Hang Seng 50 Trading Strategy Guide

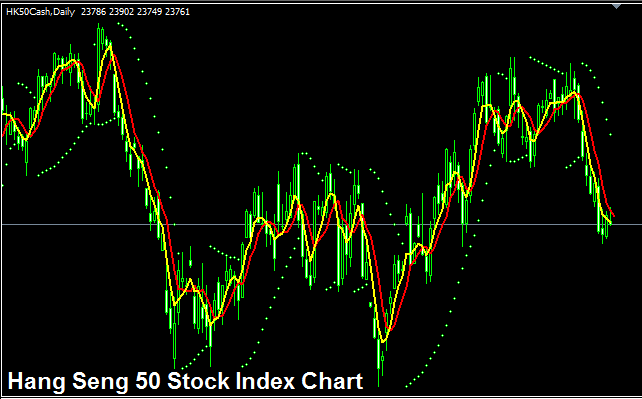

The HANGSENG50 Indices Trade Chart

The HANGSENG50 Indices chart is displayed & shown above. On above example this Index is named HK50CASH. Example displayed and illustrated above is of HANGSENG50 Indices on MT4 Forex Platform Software.

Strategy for Trading HANGSENG 50 Stock Index

The HANGSENG50 Stock Index monitors the total market capitalization of the fifty leading corporations in Hong Kong. This Index generally exhibits an upward trajectory over the long term but its directional movement is characterized by higher volatility. In contrast to other stock indices like the EURO STOXX and DAX30, which display less volatile trend movements, this particular stock index experiences more pronounced swings in its trend.

Over a long time period this stock index will in general move upward, you want to be biased and keep on buying as the index heads & moves upwards.

A solid stock index plan is to buy during dips. As a trader, expect wider swings and more ups and downs with this index.

During Economic Slow-Down & Recession

In recession periods with slow economic growth, companies report smaller earnings, profits, and future growth estimates. Traders sell stocks from firms showing weak profits, so indices that track those shares drop too.

In such periods, trends often drop. Adjust your strategy to match the downward moves in the index you trade.

Contracts & Specifications

Margin Requirement for 1 Lot - HKD 450

Value per Pip - HKD 1

Remember that even though prices generally go up, those who trade must pay attention to how prices change each day. Indexes might sometimes stay steady within a certain range or go down a bit. To handle these situations well, it's very important to trade using plans like the index strategy and carefully manage your money to protect against unexpected changes in the market. About learning ways to manage money with stock indexes: What is managing money with indexes & what is a stock index money management system.

Study More Guides and Courses:

- Where to Find Indicators on MT4 Platform Charts Menu

- Chart Patterns for XAU USD: Examination of Consolidation Setups and Symmetrical Triangles

- FX Transaction Trading

- When Does the US500 Index Begin Trading?

- How to Incorporate a Specific Symbol onto the MT4 Platform.

- Understanding Trade Quotes

- EURHKD Spreads EURHKD Spreads