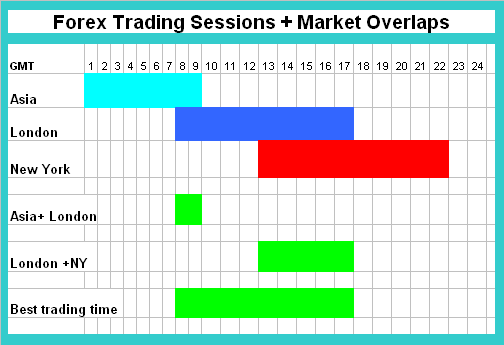

Therefore to create the best hours based on these three sessions is shown:

Market Session Hours & Market Sessions Over-laps

The chart presented shows the schedule for the start and conclusion of each trading session. The chart also indicates overlapping sessions and pinpoints optimal times for Gold trading and trading with other instruments based on these overlaps.

Summary:

Determine Your Gold Schedule

The kind of XAU/USD trader you are will decide your trading plan. If you have limited time, a long-term strategy for trading gold would be a better fit. However, if you have plenty of time, you might choose to engage in intraday trading, where you make trades during the busiest times in the market. The chart above highlights the best GMT times for trading, which are around 800 GMT to 1800 GMT.

Determine Your Time-frame

To establish a trading schedule, it is essential to determine the chart time-frame you will be using. Experiment with various chart time-frames until you identify the one that is most suitable and comfortable for your trading schedule in the market.

Test Your Gold Strategy

Test your trading plan on a demo account for at least two months. Log each trade and check your plan's progress. Figure out the best times for profits in your gold trading setup.

Your strategy should be specified on the XAUUSD trading plan that you use.

For further information on how to detail your strategy within your trading plan, consult the tutorial focused on composing a Gold trading plan. This guide offers a format example that you can use to outline your timetable.

More Courses & Courses:

- How Do I Read MetaTrader 4 Upward XAUUSD Channel on MT4 Software?

- How to Use the Bar Chart on MT4

- Identifying the Most Favorable Times for Trading FX Currency Pairs

- Maximum Leverage vs. Used Leverage in Trades

- Comparative Benefits of Trading FX Over Equity and Stock Markets

- How do beginner traders choose the right XAU/USD strategy?

- How Do I Use MT4 DeMark Range Extension Indices Indicator?

- Where to Find Regulated XAUUSD Brokers

- What is the bid-ask spread for USDCHF?

- Stochastic Oscillator Forex Buy Sell Signal