Stochastics Oscillator Analysis - Stochastic Signals for Trading

Developed & Created by George C. Lane

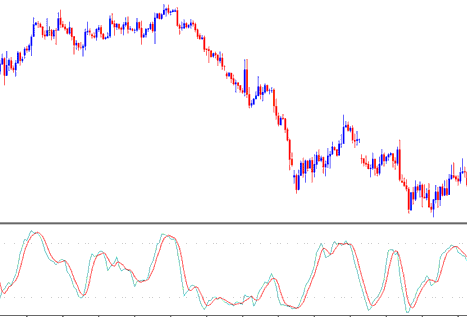

Stochastic Oscillator is a technical tool that measures momentum: it compares the current closing price to the highest and lowest prices over a specific number of periods. The Oscillator uses a range from 0 to 100 to show its values.

This oscillator operates on the principle that during an upward trend, prices close near the high of their range, while in a downward trend, prices close near the low of their range.

The Stochastic Lines are drawn as 2 lines - %K and %D.

- Fast line %K is the main

- Slow line %D is the signal

Overview of the Three Variations of the Stochastics Oscillators Indicator: Fast, Slow, and Full

The three types of Stochastic Oscillators include fast, slow, and full Stochastic. They analyze a specific chart period, such as 14 days, comparing the current closing price to the high-low range within that timeframe to calculate oscillator values.

This oscillator works on the principle that:

- In an uptrend, price often tends to close at the high of stick.

- In a downtrend, price tends to close at the low of candlestick.

This particular indicator serves to map out the underlying momentum of Forex trends, accurately pinpointing periods when a market is either overbought or oversold.

FX Technical Analysis and Generating Signals

The primary methodologies employed for analyzing Stochastic Oscillators to derive Forex trading signals involve crossover signals, divergence signals, and the identification of overbought/oversold boundaries. The following outlines the specific techniques and methods utilized for generating trade signals.

Forex Cross-over Signals

Buy signal - Percentage K line crosses above %D line (both lines moving upwards)

Identification of a Sell trading signal: the %K line crosses beneath the %D line while both trend downwards.

50-level Crossover:

Buy signal - when stochastic indicator lines cross above the 50 mark, it generates a buy trading signal.

Sell Signal Generation - A signal to sell is triggered when the lines of the stochastic trading technical indicator cross below the 50 mark.

Forex Divergence Trading

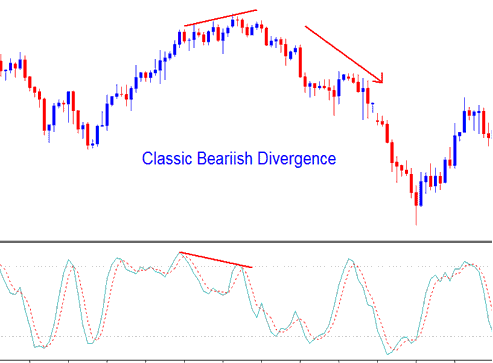

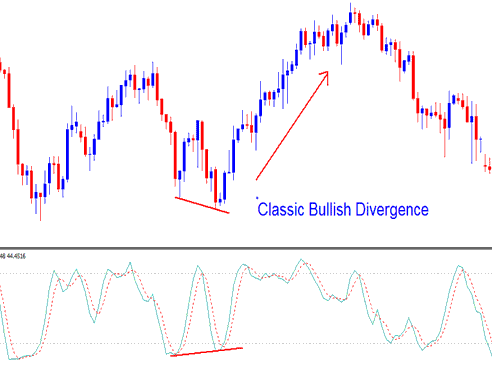

The Stochastic indicator is also employed to detect divergences occurring between the indicator's readings and the actual market price.

This is used to determine potential trend reversal signal.

Upward/rising trend reversal - identified by classic bearish divergence

Trend reversal - identified by a classic bearish divergence setup

Downwards trend reversal - identified by a classic bullish divergence

Trend reversal - identified by a classic bullish divergence setup

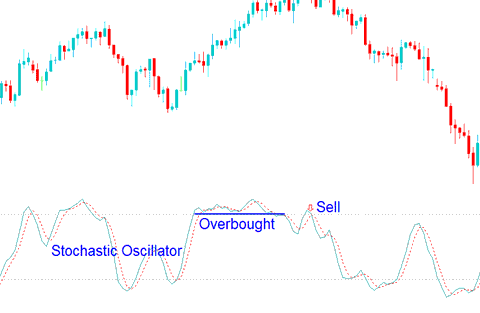

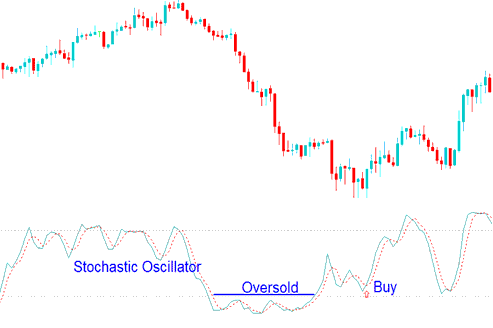

Over-bought/Oversold Levels in Trading Indicator

The Stochastic tool is primarily employed to pinpoint potential overbought and oversold conditions within price fluctuations.

- Overbought values greater than 70 level - A sell trading signal forms when the oscillator rises above 70% and then falls below this technical level.

Overbought - Values Greater 70

- Oversold values less than 30 level - a buy trading signal is derived & generated when the oscillator goes below 30% & then rises above this technical level.

Oversold - Values Less Than 30

Stochastic signals trigger when it crosses key levels. But overbought or oversold areas can fake out in strong trends.

Learn More Topics & Courses:

- Setting Up Quotes on MetaTrader 4 for Trading

- Opening and Closing Times for AUD/USD Trades

- Entry Stop Orders: Learn About Buy Stop Orders and Sell Stop Orders

- How do I read trend signals on a chart?

- How to Add CAC in the MT5 App on Your Phone

- Understanding the Upper and Lower Limits of the FX Bollinger Band Indicator

- Analyzing MT4 Charts for Trading Analysis

- Developing a Custom XAU USD MetaTrader 4 Expert Advisor (EA) within the MT4 Environment

- Complete Breakdown of the Kauffman Efficiency Ratio Indicator with Examples