What is the analysis and signal generation approach using the Triple Exponential Moving Average (TEMA)?

Developed & Created by Patrick Mulloy.

This tool was first used for analyzing stocks and commodities before it was used for analyzing charts in general.

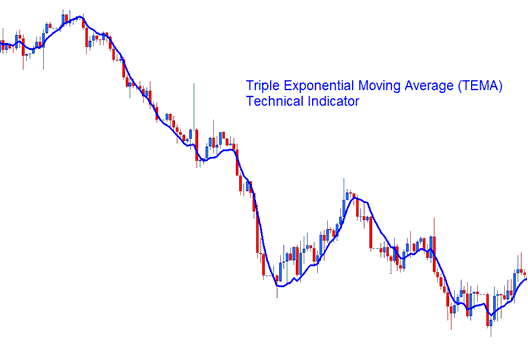

This is a trading indicator that follows market trends, made to reduce the delay of the original and initial exponential MA.

The calculation is based on 3 EMAs:

- a single EMA

- a double EMA and

- a triple EMA

The 3 EMAs when combined produce a lesser amount of lag than any of the 3 EMAs.

Forex Analysis and How to Generate Trading Signals

The TEMA can be traded and transacted in a similar way as the original and initial Moving Averages

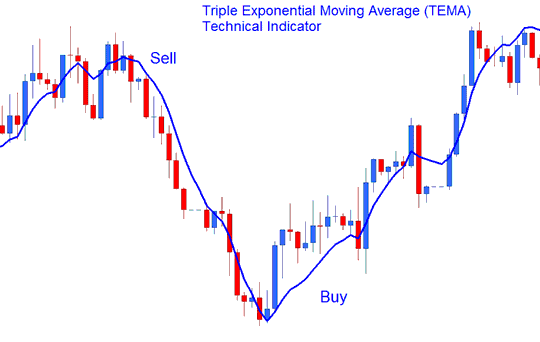

The most used technical analysis method for creating signals involves comparing the Moving Average line with the price changes of a currency pair.

- A buy signal gets derived/generated when both the price and the trading indicator are heading and moving upward while

- A sell signal gets derived and generated when the price and the indicator are both heading downward.

Buy Sell Trade Signal

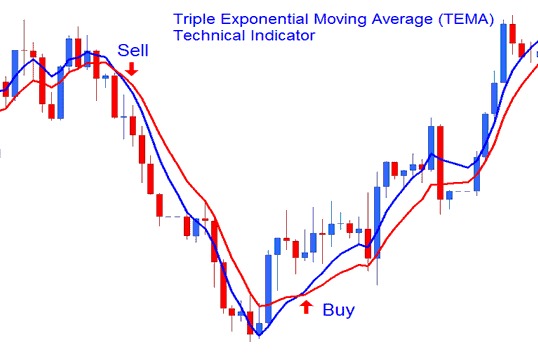

Forex Crossover System

Another popular trading analysis method of TEMA is the crossover trading system.

The TEMA crossover method uses two or more triple exponential MAs that cross each other to create trading signals. One of these indicators uses a shorter time period than the other. This system will also use other indicators as extra confirmation for a trade.

Forex Crossover System

More Courses:

- Minimum Amount Needed to Trade US 100

- A Trading Course and Lesson Tutorial Specifically for Trading the NETH25 Index

- How Much Money Do You Need for 1 Lot/Contract of GER30 Index?

- Moving Average (MA) Strategies – How to Analyze the Market

- Which currencies actually get traded in the forex market?

- Understanding Spinning Tops and Doji Candlestick Patterns

- How to Study and Understand a List of Price Action Trade Strategies

- Curious about volatility in XAU/USD markets? Here's how to use Bollinger Bands to analyze high and low volatility.