Technical Trading Signals from Momentum Analysis and Momentum Oscillator.

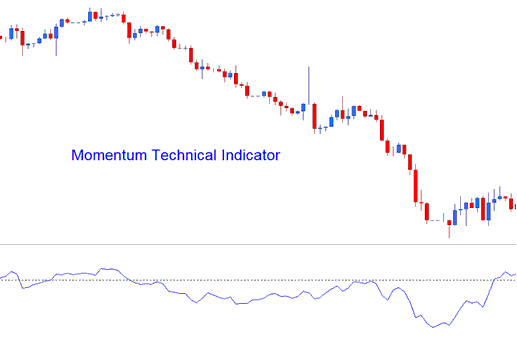

Using mathematical formulas, the momentum indicator determines the line of plotting. The speed at which prices fluctuate is predicted by momentum. The difference between the current price candle and the average/mean price of a chosen and selected is what is used to compute this. Number of price bars ago.

Momentum represents the rate of change of the currency’s price over the given timeframe periods. The faster that the prices rises, the larger the increase in force. The faster that the prices decline, the larger and greater the decrease in momentum.

As the rate of price movement decelerates, the underlying momentum will similarly weaken and begin to converge back towards a central average level.

Momentum

Forex Analysis and How to Generate Signals

This indicator generates technical buy and sell signals. The three most common methods used in forex trading include:

Zero Centerline Forex Crossovers Signals:

- A buy signal gets derived and generated when the Momentum crosses above zero mark

- A sell trade signal gets generated/derived when the Momentum crosses below zero mark

Overbought/Over-sold Levels:

Momentum serves as an overbought/oversold indicator, identifying potential levels based on historical readings and values. Previous momentum highs or lows act as benchmarks to determine these overbought or oversold conditions.

- Readings above the overbought level mean the forex pair is over-bought & a price correction is pending

- While readings below the over-sold level the currency is over-sold and a price rally is pending.

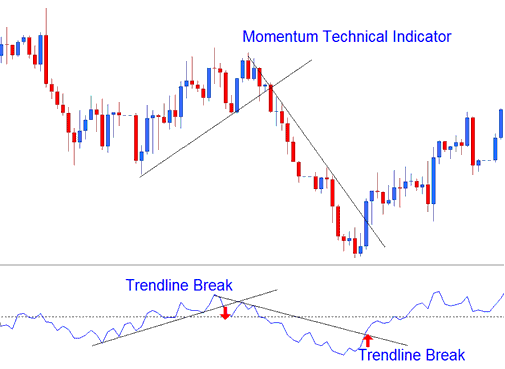

Forex Trendline Break Outs:

Trendlines can be drawn on the Momentum, connecting the high and low points. Momentum starts to change before the price does, making it a leading sign.

- Bullish reversal - Momentum values/readings breaking above a downwards trend line warns of a possible bullish reversal setup while

- Bearish reversal - momentum values/readings breaking below an upward trendline warns of a possible bearish reversal signal.

Analysis in FX Trading

Get More Tutorials & Topics:

- Summary of using the Bollinger Band indicator for trading Gold.

- How to Use MT4 Moving Average Envelopes Trading Indicator

- USD vs DKK Exchange Chart

- Top FX Brokers: A Beginner's Selection Guide

- 1H Swing Trading Approaches

- Adding AEX to MetaTrader 5 Mobile Application

- XAUUSD Charting Options: Examining Gold's Candlestick, Line, and Bar Representations

- Definition of Mini Lot in Trading

- William % R Indicator for FX Trading Use

- Head and Shoulders vs Reverse/Inverse Head and Shoulder Chart Setup