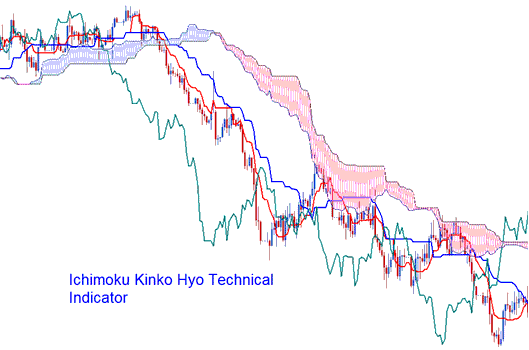

Ichimoku Indicator

Step 3: In the next window, see these parameters. Click next to move on without changing anything. This is for MT5 platform Bitcoin setup.

- Ichimoku means: 'a glance' or 'a look'

- Kinko means 'equilibrium' or 'balance'

- Hyo is a Japanese word/term for "chart"

Ichimoku translates to 'a glance at an equilibrium chart' and is designed to identify potential price directions while helping traders determine optimal times to enter or exit the market.

Calculation

This indicator consists of five lines plotted using the midpoints of previous highs and lows. The 5 lines are calculated as follows:

1) Tenkan Sen: Conversion Line: Red Line (Highest High + Lowest Low) / 2, for last 9 price periods

2) The Kijun-Sen (Base Line): Depicted by the Blue Line, calculated as (Highest High + Lowest Low) / 2, over the preceding 26 pricing periods.

3) Lagging Span (Chikou Span): Displayed in Green, representing today's closing price projected 26 trading periods into the past.

4) Senkou Span A: This Leading Span A value is calculated as the average of the Tenkan-Sen and Kijun-Sen, projected 26 price periods into the future.

5) Senkou Span B: Leading Span-B: (Highest High + Lowest Low)/2, for the previous past 52 price periods, drawn 26 price periods ahead

Kumo: Cloud: area between Senkou Span A and B

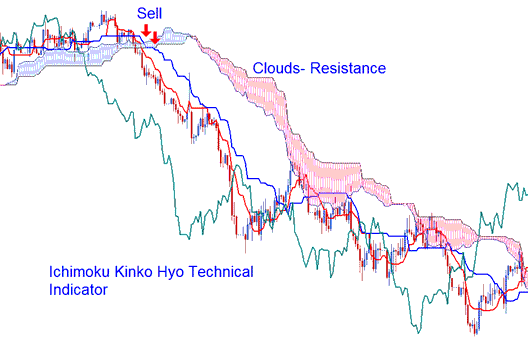

Forex Technical Analysis and How to Generate Trading Signals

Bullish trading signal - Tenkan-Sen crosses Kijun-Sen from below.

Bearish trading signal - Tenkan-Sen crosses the Kijun-Sen from above.

However, there are different areas of strength for the buy and sell trade signals generated.

Analysis in FX Trading

Bullish crossover signal occurs and happens above the Kumo (clouds),

Strong buy trade signal.

Bearish crossover signal occurs and happens below the Kumo (clouds),

Strong sell signal.

If a bullish/ bearish cross over signal takes place within the Kumo (clouds) it is considered a medium strength buy/sell trade signal.

A bullish crossover which occurs below the clouds is considered a weak buy trade signal while a bearish cross over that occurs above the clouds is regarded a weak sell trade signal.

Support and Resistance Levels

You can guess where support and resistance might be by using Kumo (clouds). Kumo can also help you find and understand the main direction of the market.

- If price is above Kumo, the current price trend is said to be upwards.

- If the price is below Kumo, the current price trend is said to be downwards.

Chikou Span measures the strength of buy or sell signals.

- If the Chikou Span indicator is below the closing price of the last 26 periods ago & a sell short signal is generated, then the momentum of trend is downward, otherwise the signal is considered to be a weak sell signal.

- If there a bullish signal and the Chikou Span is above price of the last 26 periods ago, then the momentum of the trend is to the up-side, otherwise it's considered to be a weak buy trading signal.

Learn More Lessons and Tutorials & Topics:

- How Do You Place Fractals Trading Indicator in XAUUSD Chart on MT4 Platform/Software?

- Analysis of Trading Indicators for the AEX 25 Index on the MT4 Platform.

- Learn How to Trade S&P Indices

- Bollinger Bands Analysis in MetaTrader 5

- Query: How to Add the US 500 Index to the MT4 Android Trading Application?

- What is the worth of 1 pip in a mini trading account with mini lots?