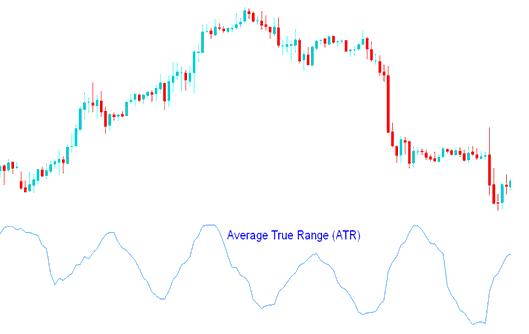

Average True Range - ATR Analysis and ATR Signals

Created and Developed by J. Welles Wilder

The Average True Range (ATR) indicator measures market volatility by assessing the range of price movements over a specific period. It is directionally neutral and does not predict trends in the Forex market.

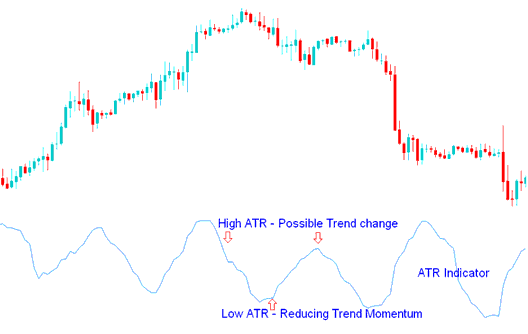

High ATR indicator values

High Average True Range values indicated market bottoms after a sell-off.

Low ATR readings

Low ATR numbers showed long times of sideways price moves, like price range bound movement, such as the ones that are found at market peaks and times of market stability. Low ATR technical indicator numbers are common for times of sideways market action that lasts for a long time, which can happen at the top of a market trend and when things are consolidating.

Calculation

This technical indicator is calculated using the following formula:

- Difference between the present high and the current low

- Difference between the previous closing price and the current high

- Difference between the previous closing price and the current low

The final Average is determined by summing these values and calculating the mean.

FX Analysis & Generating Signals

ATR indicator can be analyzed using the same principles as other volatility trading indicators.

Possible change of trend and signal of a turnaround - The higher the number for the indicator, the more likely a trend will change direction.

Measure of the trend energy - The lower the indicator's value, the weaker the price trend move.

Analysis in FX Trading

Study More Topics and Tutorials:

- CAC Indices Trading Methods

- Curious about the Kauffman Efficiency Ratio MetaTrader 4 indicator? Here's what it does.

- Here's how to calculate the GBPDKK bid-ask spread.

- EURZAR Spread Overview

- RSI Trade System

- Essential Foreign Exchange Advice for Individuals New to FX Trading

- Want an example of JP 225 index trading strategies? I'll give you one.

- Commonly Asked Questions and Answers About Trading XAU/USD

- List of IBEX35 Strategies and Best Strategies for Trading IBEX

- Curious about volatility in XAU/USD markets? Here's how to use Bollinger Bands to analyze high and low volatility.